Trinity Ventures looking to raise $325 million fund

Backer of BeachMint, Care.com, thredUP looks to raise 11th fund

Trinity Ventures is on track to raise a new fund, according to a filing with the Securities and Exchange Commission Friday.

CalledTrinity Ventures XI, the early-stage venture capital firm is targeting $325 million. The last time Trinity raised a fund was back in 2009, when it raised $300 million.

Trinity has been pretty busy in the past couple years. In October, it participated in a $14.5 million round for thredUP, an e-commerce platform devoted exclusively to used kids’ clothes and in September, the firm was part of the $50 million raise that went into Care.Com, an online service that specializes in finding an array of people for a range of care jobs. In January, Trinity Ventures led an $8 million round for Skyfire, a company that is dedicated to harnessing the power of the cloud to create moTbile solutions for operators and consumer.

In June of last year, social commerce company BeachMint announced that it raised $23.5 million in new funding, with participation from Trinity Ventures. In November, cloud-based performance tool software, New Relic raised $15 million in a Series D round of funding, in which Trinity Ventures participated. Then, in December, Trinity led a $5.33 million Series B round of financing for ScaleArc, which provides database infrastructure software that helps companies optimize their databases.

Founded in 1986, Trinity Ventures has over $1 billion under management, and has invested in over 100 companies, many of which have been acquired or gone public.

It invested in Affinity Labs, which was acquired by Monster.com; Bix, which was acquired by Yahoo; IntruVert Networks, which was acquired by Network Associates; Crescendo Communications, which was acquired by Cisco; Network Alchemy, which was acquired by Nokia; Photobucket, which was acquired by News Corporation; Speedera Networks, which was acquired by Akamai Technologies; Modulus Video, which was acquired by Motorola; and Sygate Technologies, which was acquired by Symantec.

Its investments which are now traded publically include Aruba Networks; Blue Nile; Extreme Networks; Forte Software; LoopNet; SciQuest; Starbucks; and Wall Data.

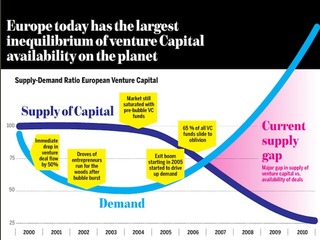

Trinity Venture's fund is just the latest to be raised in 2012, a year that is on pace to see the most VC money raised since 2008.

Kleiner Perkins Caufield & Byers closed a $525 million fund In May. In April, early-stage venture capital firm First Round Capital announced that it was going to raise its fourth fund, with a target of $135 million, while Berlin-based Earlybird raised a $100 million fund. In March, Groupon investor NEA filed with the SEC to raise $2.3 billion, while DST, one of Facebook's biggest investors, was looking to raise $1 billion.

Andreessen Horowitz secured a $1.5 billion fund in January, announcing it had raised $2.7 billion in three years. While it has only been around since 2009, Andreessen Horowitz is already a top VC firm, raking in siginificant management fees.

In June, Khosla Ventures announced a new fund for an undisclosed amount, while Madrona Venture Group closed a $300 million fund.

In August, Sequoia Capital surpassed its goal of raising $975 million for three early-stage funds, and just yesterday Nexus Venture Partners, a venture firm whose major focus is on India-based technology startups, announced Thursday that it's raised $270 million for its third fund.

Most recently, Thrive Capital closed a $150 million fund in September.

In the second quarter of 2012, 38 VC firms raised a total of $5.9 billion, according to the National Venture Capital Association.

Trinity Ventures could not be reached for comment.

(Image source: https://www.trinityventures.com/)

Related Companies, Investors, and Entrepreneurs

thredUP

Startup/Business

Joined Vator on

thredUP enables customers to extract maximum value from their closets by matching their high-quality used clothes with the preferences and changing sizes of others in a robust peer-to-peer network. With an easy-to-use interface (no bartering, no auctions, no hassle) and Netflix styled pre-paid envelopes, thredUP is the first recycler + personal shopper combination, ever.Related News

ScaleArc raises $5.33 million for database optimization

Andreessen Horowitz secures $1.5B fund

New Relic secures $15M for cloud performance management

Khosla Ventures files for new seed fund

Kids clothing resale site thredUP raises $14.5M

Q2 VC financings are the biggest since the dot-com boom

Care.com locks down $50M for finding home helpers

Thrive Capital raises $150 million fund

Kleiner Perkins Caufield & Byers closes $525M fund

Nexus Venture Partners closes $270M fund

VC firm Madrona Venture Group closes $300M fund

DST looking to raise $1 billion for new tech fund

Skyfire pockets $8M for data optimizing mobile apps

Berlin-based Earlybird closes $100M Fund IV

Sequoia Capital surpassing fundraising goal

NEA seeks to raise $2.3 billion fund