Last time I checked in with PayNearMe CEO Danny Shader, he hinted at some mobile developments on the horizon. That would be a pretty impressive feat for a company that has made a name for itself as a cash payment system for online transactions. But today, that mobile option has become a reality, as PayNearMe announced Wednesday that users can now complete cash transactions with their smartphones.

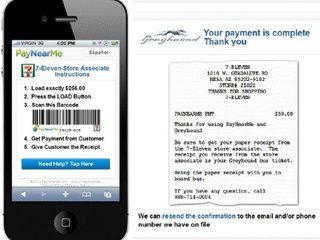

What dark magic is this, you ask? It’s surprisingly uncomplicated. Take, for example, one of PayNearMe’s first partners: Greyhound. A customer who wants to buy a Greyhound bus ticket can initiate the transaction via smartphone and receive a barcode that can be scanned at any one of the PayNearMe payment locations, such as a participating 7-Eleven, where the customer can pay in cash.

It’s a big leap from PayNearMe’s previous mobile solution, which relied on a specialized card.

Along with Greyhound, financial services company Progreso Financiero also jumped on board the new mobile option. Since deploying the mobile payment option, Greyhound says that it has experienced a high volume of mobile transactions, averaging 20% of its cash payments.

But how many people without bank accounts or credit cards own smartphones? As it turns out: a lot.

“More than 50% of Americans between the ages of 18 and 35 who have an income level below 35k have smartphones,” Shader told me. “In addition, teens overwhelmingly prefer smartphones. And, of course, these percentages are continuing to rise. That’s why over 20% of our Greyhound transactions are conducted with smartphones using PayNearMe mobile. We’d be shocked if that were not greater than 50% within two years.”

PayNearMe works with merchants in a bevy of varied sectors, including e-commerce, lending, rent payments, remittance, bill payment, transportation, entertainment, collections, government, and even tuition repayment, and all of PayNearMe’s merchants will get the new option by default.

“Our observation is that there are no transaction types that PayNearMe cannot handle (including mobile),” said Shader.

For a company targeting the segment of the population without bank accounts and/or credit cards (25% of the population, to be specific), it has experienced surprising growth—30% of monthly compounded growth, according to the company. Launched back in September 2010, PayNearMe—formerly Kwedit—has raised $22.3 million from Khosla Ventures, Floodgate, True Ventures, Maveron, Kapor Capital, Fenwick & West, Endeavor Partners, and August Capital.