DUOS expands AI capabilities to help seniors apply for assistance programs

It will complete and submit forms, and integrate with state benefit systems

Read more...If you thought last year was an important year for sharing economy companies, think again.

This year, dozens of ride-hailing services, vacation rental marketplaces, and other collaboratively-based startups raked in billions of dollars, expanded globally, and quite simply extended their spheres of influence. Though most have mission statements that sound as simple as pie, most also exude visions far greater than they let on, which is why investors are leaping at the opportunity to get on board.

Here are the top 10 biggest stories from 2015 about sharing economy companies.

1. The commonplace mega-round

The biggest news of the year must be the sheer influx of money flooding sharing economy companies, so much so that it became common for the biggest names to regularly pick up funding rounds over $1 billion.

Uber, the top fundraiser, picked up about $4.8 billion across four rounds: $1.6 billion in in convertible debt from Goldman Sachs (January), $1 billion in an expanded Series E (February), $1 billion from Microsoft and Indian media company Bennett, Coleman, and Company F (July), and $1.2 billion led by Baidu (September). Uber's rivals across the world—including Didi Kuaidi in China, OlaCabs in India, GrabTaxi in Singapore, and Lyft in the U.S.—each raised at least one mega-round, making for a combined total of nearly $3.9 billion.

And in other areas—including home sharing (Airbnb, Tujia), workspace rentals (WeWork), and car rentals (YongChe)—there were several multimillion dollar rounds across the globe. Each of these companies’ investors must be convinced that their unicorn is the one that will be around in a decade, doing more than just providing taxis or a vacation rental site... but which will it be? As John Doerr said at Post Seed last month, basic math says not all these companies can exit.

2. The anti-Uber alliance

While certainly most companies that arise in a booming market won’t go public and operate successfully for decades, that’s not to say that everyone but Uber (or whoever wins) will go out of business. In past booms, like the social marketing management wave a few years ago, some businesses do go out of business, but many others also consolidate through mergers and acquisitions.

Already, in the car-hailing sector, we are seeing early signs of what could be official consolidation further down the line. Initially, Didi Kuaidi and Lyft formed an agreement so that Lyft customers in China could hail Didi Kuaidi drivers through the Lyft app. The inverse would hold true for Didi Kuaidi’s customers hailing Lyft drivers in the U.S.

In December, the two expanded the partnership to India with Ola and Southeast Asia with GrabTaxi, offering a strategic, concerted plan to compete with the very well-funded Uber across several of its most important markets. While there’s nothing yet official to say that these four companies could eventually merge, these early partnerships signal a potential firmer agreement further down the line.

3. Expedia acquires HomeAway for $3.9 billion

Hand in hand with the massive funding rounds cited above is the fact that most sharing economy companies steered clear of the public markets. The most oft-cited reason is that these companies don’t see much value in an IPO when they can privately raise tons of financing and still maintain control of the company. Another obvious reason is evident just by looking at the average-at-best performances of most tech IPOs this year.

Back in 2011, when Airbnb finally hit its one millionth night booked, vacation rental marketplace HomeAway was already going public. In the years since, HomeAway has built a solid business, most recently marking a 24.4 percent rise in its bottom line, from $18.9 million in Q3 2014 to $23.5 million in Q3 2015. It’s that success, and the growing interest in this market fueled by Airbnb’s marketing machine, that drove Expedia to acquire HomeAway for $3.9 billion in November, the most considerable sharing economy acquisition of the year.

4. Etsy goes public, and its stock has plunged ever since

Etsy, the peer-to-peer marketplace for handmade or vintage items, was the only sharing economy to go public this year—and likely for good reason.

In mid-April, when it hit the Nasdaq under the ticker symbol ETSY, everything seemed to being going gravy. Shares closed the first day at $30, a huge 88 percent pop from the company's initial pricing for its stock. The IPO raised $267 million for the company, ultimately valuing it at $3.3 billion.

But, whether it’s investors’ failing faith in the company or simply a barometer of the public market as a whole, Etsy’s stock has been in a freefall ever since. In May, its share price dropped below $20 and, in November, it dipped below $10. In the past week alone, shares have dropped from above $9.50 to barely above $8.50. Its market cap, now $1 billion, is just a third of what it was at the end of its IPO day. And with Amazon’s launch of its own Etsy-like marketplace, investors are even more skittish about the company’s prospects.

5. WeWork: An anomaly among the top sharing companies

Of the top most well-funded sharing economy companies ever, six are car services (Uber, Didi Kuaidi, Ola, Lyft, YongChe, GrabTaxi) and three are vacation rental services (Airbnb, HomeAway, and Tujia).

That leaves WeWork, a New York-based company that allows entrepreneurs, freelancers, startups, and small businesses to rent shared workspaces in the community. The company officially joined the most valuable startup club last year when it raised a $355 million Series D from Goldman Sachs, T. Rowe Price, and Wellington Management, but it cemented its mythical unicorn status with another $434 million round closed this past summer.

In conceptual terms, WeWork’s anomalous nature among the ride-hailing companies and home-sharing sites indicates what it takes to be one of today’s most most valuable companies: a really, really big idea. When you look at Uber’s vast array of delivery options (from the established UberEATS to novelty flu shot deliveries), you realize that this isn’t just about providing taxis with apps, but ultimately about being the underlying infrastructure for transportation of people and things. Same with Airbnb owning the home listing platform and, as we see with WeWork, owning the platform for professional spaces.

6. Seattle approves unions for Lyft and Uber drivers

From India to China and San Francisco to New York, sharing economy companies have faced a hefty amount of pressure from regulatory bodies, city committees, and lawyers. Generally, it seems that the more valuable the company, the greater their troubles.

In California, for example, Uber faces a class-action suit—recently expanded to anyone who’s ever driven for the company—in which plaintiffs are demanding they be classified as full-time employees instead of independent contractors. If the court rules in their favor, drivers could be compensated for work expenses, including fuel, car maintenance, and smartphone bills.

Perhaps the most decisive change of 2015, however, already arrived in Seattle this month. In a unanimous 8-0 vote, the Seattle City Council approved a bill allowing Uber and Lyft drivers to form unions. Both companies are disappointed in the ruling, which is disappointing in itself. Strong unions will do for drivers what it has done for any other workers that can organize: give them increased power to collectively bargain over their wages and working conditions.

Though Seattle is the first city in the nation to allow drivers to unionize, city councils across the country could take the decision as precedent for the rules in their own communities.

7. Airbnb named “Best Place to Work”

A year ago, company review site Glassdoor ranked Google at the very top of its annual “Best Place to Work” list, which is compiled based on surveys of employees across North America and Europe. As one of the biggest, most widely known companies to emerge from Silicon Valley, Google originally set the standard for highly favorable employee perks, from competitive salaries and benefits to on-campus amenities worth boasting about.

This year, Airbnb took the top spot. The company didn't even make the list last year, providing yet another compelling indication that sharing economy companies are just starting to come into their own. For example, major players from the established social media space (Facebook and LinkedIn) took spots #6 and #7 on the list, while Uber, Lyft, Etsy, and WeWork didn’t place in the top 50. That may start changing in the coming years.

8. Uber moves its global headquarters to Oakland

If you’re reading this, you probably know that we’re big fans of Oakland. Vator has hosted multiple events there and strongly believes in the city's prospects as the next great tech hub.

That argument got a big boost of confidence in September when Uber confirmed that it had purchased the historic Sears building (known as Uptown Station) in the middle of downtown Oakland to serve as the company’s global headquarters. The building is set to open in 2017 and provide space for between 2,000 and 3,000 employees, more than doubling the company’s current workforce in the Bay Area.

While older tech companies like Pandora and Ask.com have been planted in the east bay for several years, Uber’s entry will likely be the first of many expansions for tech companies, as the cost of both residential and commercial space in San Francisco continues to skyrocket. Going (not quite yet gone) are the days when “I’ll move to Oakland” was a reasonable strategy for dealing with sky-high rent in San Francisco.

9. Airbnb wins popular support in San Francisco

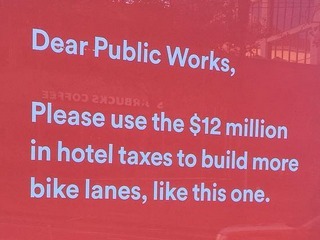

This year could have ended a lot worse for Airbnb, which soured much of San Francisco in October with passive-aggressive billboard ads complaining about having to pay hotel taxes. (And ignoring the fact that the company evaded those same taxes for the first six years of its operation.)

But the city hadn’t soured enough, apparently, to place new restrictions on the home sharing site. In the November 3 election, San Francisco residents rejected Proposition F, nicknamed the “Airbnb law” because it would have placed additional restrictions on short-term residential rentals.

With this small but significant victory—and the controversial ad campaign—behind it, Airbnb forged ahead with a concerted effort to do better by the community. In November, it released a Community Compact outlining its mission to boost economic opportunity for hosts across the world while making sure its service doesn’t make renting harder for residents. The company certainly doesn’t have a perfect track record, but now at least they’re trying to clean up their act.

10. The sharing economy boom

There’s one crucial trend underlying all these stories: the sharing economy is booming.

In the U.S. alone, Uber is made possible through the services of 400,000 drivers. Lyft counts 100,000 drivers across the country, and its partners in China, India, and Singapore likely employ several more thousands.

On Airbnb, you can find over two million listings across the globe, the vast majority provided by a host like you, me, or someone we know personally. HomeAway hosts another million globally and Tujia hosts 300,000 in China.

WeWork offers professional working spaces across the U.S., Israel, the Netherlands, and the U.K. And Etsy is the place where 1.5 million craftspeople actively sell their wares.

None of these companies could see the kind of success they’re seeing today without the sheer manpower provided by the drivers, homeowners, and sellers that make up their independent workforce. There is no Uber without a driver. There is no Airbnb without an extra room in your house. There is no Etsy without a friendly jeweler down the road. And that’s still one of the most important sharing economy stories there is.

It will complete and submit forms, and integrate with state benefit systems

Read more...The bill would require a report on how these industries use AI to valuate homes and underwrite loans

Read more...The artists wrote an open letter accusing OpenAI of misleading and using them

Read more...Startup/Business

Joined Vator on

Lyft is a peer-to-peer transportation platform that connects passengers who need rides with drivers willing to provide rides using their own personal vehicles.

Startup/Business

Joined Vator on

Airbnb.com is the “Ebay of space.” The online marketplace allows anyone from private residents to commercial properties to rent out their extra space. The reputation-based site allows for user reviews, verification, and online transactions, for which Airbnb takes a commission. As of June, 2009, the San Francisco-based company has listings in over 1062 cities in 76 countries.

Startup/Business

Joined Vator on

Uber is a ridesharing service headquartered in San Francisco, United States, which operates in multiple international cities. The company uses a smartphone application to arrange rides between riders and drivers.