LivingSocial announced Thursday that it has received a massive $175 million investment from Amazon, along with an additional $8 million from LightSpeed Venture Partners, bringing the total to an eye-popping $183 million. Founded in 2007, the daily deals company previously raised $49 million from LightSpeed Venture Partners, U.S. Venture Partners, Grotech Ventures, and Revolution, bringing the company’s total funds raised to $232 million.

The company plans to use the new capital to continue its global expansion. Currently, the site serves 10 million subscribers in more than 120 markets throughout the U.S., Canada, the UK, Ireland, and Australia. At this point, the company is averaging a new local launch per day. Due to its global reach, the company claims to be booking over $1 million per day in revenues and plans to see over $500 million in revenues in 2011.

LivingSocial recently added Australia to its growing list of markets when it invested $5 million in Australian daily deals site Jump On It for a controlling majority stake in the company. Additionally, LivingSocial in October acquired Urban Escapes to boost its activity-based offers.

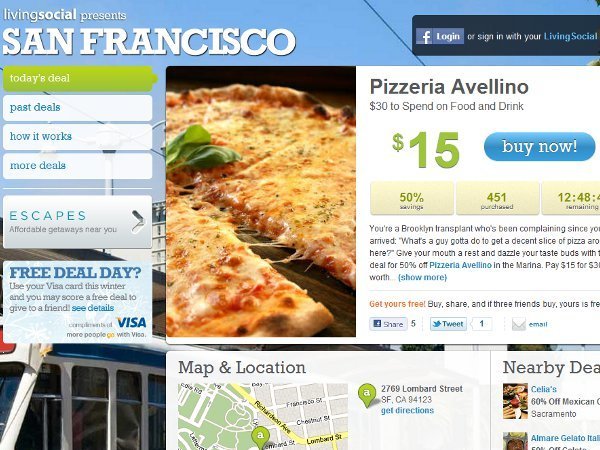

The Washington, D.C.-based company has long played second-fiddle to Groupon, but LivingSocial has been gaining in popularity and some data even shows that LivingSocial is getting more unique monthly users than Groupon. What LivingSocial and Groupon have in common–besides their business model–is their human touch. LivingSocial boasts of having “dedicated area experts” on the ground in each of its markets to research and negotiate the best deals for subscribers.

VentureBeat first broke the news of Amazon’s reported interest in LivingSocial back in mid-November, around the same time that Google’s interest in Groupon was first reported (nooo word on that yet). The strategic investment is not Amazon’s first foray into the daily deals space. Over the summer, Amazon acquired daily deals site Woot.com for a rumored $110 million.

“To be the biggest player in the local commerce space there is no one better to work with than Amazon,” said Tim O’Shaughnessy, CEO of LivingSocial, in a prepared statement. “As the social shopping space continues to heat up, LivingSocial is committed to staying focused on providing the high level of quality that consumers and merchants have come to expect when working with us.”

In early November, Amazon acquired Diapers.com parent Quidsi for $545 million. The e-commerce company made a name for itself for its rapid delivery service (1-2 days), low prices, and ultra-streamlined warehouse.