Oxford Cancer Analytics raises $11M to detect lung cancer via a blood test

OXcan combines proteomics and artificial intelligence for early detection

Read more...

Lending Club has long been looked at as a potential IPO candidate, and now the moment has finally arrived: the company is going public!

The peer to peer loan provider filed an S-1 form with the Securities and Exchange Commission on Wednesday, and is seeking to raise $500 million in its initial public offering. Underwriters for the IPO include Morgan Stanley, Goldman Sachs and Citigroup. The company has not yet revealed how many shares it plans to offer, or their expected price.

Founded in 2007, Lending Club is an online credit marketplace where investors provide loans to creditworthy borrowers in exchange for the interest income. It bills itself as an alternative to the traditional banking system, providing lower rates to borrowers.

Lending Club makes money through origination and service fees. Borrowers pay a one-time origination fee of 1.11% to 5% of the total loan amount, depending on the loan grade and term. Meanwhile, investors pay a service fee of 1% of each payment received from a borrower.

The S-1 revealed that, in the full year 2013, Lending Club brought in $85 million in revenue, up from $30 million in 2012. Due to high cost of operations, including spending $39 million on sales and marketing, the company came away with $7 million in net income last year, up from a loss of nearly the same amount the year before.

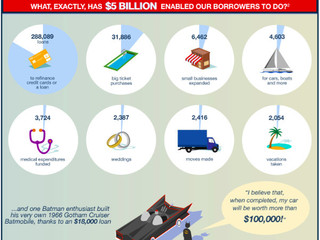

Last month, Lending Club announced that for the first time ever, it had issued $1 billion in loans in a single quarter, bringing it to $5 billion issued to date.

The San Francisco-based company has raised nearly $400 million in venture funding, most recently raising $65 million from T. Rowe Price, Wellington Management Company, BlackRock Inc. and Sands Capital. The round valued Lending Club at $3.75 billion.

Previous investors in the company include Coatue Management, DST Global, Google Capital, Foundation Capital, Kleiner Perkins Caufield & Byers, Union Square Ventures, Thomvest Ventures, Morgenthaler Ventures, Canaan Partners and Norwest Venture Partners.

The 2014 IPO landscape

2014 has been something of renaissance for the IPO market. Lending Club is just the latest big name to

Candy Crush maker King, food delivery service GrubHub, video ad platform TubeMogul, online caregiver platform Care.com, cloud-based customer service software provider Zendesk, high-definition personal camera manufactuerer GoPro, digital coupon provider Coupons.com, and online automotive information and communications platform TrueCar have all already hit the market.

Others that have filed include cloud storage company Box, Web-hosting and domain registration company GoDaddy, inbound marketing software platform HubSpot., online home furnishing company Wayfair, online marketing and advertising company Yodle, online dating website Zoosk and Chinese e-commerce giant Alibaba.

(Image source: lendingclub.com)

OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...Startup/Business

Joined Vator on

TrueCar, Inc. is an online automotive information and communications platform focused on creating a better car buying experience for dealers and consumers. Consumers want a hassle-free car buying experience and dealers want high-quality sales velocity. TrueCar helps achieve these goals by providing unbiased market information on new car transactions and by supplying an online communications platform through which dealers and consumers can communicate with each other. TrueCar’s market-based information provides both consumers and dealers with an accurate and comprehensive understanding of what others actually paid recently for similar vehicles, both locally and nationally. TrueCar’s communications platform then allows informed, ready-to-buy consumers to communicate directly with participating dealers. Some of the nation’s largest and most well respected membership and service organizations rely on websites powered by TrueCar to help educate their members and customers who are in the automotive market. TrueCar is headquartered in Santa Monica, CA, and has offices in San Francisco, CA, and Austin, TX. After experiencing dramatic growth since 2006, TrueCar is developing a suite of products and services centered on radical clarity through the comprehensive analysis of market data and information. TrueCar’s participating dealer partners have sold over 500,000 new vehicles to TrueCar users nationwide.

Startup/Business

Joined Vator on

Box provides secure, scalable content sharing that both users and IT love and adopt, including 82% of the FORTUNE 500. Box's dynamic, flexible content management solution empowers users to share and access content from anywhere, while providing IT enterprise-grade security and oversight into how content moves within their organizations. Content on Box can also be accessed through mobile applications, and extended to partner applications such as Google Apps, NetSuite and Salesforce. Box is a privately held company and is backed by venture capital firms Andreessen Horowitz, Bessemer Venture Partners, Draper Fisher Jurvetson, Emergence Capital Partners, Meritech Capital Partners, NEA, Scale Venture Partners, and U.S. Venture Partners, and strategic investors salesforce.com and SAP.

Startup/Business

Joined Vator on

Founded in 2006, Care.com is the largest and fastest growing service used by families to find high-quality caregivers, providing a trusted place to easily connect, share caregiving experiences and get advice. The company addresses the unique lifecycle of care needs that each family goes through-child care, special needs care, tutoring and lessons, senior care, pet care, housekeeping and more. The service helps families find and select the best care available based on detailed profiles, background checks and references for hundreds of thousands of mom-reviewed and pre-screened providers who seek to share their services. Through its Care.com Employer Program, corporations can offer Care.com memberships as a benefit to employees. www.care.com

Startup/Business

Joined Vator on

Lending Club is a social lending network where members can borrow and lend money among themselves at better rates.

Lending Club provides a much improved infrastructure for social lending: state-of-the-art technology to authenticate all users (ensuring making sure they are who they say they are); credit scoring systems which rate borrower risk; and, the automated clearing house (ACH) system to move the funds between both parties. In addition, we provide our LendingMatch™ system to minimize risk and allow community based lending.

Startup/Business

Joined Vator on

HubSpot is an inbound marketing system that helps your company get found online, generate more inbound prospects and convert a higher percentage of them into leads and customers. HubSpot helps companies get found by more prospects using search engine optimization and marketing, leveraging blogs and the blogosphere and engaging in online social media. By using landing pages, lead intelligence and marketing analytics, HubSpot customers convert more prospects into leads and customers. Based in Cambridge MA, HubSpot Internet marketing can be found at www.HubSpot.com and the Website Grader free SEO tool is available at www.WebsiteGrader.com.

Startup/Business

Joined Vator on

Founded in 2006 by online video buffs who met while in graduate school and won the UC Berkeley Business Plan Competition, TubeMogul's objective from the start has been to empower online video producers, advertisers and the online video industry by providing publishing tools and insightful, easy to interpret analytics.

With TubeMogul, users upload videos once and TubeMogul deploys them to as many of the top video sharing sites the producer chooses. TubeMogul's integrated analytics then provide a single source of metrics on where, when, and how often the videos are viewed. TubeMogul's free beta service has been live since November of 2006. In January 2008, TubeMogul announced the launch of its Premium Products, which include a host of new professional features.