Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

Home-ownership is on the decline. As we discussed earlier this month, fully one-third of all homes in the U.S. are renter occupied, and the biggest renter population consists of millennials, for whom home-ownership has been on the decline since the mid-2000s. California ties with Hawaii for the second-lowest rate of home-ownership in the country, next to New York.

More people are renting today than they have been in the last 10 years, and interestingly enough, fully 20% of renters pay in cash. That’s roughly 6%-7% of all rental payments. The process can be tricky though, as many property managers are reticent to accept cash, which often leaves unbanked renters with few options other than running out and picking up a money order. That means driving across town to pick up the money order, then driving to the property management office to drop off the money order during office hours.

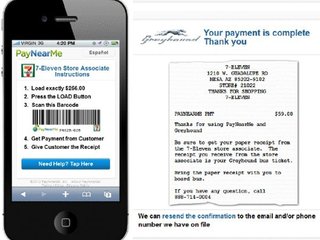

Naturally, cash payment solution PayNearMe is proposing an easier way. The company, which has made a name for itself by taking on the difficult challenge of bringing cash-payers into the e-commerce world, announced Wednesday that it has integrated with property management software company AppFolio to allow renters to pay quickly with cash.

“Since about 20% of rent payments are made with cash or money orders, and since both can lead to security or operational problems for tenants and landlords, rent was an obvious target for PayNearMe,” CEO Danny Shader tells me. “Over the past year, we've run tests with regional property managers, and received overwhelmingly positive feedback from renters and property managers. In the process, we made a number of product-level changes to improve the process of on-boarding property managers and simplifying the payment process for consumers.”

Shader adds that PayNearMe then sought out a partner who provided end-to-end services for property managers and found “kindred spirits” in the team at AppFolio.

Like PayNearMe’s cash-payment solutions for online shopping and loan repayment, renters living in a unit managed by AppFolio’s software can simply make their transaction online, at which point they’ll get a special barcode, which they can print out or receive on their mobile device. They can then go to any neighborhood 7-Eleven or ACE Cash Express, show the barcode, pay in cash, and the payment is automatically credited to their account—no mess, no fuss.

Shader says that more than 30% of PayNearMe users are using the service from a mobile device, and penetration is growing at about 2% per month. He projects that mobile will be the dominant way that people will use PayNearMe in the next couple of years.

In addition to AppFolio, PayNearMe also works with Amazon, Progreso Financiero, Greyhound, Westlake Financial Services, and more to allow consumers to pay in cash for online transactions. One-quarter of U.S. households are unbanked or underbanked, meaning they don't have a bank account, credit card, or debit card. But Danny Shader notes that PayNearMe doesn't just serve the unbanked--it also serves those who prefer to pay in cash.

The Santa Barbara-based AppFolio is a property management software solution specifically designed for residential properties, and covers everything from actual management tasks like online rental applications, tenant screenings, owners portals, and utility billing, to accounting tasks, like online payments from renters, payments to owners, property budgeting, and more.

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...Startup/Business

Joined Vator on

PayNearMe combines a modified cash load network with an application technology platform so that consumers without credit or debit cards—or those who prefer to pay with cash—can conduct a wide range of remote transactions. By doing so, PayNearMe enables companies in a diverse set of industries to turn millions of American households into new paying customers. Consumers can use PayNearMe to pay for ecommerce purchases, telephone orders, loan repayments, money transfers, load funds into e-wallets and more at retail locations throughout the U.S., starting with 6,000 7-Eleven stores.

Joined Vator on