DUOS expands AI capabilities to help seniors apply for assistance programs

It will complete and submit forms, and integrate with state benefit systems

Read more...

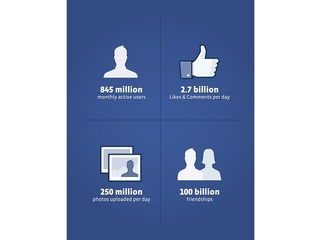

As its IPO creeps closer and closer, Facebook has updated its S-1 filing for the fourth time to reflect that the company now has 500 million mobile users, 901 million monthly active users, and has made $1.058 billion in revenue for Q1 of 2012. While those all sound astromonical and amazing by most standards, in the bizarro world of Facebook, it is less-than-stellar.

This update spells some trouble for the public aspirations for the largest social media network in the world. Until now, Facebook has prided itself on rapid growth, but this past quarter shows that there has been a slowing down in revenue growth. The revenue from this past quarter means that Facebook generated 45% more revenue from a year ago but shows a 6% decline compared with the fourth quarter of 2011.

The decline in quarterly revenue happened just as Facebook's monthly active user count rose to 901 million (as of March 31), up from the 845 million reported for Dec. 31, 2011. This means that if Facebook maintains its current revenue rate, it would be generating between $4.50 and $4.80 for each of its 901 million users per year.

Facebook also revealed that it paid Instagram 23 million shares at $30.89 a share plus $300 million cash to reach the total of $1,010,470,000 for the photo-sharing app.

Mark Zuckerberg included a special note in the filing, stating that, “We don’t plan on doing many more of these, if any at all” and clarified that their "ability to acquire and integrate larger or more complex companies, products, or technologies in a successful manner is unproven. In the future, we may not be able to find other suitable acquisition candidates, and we may not be able to complete acquisitions on favorable terms, if at all.”

If Facebook’s shares trade above the $44.10 seen on the SecondMarket, Instagram’s small team could be in store for north of $1.3 billion rather than the $1 billion figure that has been circulated widely -- the gift that just keeps on giving.

Advertising made up the lion's-share of the Facebook revenue with $872 million, while digital payments and other fees made up the remaining for $186 million. Also notable is the growing international revenue, which accounted for 49% of the company's total revenue this past quarter, up from 42% in Q1 2011 -- and up from 44% the whole year of 2011.

As gaming becomes an even bigger force to be reckoned with, payments were strong but Zynga's role has dampened -- dropping to 15% of the payments sector rather than the 19% seen a year ago. This could be a reflection of the growing gaming space, or a strategic effort by Facebook to drive more traffic to alternative gaming developers -- either way it is a boost to Facebook investors that thought the partnership was too dependent between Facebook and Zynga.

More by the numbers

Facebook now hosts more than 300 million photo uploads a day (up from 250 million), has a constantly growing 125 billion total friendships (up from 100 billion), experienced 3.2 billion likes and comments per day (up from 2.7 billion), and powers 9 million apps and sites (up from 7 million).

The company is also heavy on patents at the moment -- earlier today Facebook listed that it dropped $550 million in cash to snap up 650 patents from Microsoft (which had just been bought from AOL) and now that brings the company to more than 1400 patents.

Now eMarketer analysts expect Facebook to generate somewhere in the neighborhood of $6.1 billion in total revenue in 2012 -- a number that is up 40% from the $3.7 billion cranked out in 2011.

Many analysts are still split on what this could mean for the IPO, but it is hard to argue with such a large company and analysts over at eMarketer are chalking this up as a transitional quarter that wasn't going to churn out overwhelming results anyway.

We are still expecting the IPO around May 17 with estimates placing the amount raised at around $10 billion with a valuation near $104 billion.

It is doubtful that this will be any type of black cloud over the upcoming IPO and if anything might just help the company experience a this-worldly debut and modest pop -- rather than run the risk of underpricing and disappointing current investors.

It will complete and submit forms, and integrate with state benefit systems

Read more...The bill would require a report on how these industries use AI to valuate homes and underwrite loans

Read more...The artists wrote an open letter accusing OpenAI of misleading and using them

Read more...Startup/Business

Joined Vator on

Zynga is the largest social gaming company with 8.5 million daily users and 45 million monthly users. Zynga’s games are available on Facebook, MySpace, Bebo, Hi5, Friendster, Yahoo! and the iPhone, and include Texas Hold’Em Poker, Mafia Wars, YoVille, Vampires, Street Racing, Scramble and Word Twist. The company is funded by Kleiner Perkins Caufield & Byers, IVP, Union Square Ventures, Foundry Group, Avalon Ventures, Pilot Group, Reid Hoffman and Peter Thiel. Zynga is headquartered at the Chip Factory in San Francisco. For more information, please visit www.zynga.com.