Oxford Cancer Analytics raises $11M to detect lung cancer via a blood test

OXcan combines proteomics and artificial intelligence for early detection

Read more... Despite COVID, or maybe even because of it, the investment side of healthcare shot up in 2020 to reach record highs. As Winston Churchill once famously said, "Never let a good crisis go to waste."

Despite COVID, or maybe even because of it, the investment side of healthcare shot up in 2020 to reach record highs. As Winston Churchill once famously said, "Never let a good crisis go to waste."

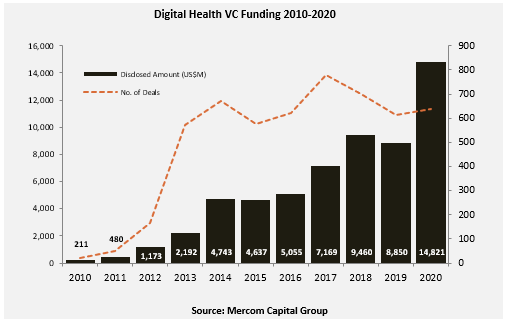

In 2020, the total, the amount invested in digital health, including VC, debt, and public market financing, came to 21.6 billion, more than doubling the $10.6 billion in 2019, according to a new report out from Mercom Capital Group on Wednesday.

Funding just from VCs totaled $14.8 billion this year across 637 deals, a record amount of investor for the digital health space. That number rose 66 percent from 2019, when there was $8.9 billion invested.  The top VC funded deals around the globe in 2020 were: Chinese healthcare portal DXY's $500 round; $285 million raised by fitness and wellness marketplace ClassPass; $250 million raised by Alto Pharmacy, a prescription drug retail platform; the $226 million raised by AI healthcare solution Olive, and $214 million raised by SomaLogic, a protein biomarker discovery and clinical diagnostics company.

The top VC funded deals around the globe in 2020 were: Chinese healthcare portal DXY's $500 round; $285 million raised by fitness and wellness marketplace ClassPass; $250 million raised by Alto Pharmacy, a prescription drug retail platform; the $226 million raised by AI healthcare solution Olive, and $214 million raised by SomaLogic, a protein biomarker discovery and clinical diagnostics company.

When broken down by category, it's no surprise that telemedicine came out ahead with $4.3 billion invested, a 139 percent increase from 2019 (there's a reason we picked it as the big winner of 2020). Some of the companies that raised funding includes Amwell, MDLive, Carbon Health, Eko Health, and Binah.ai. Amwell also went public, raising $742 million at a $3.69 billion valuation.

No other category even came close to that reaching that number: the second highest was the $1.8 billion invested in the data analytics category, followed by $1.4 billion in mHealth apps and $1.2 billion in clinical decision support.

While investing was up last year, so was M&A: there were 184 M&A transactions in 2020, a 9 percent increase compared to 169 in 2019.

In terms of the biggest deals, the list was topped by Teladoc’s acquisition of Livongo Health for $18.5 billion, which was announced in August and completed in October. The combination of Teladoc Health and Livongo, which went public in 2019, is expected to have 2020 pro forma revenue of approximately $1.3 billion. That was followed by the $4.7 billion spent by Blackstone to buy Ancestry, a deal announced in August and completed in December.

The other big deals of the year included Philips buying BioTelemetry for $2.8 billion, Invitae acquiriing ArcherDX for $1.4 billion, and WellSky purchasing of Allscripts’s CarePort Health (CarePort) business for $1.35 billion.

"COVID-19 supercharged funding activity in digital health in 2020. Ten digital health categories had their best year with record funding amounts. It was also the biggest year for IPOs with six digital health companies raising over $6 billion. We could see a lot more companies going public in 2021 if the current IPO and SPAC boom continues," Raj Prabhu, CEO of Mercom Capital Group, said in a statement.

"The pandemic has mainstreamed the consumer side of digital health technologies in less than a year. Digital health products that were a novelty a year or two ago are now a necessity."

(Image source: digitalauthority.me)

OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...