Now here’s an interesting development. Little more than a week after Microsoft announced Steve Ballmer’s impending departure, the company has now announced that it’s acquiring Nokia’s devices and services business for $7.17 billion (€5.44 billion).

That breaks down to €3.79 billion for Nokia’s devices and services, and €1.65 billion to license Nokia’s patents. All of it will be in cash and Microsoft will draw on its overseas cash reserves to finance the transaction.

The two companies entered into a strategic partnership back in February 2011, in which Windows Phone became the primary OS platform for Nokia’s phones. Today, Nokia sells 9 out of 10 Windows Phone devices.

The deal brings up a number of questions. One that stands out in particular is–why buy the business at all? If the deal has been such a huge success, as Microsoft points out (Nokia and Windows Phone devices have grown 78% year-over-year and are outselling BlackBerry in 34 markets), why does Microsoft need to go to the extreme of buying Nokia’s devices and services business?

Microsoft addresses that question in a slide deck outlining the strategic rationale behind the deal. The company explains that the acquisition will protect the Windows Phone future because first party hardware will ensure Windows Phone’s ongoing presence, the acquisition will remove friction going forward and will allow Windows Phone to innovate more quickly and see more efficient marketing, and the acquisition will grow Microsoft’s OEM opportunity.

That last tidbit is telling when you consider the fact that Microsoft had—until the Surface came along—been exclusively a software company. It made the foray into hardware with the Surface tablet, which has done so poorly that Microsoft is just trying to offload it by cutting the price. Does it plan to dig itself deeper into a hardware mire it can’t get out of?

Microsoft explains that the deal will lead to better unit economics by owning the gross margin dollars and synergies, which will in turn fuel investment in innovation and marketing, which will drive further unit growth and market share.

Microsoft expects the deal to be accretive to its non-GAAP EPS in fiscal year 2015.

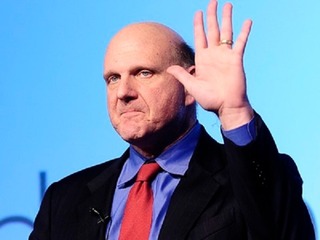

With the deal, Stephen Elop is stepping down as Nokia CEO to become EVP of Nokia’s Devices and Services with Microsoft, which could signal an eventual move into the role of Microsoft CEO when Steve Ballmer bows out.

So where does this leave Nokia? Strangely enough, Nokia plans to keep chugging along as some kind of mobile company, minus its phones.

“After a thorough assessment of how to maximize shareholder value, including consideration of a variety of alternatives, we believe this transaction is the best path forward for Nokia and its shareholders,” said Nokia interim CEO Risto Siilasmaa, in a statement. “Additionally, the deal offers future opportunities for many Nokia employees as part of a company with the strategy, financial resources and determination to succeed in the mobile space.”

Microsoft also announced that it will be building a new data center in Finland to serve its European customers. The company will invest over a quarter billion dollars into the project.

Image source: latimes.com