It’s always surreal to look outside the technology sector and see that other industries are still wallowing in the gutters of the recession, with no end in sight. One of the reasons for this is the fact that even in the pit of financial ruin, people still want their gadgets. Consumer electronics continue to thrive despite bleak times (as Apple has clearly proven). Aaaand this is probably why personal finance services are also on the rise: people don’t know how to manage their own money.

You know who I’m talking about. You’ve seen the 30-year-old guy on the corner who’s waving the Mr. Pickles sign, probably making $8 an hour, and yet he periodically stops to whip out his iPhone and slip in a little FaceTime with his hawt gf. And you know that after work he’s going to go back to his apartment to play some Kinect and then curl up in bed with his iPad2 (I hate him because I’m jealous). Meanwhile, he has $18,000 worth of credit card debt that isn’t going anywhere.

For that guy, there are services like Mint and PageOnce. Today, a new personal finance service, Personal Capital, has just emerged from stealth mode to announce that it has already raised a combined total of $25 million across two rounds of financing. Its Series A round was led by Institutional Venture Partners (IVP) and its Series B round was led by Venrock, with participation from IVP.

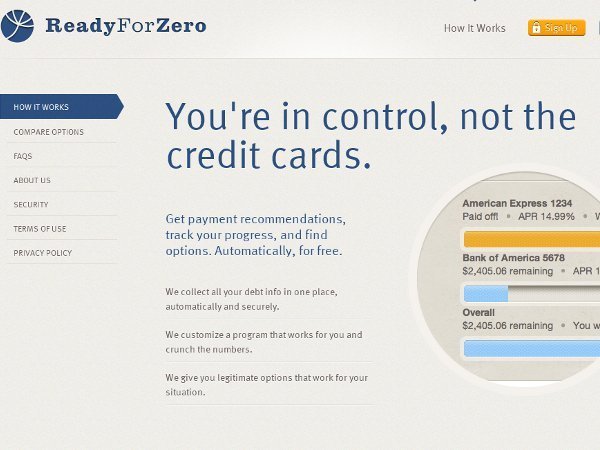

While the service is out of stealth mode, it’s still currently in private beta mode, so it isn’t yet clear how Personal Capital will stand apart from Mint, PageOnce, ReadyForZero, LearnVest, and all the other personal finance services out there. It may, however, have some echoes of Mint, since its CEO, Bill Harris, was formerly the CEO of Intuit, Mint’s parent company. (To be clear, though, Harris left Intuit in 1999, while Mint was acquired in 2009, so there was no overlap.)

personal finance services out there. It may, however, have some echoes of Mint, since its CEO, Bill Harris, was formerly the CEO of Intuit, Mint’s parent company. (To be clear, though, Harris left Intuit in 1999, while Mint was acquired in 2009, so there was no overlap.)

Filling out the rest of Personal Capital’s all-star management team is EverBank co-founder and former Fidelity Investments Personal Trust Company President, Rob Foregger (CSO), and former E-Loan CIO, Jay Shah (CIO).

The service promises to be a “next-generation financial advisor” with the aim of providing highly personalized financial management services, and judging by the tone of the announcement, it looks like Personal Capital will lean in the direction of investing.

“Personal Capital has the opportunity to create a new service that shifts the balance of power from Wall Street to the individual consumer,” said Steve Harrick, General Partner at IVP and a member of Personal Capital’s Board of Directors, in a statement. “Few companies have an opportunity of this magnitude, but even fewer companies have a team like Personal Capital — a team of leaders from the most innovative companies in financial services and technology. We believe Personal Capital has the potential to transform the entire personal financial management industry for the better.”