Generative AI entered the consciousness in 2023 with tools like ChatGPT changing the game for individuals and organizations alike, but it was in 2024 that organizations really began to adopt, and subsequently get value out of, this technology, making it a high target area for venture capitalists.

Generative AI entered the consciousness in 2023 with tools like ChatGPT changing the game for individuals and organizations alike, but it was in 2024 that organizations really began to adopt, and subsequently get value out of, this technology, making it a high target area for venture capitalists.

AI startups raised $11.4 billion in investment across 566 deals in Q3 alone, accounting for over two-thirds of global AI funding and 45% of global AI deals. However, their feelings about the technology seems to be mixed, according to a recent survey from Pitchbook, which explored VC views on technological innovation and fundraising expectations.

When it came to AI, VCs see it as both an exciting opportunity, as well as an area that’s already been overinvested and oversaturated.

The survey, which gathered insights from 53 venture capital investors, found that confidence in AI rose to 47% of respondents expressing more bullish expectations, compared with 34% of respondents in previous surveys.

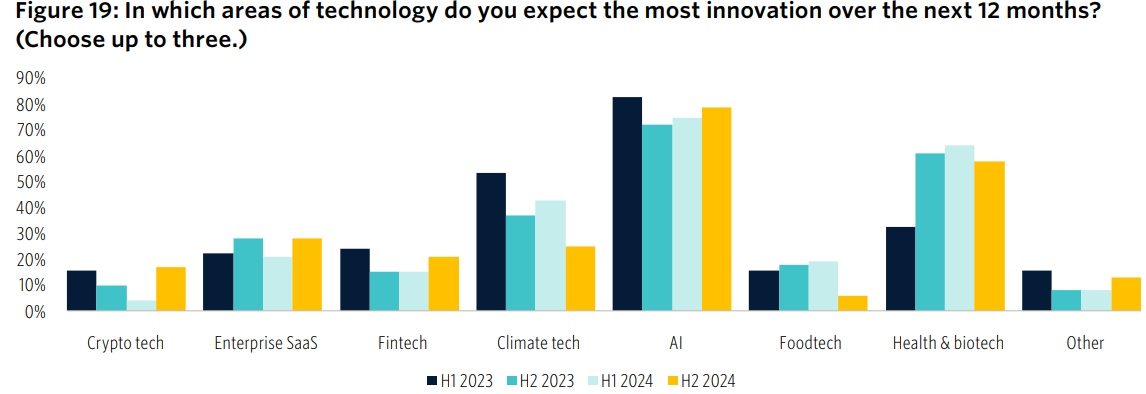

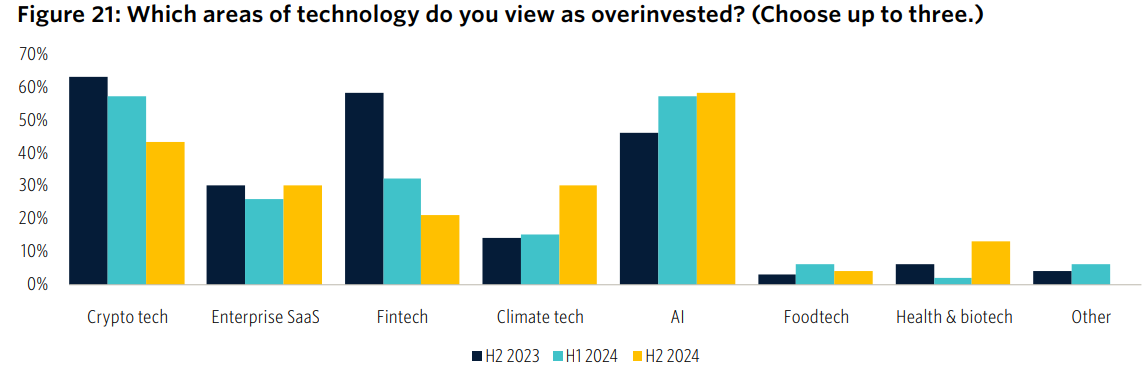

When asked which areas of technology they expect the most innovation over the next 12 months, AI came in the highest by far, with only health and biotech coming close. It was also cited as the area with the best potential for growth. Yet, at the same time, when asked which areas of technology they viewed as overinvested, AI once again came in first place, beating out crypto and fintech, two areas they had previously stated as being overinvested.

Yet, at the same time, when asked which areas of technology they viewed as overinvested, AI once again came in first place, beating out crypto and fintech, two areas they had previously stated as being overinvested.

Investors also cited chatbots, general-purpose AI tools, healthcare markets, and fintech

markets as being oversaturated. For the focus of their AI investments, healthcare AI came out on top with 39%, while 33% said AI infrastructure, and 24% cited biotech. Meanwhile, 30% percentage chose “other” applications, which included logistics, cybersecurity, and low-carbon solutions.

For the focus of their AI investments, healthcare AI came out on top with 39%, while 33% said AI infrastructure, and 24% cited biotech. Meanwhile, 30% percentage chose “other” applications, which included logistics, cybersecurity, and low-carbon solutions.

“These sectors are viewed as the most promising AI investment opportunities over the next 12 months due to their ability to leverage large data pools, streamline regulatory compliance, and deliver measurable ROI through cost savings and operational efficiencies,” Pitchbook wrote in the report.

“In healthcare and biotech, innovations in drug discovery, gene research, and protein analysis stand out, while AI infrastructure investments focus on foundational tools like datacenters, energy-efficient systems, and hyperverticalized agents.”

Of course, there are also roadblocks when it comes to adopting AI, the largest being worry over regulatory or other legal/compliance concerns, which over 50% of those surveyed cited. That was followed by a lack of use cases, a limited AI experienced workforce, cost of inferencing and model development, lack of access to training data, and AI chip availability.

“Despite the optimism, the survey underscored significant concerns about oversaturated AI subsectors and other low-performing areas. Many investors view chatbots, customer support, and general AI agents as oversaturated segments offering diminishing returns due to a lack of clear differentiation or competitive moats, leaving limited opportunities for new players to compete against established giants such as OpenAI and Google,” wrote Pitchbook.

“General-purpose AI tools, simple implementations without clear goals, and applications in areas like creative asset production and low-level administrative tasks are also considered less appealing due to regulatory challenges, public indifference, or limited longterm viability.”

(Image source: urbeuniversity.edu)