The outlook for healthcare in 2025 is rosy, healthcare execs say

Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...

Editor's note: Our 6th Annual Vator Splash LA conference is coming up on October 13 at the Loews Hotel in Santa Monica. Speakers include Mark Cuban (one of the hosts of Shark Tank and owner of the Dallas Mavericks); Brian Lee (Founder & CEO, Honest Company); Leura Fine (Founder & CEO, Laurel & Wolf ); Nick Green (Co-Founder and Co-CEO, Thrive Market); Tri Tran (CEO & Co-founder, Munchery); Adam Goldenberg (Founder & CEO, JustFab); Andre Haddad (CEO, Turo); Mike Jones (Founder, Science) and many more. Join us! REGISTER HERE.

When Vator holds its annual Splash LA conferences, we always manage to get some really great people to come and talk to us.

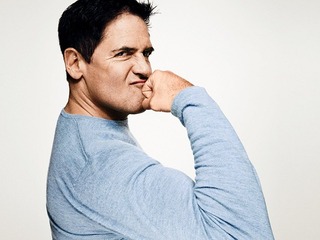

Last year, we had Michael Dubin, Founder and CEO of The Dollar Shave Club, which was acquired by Unilever. We've also had Jessica Alba, actress and co-founder of The Honest Company. This year we're going to be joined by, among others, Mark Cuban.

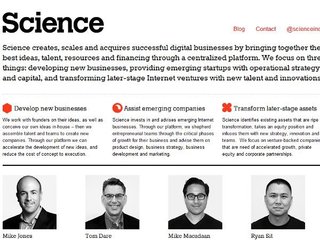

One of our other distinguished guests this year is going to be Mike Jones, the founder and CEO of Science.

The former CEO of Myspace, Jones founded his first successful company in college and since then, has founded, built and sold numerous online and mobile businesses. That list includes Userplane, a developer of chat and instant-messaging software for corporate clients, which was eventually acquired by AOL; and Tsavo Media, an online media network that was acquired by Cybernex.

Jones became CEO of Myspace in 2010, until it was sold to SpecificMedia and Justin Timberlake in 2011.

That same year, Jones founded Science, an incubator that is described on Crunchbase as "a disruptive media, marketing and commerce company that creates, invests, acquires and scales successful digital businesses."

"Fundamentally, we have a bunch of people that work at Science, and our goal is to build hit companies. That's basically it, right? Sometimes we're happy to buy a later stage business, and try to make that even into a further hit company. Sometimes we'll work with early stage entrepreneurs, invest in them, provide them resources, for them to become hit companies," he explained while speaking to Vator CEO Bambi Francisco at Vator Splash LA in 2014.

He also explained why he didn't go the traditional VC route.

"In order for us to create breakout hits, a lot of times startups need resources beyond what they can afford. Unfortunately, the way that venture capital is structured, you typically don't have the operational budgets at the VC level to really have resources to make sure those companies become successful. Generally, VCs have two things they can primarily do: they can fund companies, or they generally can replace management. Outside of that, it's really hard for them to really operationally help the growth of a business. My thought was, "If I'm going to be in the business of identifying great, early stage entrepreneurs, levering them up, hopefully become the next great leaders inside the industry of technology, I want to have a lot of resources to provide them to be very successful," he said.

"I just simply couldn't do that through the financial structure that was venture capital. I could do that through the financial structure that is an operating company. So, I chose to do that because I wanted to be spending my time on building hits. And I wanted to have a lot of resources to really make sure those companies become successful, and the only was I was able to do it was as our studio."

The Santa Monica, California-based studio launched with $10 million in funding from Rustic Canyon, White Star Capital, The Social+Capital Partnership, Tomorrow Ventures, Siemer Ventures, Philippe Camus, Jean-Marie Messier, Jonathan Miller and Dennis Phelps.

Over the past four years, Science has co-founded and invested in more than 40 companies, which have seen over seven million e-commerce packages shipped, over 65 million hours of marketplace services provided and over 1 billion mobile sessions.

Its investments have included EVENTup, Wishbone, HelloSociety, Delicious and DogVacay, the winner of the second ever Vator Splash LA competition back in 2012.

Dollar Shave Club

Science was Dollar Shave Club’s first investor, putting $100,000 into the company in 2012. Just two years later it was already seeing $65 million in sales. Jones currently serves as a board member.

What's interesting about Dollar Shave Club is that there was no technological advance behind it. In fact, as Dubin said during his talk at Splash LA, it was quite the opposite.

"Our story is, the big boys are serving you up superfluous technological advancements that don't really measure up, so to speak," he said.

That includes things like the Gillette's FlexBall, "a product they claim to shave 13 microns closer than the previous version of Gilette," as well as vibrating handles and LED guide-lights.

"These are what Gillete and Schick have up-selling the customer on and we make fun of it in the video, saying your grandfather had a great shave when he only had one blade, but the fact is that you don't need a revolutionized razor to get the job done. And so that go to market tone had really made us the people's hero of the men's grooming category, because we finally called bullshit on what the big boys are doing to take advantage of the customer," said Dubin.

"So it's not actually a revolutionized razor that we're selling, we're selling a more humble version of what you are already getting."

So why would Science want to put money into a company whose idea was to sell razors online? It came down to how the company marketed itself through humerous videos. Ultimately, Dollar Shave Club became more about the brand than the product.

Jones wrote about his investment in Dollar Shave Club on CNBC, following the company's sale.

"While the business model was promising, I wasn't wholly persuaded by the profit margins on the just-a-few-bucks-per-razor concept," he said.

"Michael, however, being a visionary who also happens to have a great sense of humor, showed me a rough cut of the video he produced that was intended to amplify attention around the company's launch by discussing Dollar Shave Club's mission. After viewing the video, I knew that Science Inc. needed to come on board and back the brand that was stirring up the pricey men's grooming marketplace."

This is the video Jones was referring to:

We're proud to have, on stage, the guy who was the first to seethe promise of Dollar Shave Club, and we can't wait to ask him more about how to take a company that is purposely not innovating, and sell it for $1 billion.

(Image source: thehindu.com)

Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...Startup/Business

Joined Vator on

DogVacay.com is a community marketplace that addresses the $5B market for dog-boarding and pet-sitting. Instead of paying for a crowded and overpriced kennel, our users book with experienced hosts who watch dogs in their own homes. In two months since launch the we have gained national coverage with thousands of approved hosts.

We provide multiple layers of quality control, a comprehensive insurance policy, emergency support, photo updates, and other pet services like daycare and walking.

We were founded in 2011 by a husband and wife team who boarded over 100 dogs in their home to make extra money while saving for their weddin. We are now venture capital funded by First Round Capital, Science, and several angels.

Joined Vator on

Joined Vator on