We’ve all been hearing a lot about the so-called “fiscal cliff” lately, which refers to a torrent of automatic tax increases and spending cuts that could take place in January 2013.

Wall Street has reacted nervously to the prospect of the economy going over the now-proverbial cliff, which could lead to a rise in unemployment and recession. As the fiscal cliff looms large as we enter next year, the question about whether its doomsday (or year) for the already-softening venture industry is starting to percolate.

Venture capitalists and early-stage investors believe that should the fiscal cliff dampen the macro environment, it could mean fewer deals in venture investing in 2013.

“No matter if we actually fall of the fiscal cliff or not, markets, private and public, hate uncertainty and don’t react well to it,” Thomas Korte, founder of AngelPad, who invests in early-stage startups, told VatorNews.

Ray Rothrock, a partner at Venrock, said something similar in an article for the San Jose Mercury News last week.

“The numbers are way down,” Rothrock said. “All these companies with these fantastic balance sheets, and nobody is really buying anything. With all the uncertainty they’re facing with the economy and taxes, buying little companies is way down on their list. Liquidity is way off and that makes everyone grumpy.”

Given the current venture capital market, are these fears justified?

The current VC market

Uncertainty is already on the rise as venture investment shows signs of losing steam. According the to latest data, venture capitalists are already putting less money into startups than they did last quarter.

VCs invested $6.5 billion in 890 deals in the third quarter of 2012, according to a MoneyTree Report from PricewaterhouseCoopers. Quarterly venture capital investment activity declined 11% in dollar volume and 5% in the number of deals. In the second quarter of 2012, VCs invested $7.3 billion in 935 deals.

Investment for the first nine months of 2012 was $19.9 billion in 2,661 deals. Unless, VCs pour $9 billion into investments in the fourth quarter (2011 saw $29 billion invested), 2012 could end up down in both dollar and deal volume. The last time that happened was in 2009, when, as you might remember, the economy was in pretty bad shape. In that year, investors put in $20 billion into startups vs $30 billion in 2008.

Even more important than VC funding, though, might be the amount of IPOs. If the stock market continues to fall, or remain volitile, it may scare off a number of companies thinking about going public.

So far this does not seem to have happened.

There were 10 venture-backed initial public offerings (IPOs) during the third quarter of 2012, compared to 11 in the previous quarter. While the amount raised was down substantially, $1.1 billion compared to $17.1 billion, NVCA attributed it the large number last quarter to the record-breaking Facebook IPO in May. Last year saw 52 exits overall. So far there have been 40 IPOs in the first nine months of 2012.

But, even though the numbers are holding steady year to year, and are actually higher from the anemic years of 2008 and 2009, “50 IPOs could not qualify as a healthy market in terms of IPO volume,” said Emily Mendell, VP of Communications at NVCA. In fact, those numbers should be at least double what they are now.

“In actuality, we would like to see 200 or more IPOs each year. We haven’t been at these levels in some time but those levels did indeed exist in the mid 1990s to 2000. Getting to 100 would be a good start,” she said.

While getting back to that number of IPOs might be good for the market, it’s also important to keep in mind that the latter half of the ’90s decade was what you’d call “bubble” years. During the years since, with a couple of exceptions, the number of IPOs has leveled off to between 25 and 50 a year. So perhaps what we are looking at now is the new normal.

M&A declining

In terms of M&A deals, there were 96 exits in the third quarter, down from 116 in the second quarter.

Deal values were higher in the second quarter because of some pretty high-flying acquisitions at the time, including three billion dollar deals, such as Facebook’s acquisition of Instagram, a deal which closed in September; Microsoft’s purchase of Yammer for $1.2 billion in June; and VMware’s acquisition Nicira for $1.26 billion in July.

Those three deals bouyed the quarter, and made it appear more healthy than it was. Annecdotally, Mendell added, she is hearing that the fourth quarter is slowing even further. And, if the exit market starts not functioning well, and companies begin to think they will not be able to see a return on their investment, less money will be pumped into new companies.

Could there be another reason that venture financing is down?

Dave Samuel, co-founder of Freestyle Capital, a seed-stage investment firm with a portfolio currently numbering more than 36 strong with 10 exits, said that, while the uncertainty of the fiscal cliff might have an impact, there is another, bigger problem facing venture capital right now.

“Exit uncertainty does eventually trickle down to seed investing but we believe the uncertainty will disappear before that happens. The Series A squeeze is a more impactful force on our industry and that is being driven more by a classic supply and demand imbalance. More companies are being funded in the seed round then the Series A funders can handle,” Samuel told VatorNews.

Data from Dow Jones VentureSource, which breaks the numbers down into seed round and first round, shows that the median amount invested into seed rounds for consumer Web was $930,000 for the first nine months of 2012, above the average of $850,000 for 2011. At the same time, the median amount invested in first rounds has remained steady at $2 million.

Keep in mind that not all companies have a seed round, so the first round would essentially be their initial financing. The second round would then be a follow-on, and in some cases a Series A, financing. The median amount of second round financing is down to $4 million, from $5.3 million in 2011. That the median amount of seed funding is up, but other rounds are the same or down, shows that VCs are not as eager to put money into the later rounds as they once were.

While Samuel says that it has not necessarily changed how Freestyle Capital chooses to invest, it is something that Samuel says he now has to think about when investing in either new prospects or existing portfolio investments.

Mendell agreed with Samuel, saying that part of the reason that it’s hard for companies to raise Series A funding is because the amount VCs are raising for their own funds is way down, she said, meaning that there is less money for those firms to invest.

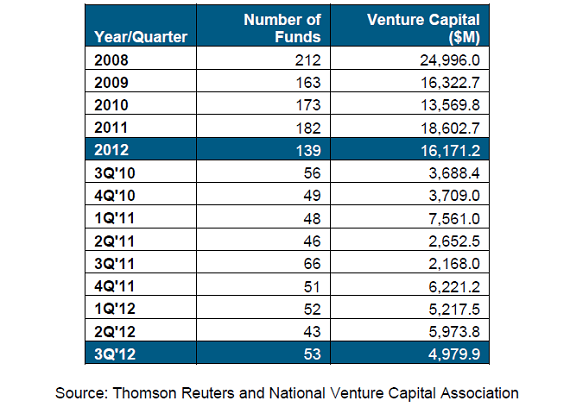

There were 53 U.S. venture capital funds in the quarter, which raised around $5.0 billion. Despite the larger number of deals, there was a 17% decrease by dollar commitments compared to the second quarter of 2012, which saw 43 funds raise nearly $6.0 billion.

Even if the amount of money raised by VCs was not slowing, there has also been a larger amount of seed rounds completed because of more active angels, accelerators and incubators. With so many startups being so generously funded, the percentage reaching a Series A was bound to decline.

The percentage of seed round vs. Series A rounds was gradually increasing from the first quarter of 2010 to the first quarter of 2012, according to data from CB Insights. Between the first and second quarter of this year, though, there was a dramatic 10% swing so that, for the first time, the percentage of seed rounds eclipsed the percentage of Series A rounds.

Conclusion

There is obviously no definitive answer to the question of whether or not the fiscal cliff will keep investors from pouring money into startups, but there is consensus on one thing: the fiscal cliff is creating uncertainty, and there are few things that affect investments more.

Sure, every investment is a risk, but investors need to be sure that there is at least some chance of getting something back. If the fiscal cliff keeps looming, and the market keeps dropping, you can’t blame investors for holding off until things become clearer.

(Image source: http://dubsism.wordpress.com)