Commercial real-estate broker SquareFoot raises $16M in Series B financing

NY-based startup plans to broaden footprint as demand for flex space market rises

Read more...

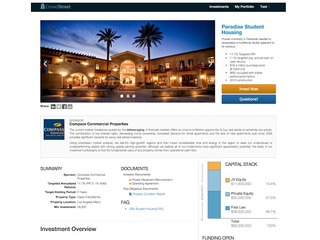

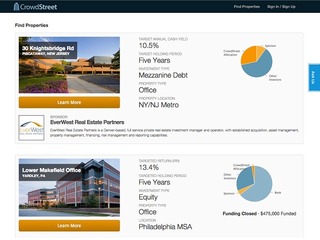

CrowdStreet is on a mission to open up the commercial real estate marketplace, using technology to make it accessible in a way that it hasn't been before.

Its platform, which brings together accredited investors and real estate developers online, has been growing quickly. There are now more than 100,000 investors on the CrowdStreet platform, who have raised over $320 million in capital through over 220 offerings. There are also 228 sponsors and $8.5 billion in commercial property value on the platform.

CrowdStreet, one of the finalists at the Vator Splash Oakland back in 2015, is now ready to expand to new areas in the commercial real estate space, a move that is being funded by an $8 million Series B round of financing, announced on Wednesday, led by Grotech Ventures.

Existing investors including Rally Ventures, Seven Peaks Ventures and Green Visor Capital also participated, as did strategic investor Noam Bardin, CEO of Waze. This is the company's first fundraising since it raised a $3.5 million round in March of 2016, and this brings its total funding to $12.8 million.

Launched in 2014, CrowdStreet provides real estate operators, funds and private equity companies a full-service marketplace solution for presenting investments online, marketing opportunities publicly, managing the offer process and maintaining ongoing investor relationships.

Over the last two years, the company has seen an increasing number of investors who are "recognizing the value of investing directly into commercial real estate," Tore Steen, CEO of CrowdStreet, told me in an interview.

"Once we’ve been able to provide them that access, transparency and efficiency, because too many times in the past that they were kind of locked out it and didn’t know how to do it, so a lot has been done around investor education, investor on boarding, if you will. And then, on the flip side, its really working with great sponsors, the commercial real estate developers and operators, and really finding those sponsors across the country who have a strong affinity for growing a base of investors," he said.

"That tends to be those developers and operators who are super regional in focus, who have already worked with investors in their local markets, but they’re confined to a local geography and their private networks. So it’s been fun to watch in the last two years to see both sides of that equation, both sides of our marketplace, really see the huge gains and opportunity that can get unlocked by putting this online by providing open access and transparency to invest in commercial real estate."

In addition to its marketplace, CrowdStreet also offers a software solution, unveiled as Sponsor Direct in 2015, but now called the "Crowdstreet Investment Software, in which it gives sponsors access to more information to better manage their investors.

"They can manage an entire lifecycle of their investors, from the prospecting of investors, to the on boarding of investors, to the fundraising with investors, and then the ongoing investor relationship management. So we’ve been adding key CRM and e-mail marketing features, we’ve been adding features around distribution management as well as document management, so all pieces of that lifecycle around an investor that a sponsor, traditionally, has had a lot of point solutions," said Steen.

What CrowdStreet really provides that others do not, he said, is an all in one solution, rather than those same sponsors needing to buy different software for different needs.

"They might use a standalone Docusign to do documents but it doesn’t store it in a central place. They might use an accounting system to do their distributions but the data from that distribution doesn’t get rolled up into a beautiful investor portal that allows an investor to see their position in those investments. They might use certain e-mail marketing tools, or CRM tools, but everything’s kind of a point solution, and the beauty is our software pulls that all together; it does everything that a sponsor would need to manage that investor for the entire lifecycle. And they’re managing these investors, not just for a year, they’ve managing these investors for many years to come."

The company plans to use the new funding for enhancing its existing services, as well for developing new products.

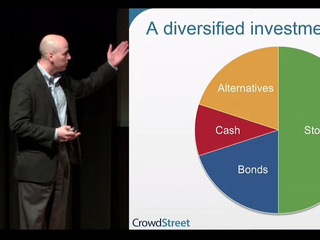

“I think our average investor on the CrowdStreet marketplace has close to six investments in their portfolio, so, as you can imagine, people are now creating a diversified portfolio of commercial real estate, so there’s a lot of enhancements in terms of portfolio management, tracking of investment positions, reinvesting as gains are realized. Now that we’re four years in we’ve had many deals that originated on the CrowdStreet marketplace that have become fully realized, so investors need those extra product features and functionality for doing that. So we’re enhancing the software, we’re adding new features and functionality based on the needs of those customers," said Steen.

In terms of new products, the company is currently remaining mum on what those might look like, though I was told that they might focus on the "average retail investor," rather than the "early adopters in the space," who have more knowledge about the commercial real estate space.

The funding will also be used to focus on a "broader array of high-quality alternative investment vehicles." What that means, essentially, is expanding to more of what Steen calls "asset types" within commercial real estate. That might include retail, medical office buildings and multi-family projects.

"We had an investor survey that was launched last year, they said one of the things they loved about the CrowdStreet marketplace is the diversity of the offerings. Well, we need to continue to diversify the types of offerings within commercial real estate because, again, it kind of goes back to them building a portfolio," said Steen.

"They want to see a diversity of asset types, risk profiles on those asset types, as well as different geographies. So it’s really an extension of the different types of commercial real estate offerings we can make. You wont see CrowdStreet suddenly providing consumer debt loans on their platform, that’s for sure."

Finally, the funding will also go toward growing the team, specifically in marketing and sales. It will go from having 50 employees to at least 75 by the end of the year.

In addition to the funding news, it was also revealed that Lawson DeVries, general partner of Grotech Ventures, has joined CrowdStreet’s board of directors.

“Grotech been around a couple decades now, has over $1 billion of fund management experience and one of the things we really like about them is their instrumental capability of working with companies that have seen great traction or are generating revenue, have had that product adoption into the marketplace, and really helping work with them to take it to the next level. That growth equity phase that we are right now," said Steen.

"Lawson, specifically, really enjoyed his embracement of the expansion of CrowdStreet, these new products and services that we bring to market, a real understanding of, with his background in institutional equity and research around that, if you will, older school financial services. His embracement of fintech and understanding of what a huge difference it can make. With Lawson bringing some of that background to bear, as we really become, and are today, the leader in online commercial real estate fundraising investor management."

DeVries is just one of several advisers that the company has; they also include Tom Byrne, ex-CEO of LoopNet, as well as Chris Keberm the ex-head of capital markets for Hines, and Lew Feldman, who was the managing partner for Goodwin Procter's capital real estate markets division.

"We talk about the board members, yes that’s important, and we talk about the VCs, but it’s also the other people and the influencers in the industry who have been really helpful as sounding board and providing some advice and information as we build out our products and services. Also, beyond just our strategic advisers who come from deep expertise in real estate and technology, is also the investor base that we’ve been working with over the last few years and the feedback that we will constantly strive to get from them to improve our marketplace," said Steen.

In the end, the real goal of CrowdStreet is "to transform investing in commercial real estate."

"Of the alternative asset types, still a very small fraction is done online and now that both sponsors investors are opening up, it’s really growing to huge adoption perspective. We talked about going to more retail grade investors; you’re going to see happen significantly over the next couple of years. There’s stats out there that talk about the crowdfunding of commercial real estate might be a couple of billion dollars; I think you’re going to, over the next two years, see that the online fundraising for commercial real estate projects is going to grow almost 8x to 10x on an annual basis online."

(Image source: crowdstreet.com)

NY-based startup plans to broaden footprint as demand for flex space market rises

Read more...Here's a simple, free, easy-to-use tool to manage your real estate properties

Read more...Bringing total investment to $50M raised by the project management platform startup

Read more...Startup/Business

Joined Vator on

CrowdStreet provides real estate operators, funds and private equity companies a full-service marketplace solution for presenting investments online, marketing opportunities publicly, managing the offer process and maintaining ongoing investor relationships. The CrowdStreet solution is enriched by services and business partnerships that empower real estate sponsors to modernize their fundraising processes and embrace online capital formation. Accredited investors, institutional investors and family offices access an intuitively-designed platform to find institutional-quality real estate investments, complete an online offer workflow, track investment performance and build a commercial real estate portfolio. Based in Portland, Oregon, CrowdStreet was founded in 2013 by a team with deep experience in commercial real estate, securities and finance, marketing, consumer Internet and software development.

Joined Vator on

Co-founder and CEO of CrowdStreet