The FDA outlines draft guidance on AI for medical devices

The agency also published draft guidance on the use of AI in drug development

Read more...

Updated to reflect new survey from WhisperNumber

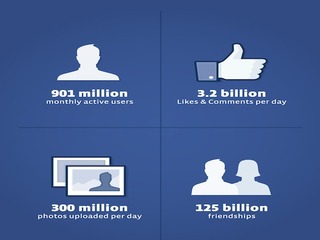

Facebook seems very confident in the final days before its goes public on Friday, and for very good reason.

Just Wednesday, it updated its S-1 yet again, this time raising its share price to $34-$38. It also added over 50 million shares for purchase, bringing the total to 388 million. It will raise at $13.1 billion, placing the company valuation between $92 billion and $103 billion.

On top of that, Mark Zuckerberg is set to become the 36th richest man in the world.

So Facebook has nothing to worry about, right? Right?

Well…

A survey came out today that might spell trouble for Facebook in the long run, so maybe it should be just a little worried. A survey done by WhisperNumber.com last week found that a vast majority of investors are not buying into the Facebook hype.

The survey, which polled 1,100 registered traders and investors, found that 71% do not consider Facebook a long-term investment and will not be buying share after Facebook’s initial public offering.

“I think traders think there’s more hype than actual business,” said John Scherr, founder and president of WhisperNumber.com told Bloomberg.

“While Facebook has done a great job in gaining users and ad revenue, we’re hearing traders use the word ‘fad’ and phrases like ‘remember MySpace.’"

Not surprisingly, some investors in the poll call Facebook’s stock overvalued.

Interestingly enough, typically when there is more negativity around a stock, the exact opposite happens, the stock goes up.

Other concerns over Facebook

Still, there are legitimate concerns, such as the company is not making any money from its mobile division.

Last week Facebook updated it S-1 filing to say that it does "not currently directly generate any meaningful revenue from the use of Facebook mobile products, and our ability to do so successfully is unproven,” despite recently hitting 300 million mobile users.

On top of that, Facebook’s revenue was $1.058 billion in Q1 2012, a number that would be staggering for any other company, but which represented a 6% decline for Facebook.

The decline could partially be caused by a lower role played by game developer Zynga, who accounted for 15% of Facebook’s revenue last quarter: 11% came from the 30% in transaction revenue Facebook takes from Zynga for virtual goods, while the other 4% came from advertising from Zynga games.

In 2011, Zynga brought in 19% of Facebook’s total revenue, with 12% of coming directly from Zynga and the other 7% from ad revenue.

With its largest source of revenue beginning to deplete, Facebook has been forced to come up with new ways to make money, recently announcing that it is opening its own App Center, where developers can charge flat fees to users.

Update:

WhisperNumber conducted a new survey on Wednesday to see if there was any change in these numbers after Facebook updated its IPO on Tuesday.

The updated results reveal that 65% of the 1,500 investors surveyed do not think that Facebook is a good long term investment, an 6% swing in Facebook's favor. 68% still say they will not be buying Facebook stock, though, only 3% less than the numbers that came out yesterday.

The surveyed also asked investors if they thought Facebook was a fad,and the results were fairly close, with 48.6% saying yes and 51.4% saying no.

(Image source: digitaltrends.com)

The agency also published draft guidance on the use of AI in drug development

Read more...The biggest focus areas for AI investing are healthcare and biotech

Read more...It will complete and submit forms, and integrate with state benefit systems

Read more...