Lore Health raises $80M, launches social network using AI to cure loneliness

LoreBot asks questions and provides encouragement, while users it with provide answers

Read more... Despite all the ups and downs of the market in 2020, it turned out to be a pretty good year for tech IPOs in the end, with companies like Airbnb, Doordash and Palantir going public and seeing huge gains.

Despite all the ups and downs of the market in 2020, it turned out to be a pretty good year for tech IPOs in the end, with companies like Airbnb, Doordash and Palantir going public and seeing huge gains.

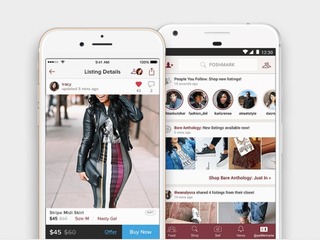

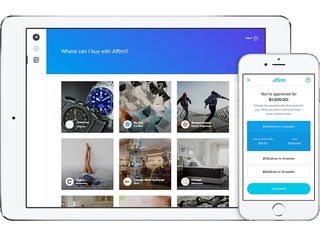

So far, the 2021 IPO market is already looking to continue that trend: with two big IPOs already happening in the first two weeks of the year. Fintech company Affirm went public on the 13th and initially nearly doubled its IPO price, ending the day up 7 percent; online thrift store Poshmark, which debuted the next day, did even better, opening at $97.50, up 132 percent above its $42 IPO price. It ended its first day up 4 percent.

There a whole slew of tech companies ready to take advantage of this market opportunity, some of which we had talked about potentially going public a few years ago and which might now be ready to finally take the plunge:

One of those that has been as a potential IPO candidate for the last few years is stock brokerage application Robinhood.

One of those that has been as a potential IPO candidate for the last few years is stock brokerage application Robinhood.

Founded in 2013, its servers stream market data from exchanges in real-time, while notifying users of scheduled events, such as earnings, dividends, or splits. The app is meant to give traders up to date information quickly.

Robinhood has raised $2.2 billion in venture capital, including a incredible series of funding rounds over 2020: a $280 million round in May, a $320 million in June, $200 million in August, and, finally, another $460 million in September, for a total of over $1.2 billion in less than six months. That gave the company a valuation of $11.7 billion.

The company has not been without its controversies, though, including an SEC investigation that resulted in the company paying a $65 million fine last month, as well as a lawsuit from the state of Massachusetts alleging that the app defrauded customers.  Dating app Bumble was born out of a bad situation, yet it has now grown to be one of the top companies in the space.

Dating app Bumble was born out of a bad situation, yet it has now grown to be one of the top companies in the space.

Whitney Wolfe Herd, the co-founder of Tinder, sued the company for sexual harassment, a lawsuit that was eventually settled with the company admitting no wrongdoing. That led her to found Bumble, with the idea of a dating app giving more control to female users: when being paired with men, those users are the ones who are able to send the first contact with matched male users (those restrictions do not apply when it's a same-sex match). As of 2020, Bumble reached 100 million users, second only to Tinder.

The company has raised three rounds of funding, though it has never disclosed how much it raised; investors including Accel, Greycroft, and Priyanka Chopra.

Last week the company unveiled its S-1 filing with the SEC as it prepares to debut on the public market, disclosing that it had 42 million monthly active users (MAUs) as of Q3 2020. In terms of revenue, that translated to $362.6 million for the first nine months of 2019, with net income of $68.6 million.

Instacart is another company that has been on the IPO radar for a few years, and now the company is in the perfect position, with COVID turning the food delivery space white hot. To wit, the four biggest food-delivery apps, which also includes Uber Eats, Doordash, GrubHub and Postmates, saw their revenue rise a collective $3 billion.

Founded in 2012, Instacart has raised $2.4 billion in funding, including three rounds across 2020: a $225 million round in June, $100 million in July, and a $200 million round in October, valuing the company at $17.7 billion. Investors that include Sequoia Capital, Andreessen Horowitz, Kleiner Perkins, Whole Foods Market, Coatue Management, D1 Capital Partners and Tiger Global Management.

Instacart showed its power after it lost its longstanding delivery partnership with Whole Foods at the end of 2018, a year after after the chain was bought by Amazon for over $13 billion. Rather than hurting Instacart, it actually led to more retailers partnering with the company in order to compete with Amazon, including Walmart. Instacart now partners with more than 500 retailers and delivers from nearly 40,000 store locations across the U.S. and Canada.

When Pinterest went public in 2019, it was the last of the big four social networks to join the public market, following Facebook, Twitter, and Snap. Those comoanies might be joined this year by Nextdoor, the social network for neighborhoods, which is reportedly aiming to go public in 2021.

When Pinterest went public in 2019, it was the last of the big four social networks to join the public market, following Facebook, Twitter, and Snap. Those comoanies might be joined this year by Nextdoor, the social network for neighborhoods, which is reportedly aiming to go public in 2021. Founded in 2011, the company has raised $455.2 million, its last round in 2019 valuing it at $2.1 billion. Investors include Meyer Equity, Tiger Global Management, Riverwood Capital, Benchmark, Kleiner Perkins, Redpoint, Comcast Ventures, Shasta Ventures, Insight Partners, Meritech Capital Partners, Valor Capital Group, Slow Ventures, Greylock, Coatue, GV, DAG Ventures, Pinnacle Ventures, and SV Angel.

One thing that NextDoor will have to contend with is the fact that is has had a long standing controversy over being used for racial profiling. This was a a topic that co-founder, and then CEO, Nirav Tolia addressed at a Vator event in 2016, but which is still not solved; the company was still receiving criticism for its handling of the issue as late as summer 2020. Considering its age and size, it's actually a little surprising that Stripe hasn't gone public yet.

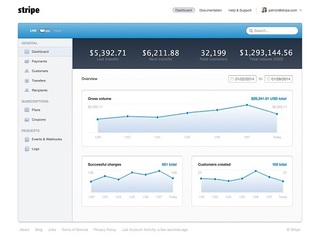

Considering its age and size, it's actually a little surprising that Stripe hasn't gone public yet.

Founded in 2009 as a way to allow anyone to accept credit card payments on the internet, the company has raised $1.6 billion, including a $600 million round in April of last year, and is valued at a whopping $36 billion valuation. Investors in the company include Andreessen Horowitz, General Catalyst, GV, and Sequoia.

In 2020, Stripe began taking payments from customers of Caviar, Coupa, Just Eat, Keap, Lightspeed, Mattel, NBC, Paid, and Zoom. According to the company, Stripe customers, on average, support 66 percent of their online payments transactions with the platform, equating on average to $40.15 million per year.  There's no speculation that Coinbase is looking to go public, as the company as already filed confidentially with the SEC, using a provision in the Jumpstart Our Business Startup (JOBS) Act, passed in 2012, which allows companies to file to go public without letting anyone know about it if they so choose. Confidential filings allow companies to test out the market without feeling pressure from investors, and allows them withdraw their IPOs without scrutiny or embarrassment.

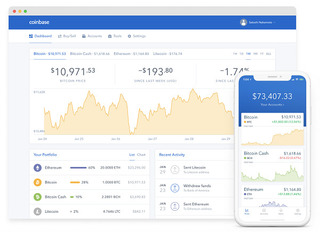

There's no speculation that Coinbase is looking to go public, as the company as already filed confidentially with the SEC, using a provision in the Jumpstart Our Business Startup (JOBS) Act, passed in 2012, which allows companies to file to go public without letting anyone know about it if they so choose. Confidential filings allow companies to test out the market without feeling pressure from investors, and allows them withdraw their IPOs without scrutiny or embarrassment.

Coinbase brokers exchanges of multiple currencies, including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin, allowing users to invest by scheduling buys daily, weekly or monthly, while also securely storing their assets, and even allowing them to buy insurance. Bitcoin, the most popular cryptocurrency, owned by an estimated 11 percent of Americans, hit a record high earlier this month.

Founded in 2012, Coinbase has raised $547.3 million in funding from investors that include True Capital Management, Fundamental Labs, Chainfund Capital, Manhattan Venture Partners, Andreessen Horowitz, Y Combinator, Greylock, IVP, Tusk Venture Partners, and Spark Capital.  If insurance startup Oscar Health decides to go public in 2021, this would be an opportune time, as healthtech stocks are currently soaring despite, or more likely because of, the COVID pandemic.

If insurance startup Oscar Health decides to go public in 2021, this would be an opportune time, as healthtech stocks are currently soaring despite, or more likely because of, the COVID pandemic.

The company, which has been on our potential IPO radar for a while now, is a tech-driven health insurance company that takes a concierge-like approach to healthcare. It provides a concierge team, including care guides and a nurse, who provide all sorts of services, from referrals to specialists to managing your condition. Patients can also use their doctor on call service to fill a prescription or just ask for advice.

Founded in 2012, Oscar has raised $1.6 billion, including two rounds in 2020, first a $225 million round in June from Alphabet, General Catalyst, Khosla Ventures, Lakestar, Thrive Capital, Baillie Gifford and Coatue. That was followed by a $140 million round in December led by Tiger Global Management, along with Dragoneer, Baillie Gifford, Coatue, Founders Fund, Khosla, Lakestar and Reinvent. The company is now valued at $6 billion. It's not all that common for gaming companies to go public; Zynga is the obvious exception, along with Rovio, the Finnish studio behind Angry Birds, which went public in 2017, and Candy Crush studio King, which did so in 2014. Partially that may because, for many of these companies, much of their revenue comes from a single title, and once that fad passes it can be hard to duplicate.

It's not all that common for gaming companies to go public; Zynga is the obvious exception, along with Rovio, the Finnish studio behind Angry Birds, which went public in 2017, and Candy Crush studio King, which did so in 2014. Partially that may because, for many of these companies, much of their revenue comes from a single title, and once that fad passes it can be hard to duplicate.

That isn't going to stop Roblox from hitting the public market; the company, which was founded in 2004, recently announced its plans to be direct listed on the New York Stock Exchange next month, while also revealing that it raised a $520 million round of funding from from Andreessen Horowitz, bringing its total to $855.7 million at a $29.5 billion valuation.

Gaming companies have benefitted from the COVID pandemic, especially Roblox: according to measurement firm Sensor Tower, players spent over $2 billion on Roblox games in 2020. The company has seen its games downloaded 437 million times on mobile, with nearly 129 million of those, or about 30 percent, generated last year. Its titles include Theme Park Tycoon 2,

Jailbreak, Super Bomb Survival!!, Hide and Seek Extreme, and Adopt Me!Online thrift store and consignment shop ThredUp is another company that has already confidentially filed for its IPO, even though its not quite as big as some of the other companies listed here, including rival company Poshmark.

Founded in 2009, ThredUp has raised $305.8 million, its last round being a $175 million round from in 2019, which included a previously undisclosed $75 million round raised in 2018. That valued the company at $670 million.

ThredUp carries more than 35,000 brands including J.Crew, Ann Taylor LOFT, Banana Republic, BCBGMAXAZRIA, Lululemon Athletica, Talbots, Free People, Lilly Pulitzer, and Madewell, processing more than 100,000 unique items daily. It has 2.4 million items listed at any given time, with 4.7 million itself that can fit in its distribution centers.Thanks to COVID, 2020 was a good year for residential real estate companies: prices soared, going up over 14 percent year-to-year, while mortgage rates collapsed, allowing brokerages and mortgage lenders to see big profits. Real estate technology company Compass is taking advantage of that, having already filed confidentially with the SEC to go public this year.

Founded in 2012, the company provides an online platform for buying, renting, and selling real estate assets.

Compass has raised $1.5 billion in funding from investors that include the SoftBank Vision Fund, Founders Fund, and Fidelity Investments. It's last funding, a $370 million round in 2019, valued the company at $6.4 billion.

(Image source: investorjunkie.com)

LoreBot asks questions and provides encouragement, while users it with provide answers

Read more...The company uses machine learning and AI to make radiologists more efficient by streamlining reports

Read more...Vitality employers and health plans will have the option to add Headspace products

Read more...