DUOS expands AI capabilities to help seniors apply for assistance programs

It will complete and submit forms, and integrate with state benefit systems

Read more...

One personal finance company, Credit Sesame, has announced that it secured $12 million in Series B funding. This round was led by Globespan Capital Partners, and included participation from existing investors, Menlo Ventures and Inventus Capital.

Founded in April 2010, the Sunnyvale company has raised $19.35 million in funding to date.

The financing is focused toward assisting the company in product development and market reach. Over the next quarter, Credit Sesame aims to add on new services for its mobile and Web versions.

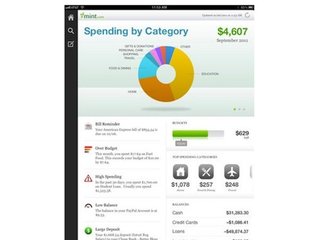

With a country still recovering from the economic downturn, Credit Sesame is specializes in one of the most necessary areas of personal finance: getting out of debt. There are a few other big Internet-tech companies, like Mint.com, that offer services that help manage current finances and finical goals, but Credit Sesame is has one focus: credits and loans.

U.S. households carry $14 trillion of debt in mortgages, credit cards, consumer loans, and student loans -- that is a heavy burden that, if turned into healthy spending, would greatly improve the country's fiscal health. Credit Sesame offers users instant, free access to credit scores and critical financial information.

Credit Sesame also analyzes your debt situation and then recommends different ways to improve your ratio to improve your credit score and monthly payments.

Now with an iPhone application to help monitor your credit score and finical ratio, Credit Sesame also recommends various loan and credit options based on its analysis your debt situation.

The company is now managing $22 billion in consumer loans through its service, and is saving its users over $170 million per month through its recommendations.

As a result, nearly half (48%) of the users visit the site 2- 3 times a month.

"Credit Sesame helps consumers better manage the critical part of their finances they often neglect: their credit and debt," said Adrian Nazari, founder and CEO of Credit Sesame, in a statement. "While consumers are out investing countless dollars and hours, trying to time the market for a slightly better return on their investments, we're giving them the edge back home, making sure they're not incurring thousands of extra dollars in cost each year on their loans and credit needs."

Currently the company plans on hiring talent in marketing and engineering and enhancing its mobile app, and an Android app is expected out in a few months.

It will complete and submit forms, and integrate with state benefit systems

Read more...The bill would require a report on how these industries use AI to valuate homes and underwrite loans

Read more...The artists wrote an open letter accusing OpenAI of misleading and using them

Read more...