Oxford Cancer Analytics raises $11M to detect lung cancer via a blood test

OXcan combines proteomics and artificial intelligence for early detection

Read more...

Things are really not going well at Zynga right now.

After a dismal earnings report that tanked its stock, Zynga may now have an addition problem on its hands to go along with the difficult financial situation it currently finds itself in.

After posting earnings and revenue that fell far short of analysts' expectations, the company saw its stock tank, going down nearly 40% to around $3.

Now, reports are coming out that major investors, as well as Zynga executives, sold off stock months before the stock went down.

According to Business Insider, CEO Marc Pincus, along with Google, Venture Partners, Union Square Ventures, Reid Hoffman, Zynga CFO David Wehner, Zynga COO John Schappert, Zynga general counsel Reginald Davis, and others, all cashed out part of their stock in April, months before the stock cratered on the disappointing earnings report.

The amount cashed out: $516 million, $200 million of which came from the 16.5 million shares Pincus sold alone.

At the time, the stock was worth around $12 a share, quadruple its current value.

It should be noted that these investors only sold a portion of their stock, not all of it, so they do still have a stake in the company’s future, and they did take a hit with all the rest of Zynga’s investors.

Zynga stock ended Thursday down 40% to 3.06 in after hours trading, its lowest value since debuting in mid-December with an IPO price of $10.

The stock peaked at $14.69 in early March when its close ties with Facebook were boosted by pre-IPO anticipation for the social network giant.

Pincus blamed the bad quarter, and subsequent stock drop, on Facebook changes, a later game launch and weaker performance from Draw Something than anticipated.

Earlier this quarter, Facebook began to emphasize new games in its news feed and notifications. Prior to that, Facebook gamers would have had to know what games to look up and install or seen what their friends were playing. Bigger games from bigger companies, such as Zynga, had previously had the advantage over smaller companies.

Facebook's new plan gave smaller companies a better chance against the bigger players.

Despite making a deal with Zynga to run sponsored stories on Zynga’s website, the rift between the two companies has been coming for a while, with Zynga bringing in less of a percentage of Facebook’s total revenue last quarter.

When Zynga purchased Draw Something developer OMGPOP for $180 million, the game was an instant success, seeing 35 million downloads in its first six weeks.

Unfortunately for Zynga, Draw Something did not meet their expectations, and suddenly their high priced purchase of a company with only one hit game looked, at best, reckless.

All may not be lost for Zynga. Earnings for the year are expected to fall between $1.15 billion to $1.225 billion, a slight drop from previous expectations.

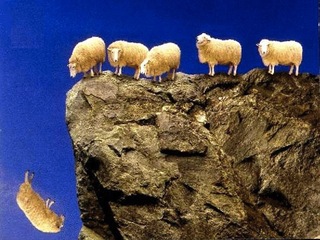

What Zynga really did not need right now, though, was the perception that its biggest investors and executives are ready to abandon ship.

Zynga was not available for comment

(Image source: blgconsultinggroup.com)

OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...Startup/Business

Joined Vator on

Zynga is the largest social gaming company with 8.5 million daily users and 45 million monthly users. Zynga’s games are available on Facebook, MySpace, Bebo, Hi5, Friendster, Yahoo! and the iPhone, and include Texas Hold’Em Poker, Mafia Wars, YoVille, Vampires, Street Racing, Scramble and Word Twist. The company is funded by Kleiner Perkins Caufield & Byers, IVP, Union Square Ventures, Foundry Group, Avalon Ventures, Pilot Group, Reid Hoffman and Peter Thiel. Zynga is headquartered at the Chip Factory in San Francisco. For more information, please visit www.zynga.com.