Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

CrowdStreet, a company that brings together accredited investors and real estate developers online, using technology to open up the commercial real estate marketplace, has just raised a new round of funding. That alone would be newsworthy just on its own, but what makes it even more interesting is the way the company went about raising it.

On Wednesday, the company announced that it closed a $12 million Series C round of funding, but that only $3 million of it came from traditional institutional investors, including previous investors Grotech Ventures, Rally Ventures, Seven Peaks Ventures, and Green Visor Capital.

The other $9 million came from CrowdStreet's own members, who used CrowdStreet's platform to invest.

"For six years, CrowdStreet’s mission was to transform investing in commercial real estate by making it more accessible and to make it more efficient. Over the last couple of years, I’ve heard personally from a lot of our investors who have come to me and said, ‘Hey, if it’s good enough for us to invest in commercial real estate, why can't we invest in CrowdStreet?’ I really took that to heart and so did Darren, my co-founder," Tore Steen, CEO of CrowdStreet, told me in an interview.

"So, we talked to the board, and we said, ‘We’re poised and ready, given the inflection points that we’ve seen over the the last six months, and the growth trajectory that CrowdStreet’s on. As we go to raise this next round of capital, let’s actually walk the walk here, let’s go out to select investor members on our marketplace, and select sponsors who’ve done a lot with us over the last few years, and let’s open it up to them.'"

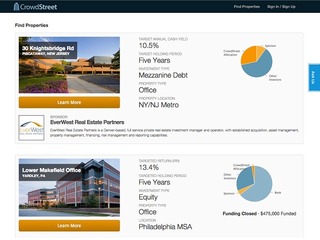

To raise a funding round this way, CrowdStreet set up a private website on its own platform, which was invite only, and required an authorization from CrowdStreet to access. The site contained videos, screencaps, a live streaming event that the company hosted for the invited investors, along with all the usual documents that they would see, such as growth plans and the financials, that they could review on their own time.

"Raising a round like this before would have been possible on a very private basis, but most likely the technology that we have developed would not have been in place to enable this. If you’re taking individual investors by dozens, trying to manage that without technology is just not possible," said Steen.

In the end, over 70 individual investors wound up participating, putting in an average of $125,000 each for a total of $9 million.

Turning members into advocates

The benefit of raising this funding this way was two-fold for CrowdStreet, said Steen. First, it made the process go much quicker than it otherwise would have; the round opened and closed in a single month, and saw over 75 of capital committed in less than a week.

Second, it also created a closer relationship between CrowdStreet and its members, who now have a stake in the company and have a greater incentive to become ambassadors for CrowdStreet.

"We actually saw a really nice strategic value of doing it this way. Not to discount the institutional investors, but we also said, ‘Isn’t it a great way to get more advocates out in the market?’ Now we’ve got some individual investors who have invested on our marketplace and now are part equity owners in CrowdStreet. They’ve got a real extra incentive to want to espouse the value of the CrowdStreet marketplace through word of mouth," said Steen.y

"We also have sponsors who did participate and, again, they now are our champions, our ambassadors, if you will, across the country. They will help find new great sponsors and open their eyes to the value of what CrowdStreet’s platform has done for them because now they have this extra little incentive. So, we saw some nice strategic value in what this can do for our business when we opened more participation in the equity of CrowdStreet."

This Series C round brings CrowdStreet's total funding to $25 million.

The evolution of the CrowdStreet platform

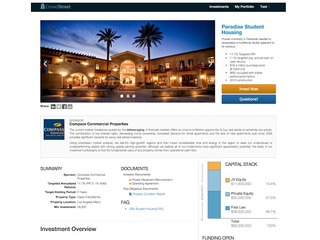

CrowdStreet, one of the finalists at the Vator Splash Oakland back in 2015, provides real estate operators, funds and private equity companies a full-service commercial real estate marketplace solution for presenting investments online, marketing opportunities publicly, managing the offer process and maintaining ongoing investor relationships.

In addition, CrowdStreet also offers a software solution, unveiled as Sponsor Direct in 2015, but now called the "Crowdstreet Investment Software," in which it gives sponsors access to more information to better manage their investors.

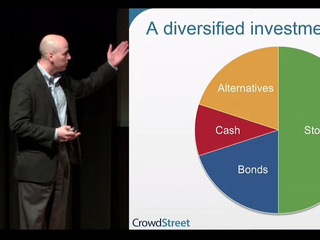

Since it last raised funding in July of 2018, the company has added a few new features to help its investors put their money into the commercial real estate space, including the launch of its own investment vehicles for investors, called the CrowdStreet Blended Portfolio. These vehicles allow investors to put in $25,000, which will then be diversified across 25 to 30 various commercial real estate investment opportunities across different geographic regions and different risk profiles,

"Think of it like an index fund of our CrowdStreet marketplace; it’s allowing investors to get a diversified portfolio for a small investment amount of $25,000. We’re now onto our fifth fund fund; they open and close every three months, and then start to deploy that capital. We’ve seen over 700 investors in the first four funds. So, that’s been one of the key new products that was introduced, and it was specifically to help investors to come online and to invest in real estate," Steen explained.

The company also created its own registered investor advisement group, called CrowdStreet Advisors, in order to provide some of the investors with a financial advisor specifically for commercial real estate opportunities. CrowdStreet creates a custom commercial real estate investment portfolio for an investor, and then deploys it according to that policy statement for them. It places them with a client advisor that will be managing their money across the CrowdStreet marketplace and the investments that they make,

"These new features are exciting because they’ve brought a lot of new investors, and what we’re doing it really meeting the investor demand out there. Up until last year, our marketplace had gained great traction, but it was a very self-serve, where investors would come and pick and choose deals on their own and have to invest on their own. Now we’re providing new vehicles and new services for those investors," said Steen.

CrowdStreet now has over 40,000 registered investors, and over 350 real estate developers using the platform. TYhe company is on track to raise over $500 million in real estate investment capital through its Marketplace for 2019 alone, which is a greater investment volume than the company saw in its first five years combined.

With its current traction and growth, Steen expects to have conversations with major sponsors across the country going forward about being part of the CrowdStreet platform.

"Their eyes are now opened up to the value of going to the retail accredited investor channel, because it’s become more efficient, because it’s streamlined in the way that it’s done using our technology platform, and the fact that CrowdStreet helps them through that process," he said.

"What we see ahead is larger institutional sponsors starting to recognize that is an opportunity for them to diversify their capital fundraising, to streamline it, to make it more efficient, and to scale and to make it repeatable. So, what we’re looking forward to is continuing to bring on the highest quality sponsors, as well as the investor base that is now understanding how they can diversify their portfolio, so we’re going to continue to offer more investment vehicles to make it easier for them."

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...Startup/Business

Joined Vator on

CrowdStreet provides real estate operators, funds and private equity companies a full-service marketplace solution for presenting investments online, marketing opportunities publicly, managing the offer process and maintaining ongoing investor relationships. The CrowdStreet solution is enriched by services and business partnerships that empower real estate sponsors to modernize their fundraising processes and embrace online capital formation. Accredited investors, institutional investors and family offices access an intuitively-designed platform to find institutional-quality real estate investments, complete an online offer workflow, track investment performance and build a commercial real estate portfolio. Based in Portland, Oregon, CrowdStreet was founded in 2013 by a team with deep experience in commercial real estate, securities and finance, marketing, consumer Internet and software development.

Joined Vator on

Co-founder and CEO of CrowdStreet