Oxford Cancer Analytics raises $11M to detect lung cancer via a blood test

OXcan combines proteomics and artificial intelligence for early detection

Read more...

For the last year or so, Vator has been running a weekly column where we highlight a different early stage venture capitalists. One thing that has been eye opening to me has been how few women I can find to be a part of that series. It's not that there aren't any, and we have been able to find a few really great women to interview, including Stephanie Palmeri, Maha Ibrahim and Karen Griffith Gryga, among others.

Clearly, though, this is a male-dominated industry.

That's not just anecdotal, either; the numbers back it up. At the end of 2014, there were only 164 female venture capitalists, out of a total of 3,396 in the United States. That's less than 5 percent!

We've also held a number of panels at our events about diversity, and a thing that comes up again and again is that VCs invest in what they know and understand. So if a woman starts a maternity company, for example, or menstruation, they run right into that wall once they try to raise funding for their idea.

That is why it's so important to highlight the firms that specifically have it as part of their mission to fund startups with female founders. Pitchbook has identified five of the most prominent ones.

"We back the new wave of entrepreneurs who are reimagining daily life, creating market-defining products and services that make our work, play and home lives simpler, better — and more satisfying," the firm says.

The firm backed by AOL and grew out of AOL’s #BUILTBYGIRLS initiative. Its investments typically range from $100,000 to $250,000. It has made 24 investments in 21 companies.

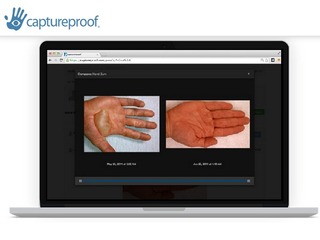

Some of the companies it has invested in include Zola, HopSkipDrive, Modsy, Thesis Couture, goTenna and CaptureProof.

"Companies seeking our capital must have at least one female founder or C-level exec, and/or be willing to recruit top female talent to the C-suite and Board of Directors. We prefer teams with strong domain expertise, and proven commercialization and entrepreneurial experience," it says on its website.

BELLE Capital lead or co-lead Series A preferred rounds and generally invests $100,000 to $1.5 million. It focuses on four sectors: IT, digital health, cleantech and technology-enabled products & services.

Some of its investments include Finomial, Digsite, Nopsec and Cardialen.

"Simply put, women make great entrepreneurs. In fact, women make better entrepreneurs. They experience greater successes – and fewer failures – than their male counterparts. Yet traditional venture capital does not currently reflect this," the firm writes.

Founded in 2013, it has made 14 investments in 13 companies in ecommerce, media, web-enabled products & services, marketplaces and platforms spaces. It has raised $5 million in funding.

It has put money into WayUp, Eloquii, Zola, Lover.ly and Women.com.

"Women entrepreneurs have seen remarkable success in launching new ventures. In fact, 46% of the privately held firms in the US are at least half owned by women," the firm writes.

"These entrepreneurs are often determined innovators who have the potential to scale their businesses and contribute to the economy in countless ways. Ultimate success requires access to capital and influential networks to propel growth - the same qualities that build market-leading companies."

Since 2005, Golden Seeds has invested over $80 million in start-up businesses and over 76 companies have received Golden Seeds funding.

Investments included EpiEP, Triptrotting, ColorModules, HitFix and Playrific.

"The Fund capitalizes on the expanding pipeline of women entrepreneurs leading gender diverse teams and creating capital efficient, high growth companies in digital media and sustainable products and services. We believe that this unique investment strategy now provides the potential for extraordinary returns," the firm says on its website.

Investments have included Newsela, Decorist, EdSurge and Proxio.

Funding for women-led companies

When it comes to women-led companies raising money, New York and Los Angeles actually have a better record than Silicon Valley. According to a report out from Female Founders Fund in January.

Overall, Series A rounds grew by 8 percent in the United States in 2015, according to a report out from Female Founders Fund in January. Every region saw an increase, except for the Bay Area, which saw Series A deals decline by 11 percent.

So, of course, the number of companies led by women who raised a Series A in the Bay Area also decreased last year. There were only 16 such companies in 2015, out of 204 Series A rounds, representing only eight percent of the total. The number was also down 30 percent from 2014.

While the Bay Area remains the area with the highest number of companies led by women getting funding, it actually has a lower overall percentage than either New York or Los Angeles.

In fact, it seems that the best place right now to be a female founder is New York, where there were 13 female-led companies that got a Series A round of funding in 2015, out of a total of 96, for a 14 percent share. That number increased very slightly, by one percent, from 2014.

In Los Angeles, which is seeing huge gains in Series A fundings overall, with a 110 percent increase year-to-year, there were five female-led companies that raised Series A funding, for a total of 13 percent. That indicates that Los Angels is an up and coming market, but one that is taking its female CEOs up with it.

(Image source: bpw-international.org)

OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...Startup/Business

Joined Vator on

CaptureProof is the HIPAA-compliant photo/video app. With CaptureProof, Doctors are instantly able to more accurately triage and remotely monitor Patients through asynchronous visual communication, decoupling medical care from time and location. CaptureProof allows a Doctor or Patient to capture, compare and share medical photos, videos and chat.

Startup/Business

Joined Vator on

Decorist is the leading virtual home design platform. We use patent-pending technology to efficiently deliver personalized decor advice from free product recommendations and Q+A to paid room makeovers. Our female-led team is growing the brand and community around this unique product and experience.

Need a little - or a lot - of home design help? That's what we do. Decorist makes it easy and affordable - all virtually.

Startup/Business

Joined Vator on

Proxio creates connections within the world of real estate, across the globe. ProxioPro(TM) is the industry's first, international, purpose-built professional network. By combining MLS and professional networking functionality, ProxioPro enables real estate agents to connect and expand their inventory and referral networks worldwide -- easily and for free. For more information visit: http://www.proxio.com/.

Startup/Business

Joined Vator on

Thesis couture is the world’s first performance driven, fashion footwear brand within the $40B global high heel market.

We’ve recruited world class experts and luminaries across fashion, technology, and anatomy to reset the standard of design excellence in women’s high heels. Our brilliant team includes a former NASA astronaut, a uniquely-trained fashion scientist and designer, a world class orthopedic surgeon, and more.

Using structural engineering principles, advanced material science and with a keen focus on human factors, we have created a patent-pending internal architecture of core components to replace the century-old parts and processes still used in today’s painful high heels.

Our design and materials measurably improve load distribution across the foot, impact shock, and kinematics, resulting in a healthier and longer-wearing shoe that never compromises on high fashion or sexy aesthetic.

Startup/Business

Joined Vator on

MILESTONES

Triptrotting re-launched its site in May, 2011 with only 500 members, and by June 2011 already has thousands of users in 500+ cities across 100+ countries.

In January 2011, Triptrotting received seed funding from Bill Gross' Idealab, leading creator and operator of technology companies.

In May 2010, Triptrotting placed 2nd at the University of Southern California Marshall School of Business Seed Competition on the MBA level

Joined Vator on

Maha has been in the venture capital and technology industries for over 15 years. She currently sits on the boards for ClusterHQ, Cuyana, Kabam, Komprise, Koolbit, The RealReal, Twenty20 and UNIFi Software.

Joined Vator on

Stephanie is a partner with Uncork, where she invests early in companies empowering individuals, families, businesses, and communities, like Poshmark, ClassDojo, Clever, Survata, Lantern, Fatherly, Pared, Carrot, Chariot (Ford), and Niche (Twitter).

Joined Vator on