Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...Editor's Note: Our annual Vator Splash Spring 2016 conference is around the corner on May 12, 2016 at the historic Scottish Rite Center in Oakland. Speakers include Nigel Eccles (CEO & Co-founder, FanDuel), Andy Dunn (Founder & CEO, Bonobos), Mitch Kapor (Founder, Kapor Center for Social Impact); Founders of NextDoor, Handy, TubeMogul, TaskEasy; Investors from Khosla Ventures, Javelin Venture Partners, Kapor Capital, Greylock, DFJ, IDG, IVP and more. Join us! REGISTER HERE.

Mayfield, a venture capital firm that invests from seed to late-stage rounds, announced today that it has closed two new funds totaling up to $525 million.

Mayfield, a venture capital firm that invests from seed to late-stage rounds, announced today that it has closed two new funds totaling up to $525 million.

The majority of that capital ($400 million) makes up Mayfield XV, the fund focused on early-stage companies, while the rest ($125 million) will go to Mayfield Select for later-stage investing. Mayfield says that Mayfield Select is a first for the firm, which has traditionally focused on investing in younger startups. Even so, those late-stage dollars will be used to fuel growth of existing portfolio companies, so it’s unlikely to see Mayfield participating in late-stage rounds for companies foreign to the firm.

This is a notable approach, as some other early-stage firms will simply reserve some unannounced portion of their fund for follow-on capital. Instead, Mayfield’s two new funds clearly draw the line.

Headquartered in Menlo Park and one of Silicon Valley’s oldest VC firms, Mayfield has helped fund some of the early giants in technology. Some of those early investments include Atari, Genentech, Compaq, SanDisk, and Citrix—all of which were founded before 1990.

Here are some of the firm’s more recent investments:

“We raise early-stage focused funds of approximately $400 million usually every 3-4 years and invest in roughly 30 companies per fund,” said Mayfield Managing Director Navin Chaddha in a prepared statement. “Mayfield XV is our fourth consecutive fund with a consistent size that follows our established strategy of investing primarily in early-stage technology companies serving enterprises and consumers.”

Though Mayfield has two new funds, its management team will remain the same: Navin Chaddha, Rajeev Batra, Tim Chang, Ursheet Parikh, and Robin Vasan.

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...Startup/Business

Joined Vator on

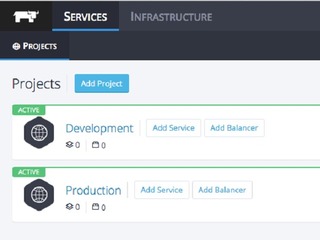

Docker, Inc. (formely known as dotCloud) is the company behind the open-source Docker project and the growing Docker ecosystem of people, products, platforms, and partners revolutionizing the way code is built, packaged, and deployed.

Docker aims to enable a new age of agile and creative development, by building "the button" that enables any code to instantly and consistently run on any server, anywhere.

Docker is an open source engine that enables any application to be deployed as a lightweight, portable, self-sufficient container that will run virtually anywhere. By delivering on the twin promises "Build Once…Run Anywhere” and “Configure Once…Run Anything," Docker has seen explosive growth, and its impact is being seen across devops, PaaS, scale-out, hybrid cloud and other environments that need a lightweight alternative to traditional virtualization. (Click here to read more about Docker.)

The people of Docker, Inc. are the original authors and the primary contributors to and maintainers of the Docker project. We also run the platforms and systems that make the Docker project run, including the Docker public Indexand provide materials and support to the rapidly expanding Docker community.

Startup/Business

Joined Vator on

Massdrop is a community commerce platform that makes it possible for enthusiast communities to buy together. When multiple people get together and use their combined purchasing power to buy something, it's called a “drop”.

Angel group/VC

Joined Vator on

Rosenthal, a principal at venture firm Mayfield Fund, talks about what he's looking to invest in - wireless, communications, infrastructure. He also gives advice on how to pitch him.Startup/Business

Joined Vator on

Docker, Inc. is the commercial entity behind the open source Docker project, and is the chief sponsor of the Docker ecosystem. Docker is an open source engine for deploying any application as a lightweight, portable, self-sufficient container that will run virtually anywhere. By delivering on the twin promises “Build Once…Run Anywhere” and “Configure Once…Run Anything,” Docker has seen explosive growth, and its impact is being seen across devops, PaaS and hybrid cloud environments. Nine months after launching, the Docker community is expanding rapidly: Docker containers have been downloaded over 400,000 times, the project has received almost 9,000 Github stars, and is receiving contributions from more than 300 community developers. Thousands of “Dockerized” applications are now available at the Docker public index. Docker, Inc. offers both commercial Docker services and PaaS offerings at the docker.com website.

Startup/Business

Joined Vator on

Lyft is a peer-to-peer transportation platform that connects passengers who need rides with drivers willing to provide rides using their own personal vehicles.

Startup/Business

Joined Vator on

Portworx provides software infrastructure to depoy containerized applications.

Portworx PWX enables the rapid deployment of stateful, distributed applications into production. With PWX, applications can be scaled rapidly without IT intervention. DevOps can provision storage to containers in an automated and container-centric way. This eliminates infrastructure tweaking and custom script writing that delay production deployment and scaling.