Morgenthaler Ventures to raise $200M for new fund

Firm's tenth fund will focus on early stage IT companies

Who says venture capital is slowing down? Yesterday it was revealed that Sequoia Capital was looking to raise a new fund, mere months after raising $1 billion and they were not the only ones: venture capital firm Morgenthaler Ventures is looking to raise a new fund, according to sources close to the fund.

The fund, which would be Morgenthaler’s tenth, will be called IT Fund X and it will be focused on early stage IT companies. Morgenthaler has capped the fund at $200 million.

No formal documents have been distributed, but the firm is already having conversations and should begin its fundraising efforts in January.

Menlo Park, California-based Morgenthaler Ventures was established in 1968, and has invested in numerous companies in its forty-plus year history, including NexTag, Siri, Jaspersoft, MuleSource, Practice Fusion, Force10, Sezmi, Nominum, Voltage Security, Peregrine Semiconductor, Cortina, Brion, Synopsys, Verifone, Nuance Communications, Apple and NEXTEL.

Morgenthaler previously raised $400 million for its ninth fund in 2008, using the money to invest in both IT and life sciences. For the IT portion of the fund of Fund IX is generating a net IRR (internal rate of return) of roughly 70% through Q3 2012, a limited partner told us.

Morgenthaler raised its ninth fund in 2008, a $400 million effort that was evenly split between between IT and life sciences. Morgenthaler used the money it raised to participated in a $20 million round, and then a $50 million round, of financing for organization tool Evernote. The firm also participated in a $25 million round for Lending Club, a platform where users can take out personal loans or invest in them. Morgenthaler also led a $15 million round for Pageonce, a mobile finance app.

In September, the firm led a $17 million Series B round of funding for Doximity, which helps doctors get the help they need via a HIPAA-compliant social network just for physicians.

The new fund will reportedly have nothing to do with Lightstone Ventures, which is a firm that was formed by the life sciences partners at Morgenthaler Ventures and Advanced Technology Ventures. Lightstone is raising a separate $250 million fund, which will focus on early-stage therapeutics and medical devices.

Morgenthaler Ventures would not comment.

A list of 2012 funds

Kleiner Perkins Caufield & Byers closed a $525 million fund In May. In April, early-stage venture capital firm First Round Capital announced that it was going to raise its fourth fund, with a target of $135 million, while Berlin-based Earlybird raised a $100 million fund. In March, Groupon investor NEA filed with the SEC to raise $2.3 billion, while DST, one of Facebook's biggest investors, was looking to raise $1 billion.

Andreessen Horowitz secured a $1.5 billion fund in January, announcing it had raised $2.7 billion in three years. While it has only been around since 2009, Andreessen Horowitz is already a top VC firm, raking in siginificant management fees.

In June, Khosla Ventures announced a new fund for an undisclosed amount, while Madrona Venture Group closed a $300 million fund.

In August, Sequoia Capital surpassed its goal of raising $975 million for three early-stage funds, and just yesterday Nexus Venture Partners, a venture firm whose major focus is on India-based technology startups, announced Thursday that it's raised $270 million for its third fund.

Thrive Capital closed a $150 million fund in September, and in October Trinity Ventures began targeting a $325 million fund.

In October, Atomico Ventures raised a $286 million fund, and NTT Docomo, the largest phone operator in Japan, announced a new ¥10 billion, or $125 million, fund, meant to help new businesses develop for smartphones and tablets

There were 53 U.S. venture capital funds in the third quarter of 2012, which raised around $5.0 billion. Despite the larger number of deals, there was a 17% decrease by dollar commitments compared to the second quarter of 2012, which saw 43 funds raise nearly $6.0 billion.

(Image source: https://www.morgenthaler.com/)

Related Companies, Investors, and Entrepreneurs

Morgenthaler Ventures

Startup/Business

Joined Vator on

Morgenthaler Ventures has been dedicated to helping entrepreneurs build valuable companies for more than 42 years. Today, the firm has nearly $3 billion under management, including $400 million in its ninth fund, capitalized in November of 2008. Morgenthaler has invested in approximately 300 companies in the information technology and life science sectors. Representative portfolio companies in the IT space include: NexTag, Siri Inc., Evernote, Lending Club, Jaspersoft, MuleSource, Practice Fusion, Force10, Sezmi, Nominum, Voltage Security, Peregrine Semiconductor, Cortina, Brion, Synopsys, Verifone, Nuance Communications, Apple and NEXTEL.

Evernote

Startup/Business

Joined Vator on

Our goal at Evernote is to give everyone the ability to easily capture any moment, idea, inspiration, or experience whenever they want using whichever device or platform they find most convenient, and then to make all of that information easy to find.

And we’ve done just that. From creating text and ink notes, to snapshots of whiteboards and wine labels, to clips of webpages, Evernote users can capture anything from their real and digital lives and find it all anytime.

Evernote is an independent, privately held company headquartered in Mountain View, California. Major investors include Sequoia Capital, Morgenthaler Ventures, Troika Dialog, and DOCOMO Capital.

NexTag

Startup/Business

Joined Vator on

NexTag is the leading comparison shopping site for products, financial services, travel, automobiles, real estate, education and more. At the core of NexTag are proprietary technologies and algorithms that enable shoppers to quickly compare prices and find the best deals on millions of products and services. For thousands of merchants, service providers and individuals, NexTag is an extremely efficient sales channel with its highly qualified traffic and performance-based pricing. More than 17 million people per month use NexTag to research, compare, and save on products and services online.

NexTag has been named among the nation's fastest growing companies by Inc. 500, Deloitte Technology Fast 500/Fast 50, Red Herring Top 100, San Francisco Business Times Fast 100, and the Silicon Valley/San Jose Business Journal Fast 50. The company operates comparison shopping sites in the US (www.nextag.com), the UK (www.nextag.co.uk), France (www.nextag.fr), and Germany (www.nextag.de). NexTag is headquartered in San Mateo, California with offices in London and Gurgaon, India.

Lending Club

Startup/Business

Joined Vator on

Lending Club is a social lending network where members can borrow and lend money among themselves at better rates.

Lending Club provides a much improved infrastructure for social lending: state-of-the-art technology to authenticate all users (ensuring making sure they are who they say they are); credit scoring systems which rate borrower risk; and, the automated clearing house (ACH) system to move the funds between both parties. In addition, we provide our LendingMatch™ system to minimize risk and allow community based lending.

Pageonce

Startup/Business

Joined Vator on

Pageonce is the first mobile company that allows users to access, view and manage all of their personal online accounts in a single secure application. Pageonce provides anytime, anywhere account access via iPhone and BlackBerry. With access to thousands of providers across banking, finance, credit cards, investments, utilities, airlines, hotels, ecommerce sites and more, users enjoy access to detailed transaction history and account activity and receive alerts when key changes occur in any of their accounts.

Siri

Startup/Business

Joined Vator on

Siri is a Virtual Personal Assistant - a new way to interact with the Internet on your mobile phone. Like a real assistant, Siri helps you get things done. You interact with Siri by just saying, in your own words, what you want to do. You can ask Siri to find a romantic place for dinner, and get reservations for Saturday night. You can discover things to do over the weekend, get tickets to the movies, or call a cab when you’re out on the town. You don't have to search through a bunch of web pages, following links and hunting down facts. Siri does all the work giving you the information you need at your fingertips.

We believe that in five years most people who use the Internet will have a Virtual Personal Assistant (VPA) to take care of the details of using online services. We will look back at the birth of VPAs in 2009 and wonder how we ever got by without our trusted assistant. The days of wading through links and pages from your mobile interface will seem quaint, because the natural way to interact with the rich world of information and services is to have a conversation. As John Batelle, the author of The Search, says "The future of search is a conversation with someone we trust."

Atomico

Angel group/VC

Joined Vator on

We are entrepreneurs with a global perspective who invest in passionate entrepreneurs with disruptive, powerful ideas.Through our experience building Skype, Joost and Kazaa, we understand the value of game-changing business models and have created a worldwide network to help accelerate the growth of the companies in which we invest.

Practice Fusion

Startup/Business

Joined Vator on

Practice Fusion provides a free, web-based EMR system to physicians. With medical charting, scheduling, e-prescribing (eRx), lab integrations, referral letters, Meaningful Use certification, unlimited support and a Personal Health Record for patients, Practice Fusion's EMR the complex needs of today's healthcare providers and disrupts the health IT status quo. Practice Fusion is the fastest growing Electronic Medical Record community in the country with more than 150,000 users serving 40 million patients. The company closed a $23 million Series B round of financing led by Founders Fund in 2011. For more information about Practice Fusion, please visit www.practicefusion.com

Related News

Thrive Capital raises $150 million fund

Sequoia Capital surpassing fundraising goal

Khosla Ventures files for new seed fund

How to get funded by Morgenthaler's Rebecca Lynn

Pageonce secures $15M for mobile finance app

Already profitable, Evernote raises $50 million

Sequoia Capital looking to raise another fund

Kleiner Perkins Caufield & Byers closes $525M fund

Lending Club gets $25M in round led by Union Square

VC firm Madrona Venture Group closes $300M fund

Nexus Venture Partners closes $270M fund

Andreessen Horowitz secures $1.5B fund

NEA seeks to raise $2.3 billion fund

Morgenthaler's Rebecca Lynn talks to Bambi Francisco

Doximity gets $17M infusion for physician network

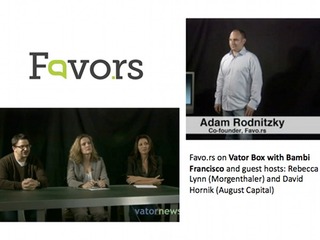

August Capital, Morgenthaler check out Favo.rs

Trinity Ventures looking to raise $325 million fund

Web-collaboration startup Evernote gets $20M