Updated 12/15/10: The article previously stated that LivingSocial got started before Groupon, but while the company was founded before Groupon, it did not begin offering daily deals until long after Groupon had pioneered the social shopping platform.

Today’s Groupon Clone of the Day is LivingSocial. Founded in 2007, LivingSocial got its start some time before Groupon, which was founded in 2008, but not as a deals site. Initially, LivingSocial began as a Facebook app that later began offering daily deals after Groupon emerged.

What I like about LivingSocial is that while it occupies the same space as Groupon (Groupon and the social buying space are synonymous at this point), it doesn’t try to mimic Groupon’s voice.

Nevertheless, Groupon remains in the lead with 40 million subscribers, compared to LivingSocial’s 10 million, but LivingSocial has been gaining in unique monthly visitors and some measurements have even shown LivingSocial eclipsing Groupon in unique monthlies.

Like rival college football teams, major corporations are rallying behind Groupon and LivingSocial. Last month, the big topic of conversation among all the tech blogs was the rumored Google/Groupon deal. The word on the street—which was never confirmed—was that Google had offered to buy Groupon for $6 billion. A number of observers were—and still are—confused. Why would Google offer to buy Groupon for so much money when it is such an easily replicable model?

Why? Because Groupon is friggen Groupon! Let me explain: aside from its trademark humor, very little separates Groupon from its plethora of clones. But over the last two years, it has cultivated a name for itself: the Groupon among the Groupon clones. Google wasn’t just looking to buy any company in the social buying space—Amazon learned that the hard way when it bought Woot…to little effect.

While Google was itching to get its hands on Groupon, Amazon rallied its forces behind LivingSocial with a $175 million investment, boosting the daily deals company’s total funds raised to $232 million. In recent months, the company has expanded to more than 120 markets and has made a few acquisitions along the way, including BuyYourFriendaDrink.com in April 2009 and Urban Escapes in October 2010. Additionally, the company invested $5 million into Australian daily deals site JumpOnIt.com for a controlling majority stake in the company.

With its rapid growth and big name backers, LivingSocial is bound to become more than just another Groupon clone.

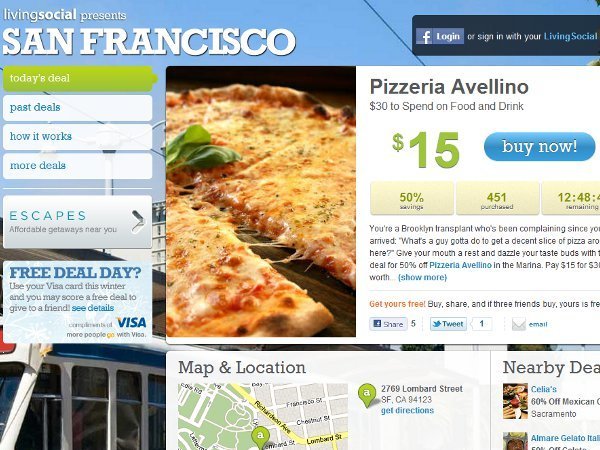

Image source: livingsocial.com