What digital health trends are VCs embracing and ignoring?

VCs from Canvas Ventures, McKesson Ventures, Sequoia Capital, Xfund at Splash Health 2017

Read more...Is there a Series A Crunch? According to panelists at Venture Shift - Matt Ocko (Data Collective), Ezra Roizen (Ackrell Capital), Tod Francis (Shasta Ventures), Michael Neril (WIN), Padma Rao (Julep), there isn't. Mike McCormick (KPMG) moderated the panel.

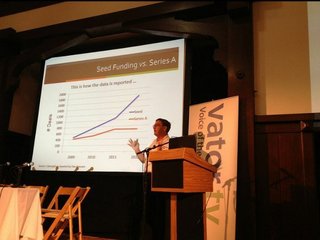

Ackrell Capital’s Ezra Roizen defended the panel's position with these numbers. In 2009, $4.9 billion was put into Series A rounds. In 2010, investors funneled $5.9 billion into A rounds. In 2012, it totaled $8.8 billion, and in 2012, A rounds came up to $8 billion. “We’re awash with series A capital,” said Roizen.

But even so, there's an influx of startups at the seed stage that's making it super hard for "all" companies to raise Series A. To that end, “It’s not a crunch, it’s a cliff, and a bunch of companies are about to fall off,” said Duncan Davidson, partner at Bullpen Capital, who gave a presentation about the state of the VC industry.

Whether we're in a crunch or not, companies still need to figure out how navigate these waters. Check out the panel for some ideas.

Venture Shift, an annual look at the changing VC industry, is hosted by Bullpen Capital and Vator.

Transcript below.

Mike: Alright. Thanks everyone for joining us today. My name is Mike McCormick and I am senior manager in the audit practice at KPMG and I specialize on technology and Venture Capital backed Companies. So I think we really have a great panel for you guys here today. Let’s start by bringing our panel up here and doing a brief introduction.

I think we’re waiting on one of our panelists, but we can go ahead and get started anyways. So why don’t we start, Ezra why don’t you start, kick us off brief introduction about yourself?

Ezra: Hi, I am Ezra, I work with Ackrell Capital, a boutique investment bank, we advise on a mid-market technology, M&A transactions and financings and great to be here. I am excited to talk about the topic. I have a copious amount of research on this post-it note, so if you turn it this way. It actually has the entire crunch database in it.

Michael: I am Michael Neril. I run a web investment network, a seed fund focus largely in enterprise and cloud, pleasure to be here.

Tod: I am Tod Francis with Shasta Ventures. We focus on Series A investing and some Series B and we focus in consumer and the enterprise across mobile internet and the connected devices.

Padma: Hi, I am Padma and I am advisor for Bullpen as well as being on the board of Julep and I am an advisor for a bunch of other companies as well.

Mike: Great, sounds like a great group, so let’s kick things off by starting on the topic of Series A crunch. If you believe there is a Series A crunch or if the current market is the new norm?

Tod: I don’t mind jumping in here, I think it’s all about how you define the word crunch. So if crunch is defined by all the seed companies, are all the seed companies going to be funded by the series A? Absolutely not! But there is definitely capital out there for Series A rounds, and it typically falls in two categories: companies that are exhibiting strong momentum or some element of momentum with their seed dollars; or where very compelling founder with a vision, that you just believe in.

But we see Series A companies that getting funded very rapidly at healthy prices when those things are in mind. And yet companies that aren’t, don’t have that kind of momentum and some of those characteristics are having a harder time raising capital, so I think their crunch part came from when it was easier to raise Series A.

They were – several years ago, maybe before the Facebook IPO when the business models were a little looser, it was just a lot easier to raise Series A dollars. And now that market is tightened up and is looking for more proof. And then the last piece, I think that feeds into it is, there’s more seed dollars. The seed rounds are getting larger so there’s an expectation of the companies being a bit further along. So I think it’s really about expectation and -- but there’s definitely capital out there for a good Series A round.

Ezra: Yeah, my research around - I went online today and did the analysis. An early stage which is defined as a product service, maybe commercially available, that may or not generate revenues was the stage. 2009 for that stage 4.9 billion, 2010 5.9 billion, 2011 8.8 billion of VC and 2012 8 billion. So in fact, we’re awash with Series A capital and in 2012 is the 8 billion, there’s 1700 deals, 4.8 million was the average deal size, so we’ve almost doubled in the last three years. So I think to Tod’s point, the crunch I think implies that there’s a supply – there’s a demands side problem. There’s not enough money, but I think the problem is the massive proliferation of the company’s trying to get that money. And so that’s the topic that would – that’s the interesting part. The crunch is almost like a crunch through the door versus being no room to go to.

Michael: So I was just going to say, that’s the great point. My only other last data point would be… I looked at an interesting report a few months ago from CB Insights, there’s a lot of other reports data but looking in 2009-2010 and there’s effectively three times a number of seed companies have raised start-up capital, as defined up to 1.5 million raised while the number of deals on the A front has really all increased very, very modestly, about 3% a year, so therein lies a kind of supply and demand imbalance as well.

Mike: So with this massive numbers of seeds companies that you’re saying –

Ezra: We have Matt coming up here, so c’mon.

Matt: Are you guys on break?

Ezra: I hope you guy – one more stuff –

Tod: Yeah, we got the booster seat.

Matt: Is this the crunch?

Mike: So Matt’s a little late for the party, but we’ll let him quickly introduce himself.

Matt: Howdy, Matt Ocko, co-founder of management partner of Data Collective, long time as an entrepreneur, long time as an investor. Relevant stats: do stuff that’s very hard, very de-tech, most other people don’t like, contrary investor, 220 deals over last twenty years with my colleagues. Fewer than twenty-five losses, thirty billion dollars in returns for entrepreneurs, that’s who I am.

Mike: Sweet! All right, so with the massive number of seed companies that we’re seeing out there, what are some recommendations you can make in terms of key metrics investors focus on or ways companies can distinguish themselves in the competitive market for raising Series A?

Padma: I think one of the key things is that, I said this when we had a discussion prior to doing this panel that for a lot of companies I advise and for a lot of entrepreneurs I meet, they don’t spend a lot of time, warning up their investors in advance to get to know them, to see if they’re a good fit, to see – yeah to actually build the confidence and the trust over time so that - I keep using analogy of being pretty girl at prom, having your cap table cleaned up, having your metrics in place. Them knowing you personally, to know if you’re a good leader and an entrepreneur, that they want to invest in.

Tod: I’d agree with that, I think it’s really about the expectation of what the fundraising is going to be like. We see a lot of blogs and discussions that tell us about “Hey, don’t let those venture guys take more than two days to make the decision,” or you all have this kind of expectation, that it’s kind of be easy to raise capital, but if you flip that around and say “Hey this is really an important round. I’m sitting the table as my own investors are gonna’ be with me for five to ten years. It’s going to take time to build relationships.” And do that! I think that it can yield a different result. You realize that’s gonna’ take a little bit of time. They’re gonna’ want to see some information, want to see some data, see momentum and have a little bit time to make the decision. I think of an entrepreneur goes into the process with that mindset, it’s much more likely be successful.

Matt: Yeah, I think Tod makes an excellent point that I’d like to amplify on. I’m not gonna’ name names, but I have seen an endless profusion of articles advocating a very Darwinian approach to raising capital. “VCs are stupid and greedy and bad and take’em for whatever you can as fast as humanly possible.” Your two day limit is awesome. I wish I could get that. “Get it done in 24 hours or they are incapable of making a decision.”

And… as with everything in life, you eventually get out, what you put into it. So if you start with an adversarial relationship in your seed; unless you are killing it and statistically not everybody kills it. There is such a thing as a really good but still from external appearance, kind of mediocre company. You’ll have an adversary of relationship with your existing investors and the other guys coming in, will have heard about the behavior and probably not being the nicest people. And that will go on through success of rounds. It’s easy to mythologize and demonize on both sides. And I think the biggest thing that I can encourage in terms of having a seamless and less stressful series of financing events is get to know the people that you want to invest in you. Think about who they are as people. Think about their firms’ culture, make sure that your culture is a thoughtful and productive and cooperative one as opposed to adversarial and you’ll have a better outcome.

I mean Tod has been at this as long – if not longer - than I have and I think that one of the things I’ve observed is big wins takes ten years! I mean Google’s an eight or nine year overnight success story, ditto for Facebook. That was actually fairly long run before they were able to monetize. Cisco didn’t reach the peak of its market cap or really reach fruition for ten or eleven years, so you have to think in this time scale and plan to have a positive relationship with the people that you’re asking to support you.

Michael: My only comment, I think, that’s a great point Matt! You’re building a partnership and you know communication and also transparency is also I found to be really, really important. Not only when you’re actually looking to bring in your partners or your new investors, but also throughout the process: quarterly and monthly investor updates. Like we invested like fifty-five companies, we certainly don’t require they run the show but having some type of quarterly communication or sense of update. It also helps when you actually go to raise your next round.

Ezra: I guess my alternative view would be given that your enemy is not the venture capitalist, your enemy is the entrepreneur sitting left and right of you – because there’s so much competition that -- think about options. Is your only option to raise the Series A? Do you need five million in cash? And if you’re designing a business plan, your quitting a job, you’re putting years of effort in this thing, you’re not making any money. You are sitting in an incubator, is the only strategy that you are optimizing for, your option. You’re optimizing, for a business that requires five million cash to basically get to the next level.

I know lots of entrepreneurs who’d done on very small amount of money but just had an idea that those incredibly capital efficient. And so I would understand that and not completely buy into notion that the only second turn in your business is to raise a substantial amount of cash to fund it, but I think that’s a – sometimes that is the only option, but it’s not always the only option. And I would spread those options out a little bit more.

Mike: So that’s a good point. What if you’re a company considering an M&A route? What advice you would give to them that differs from that of company looking to go for a Series A?

Ezra: I would take Padma’s advice and change the word VC investor, where strategic, and say get to know them early, develop relationships, do BD deals, become their friend, get dependencies. A lot of deals are done, in the abstract, but a lot of deals are done because there is a tight dependency of integration between two companies… or someone else sees that tight dependency correlates into their world. And so the more that you can basically be part of that ecosystem, the better… the better off you’ll be, but at the end of the day you have to do something novel and be innovative. You don’t necessary have to be losing tons of money.

Matt: I would actually be broadly echo that. What I would say is all of us, VC, entrepreneurs, M&A guys see something else that happened. And we say “How the heck did that happen? My thing is shinier, bigger, better, faster, those guys didn’t deserve that.” I mean, we all suffer this odd mix of jealousy and incomprehension from time to time because we’re all competitive people that like building stuff and want the things that we build to win and receive recognition, so how does that happen?

Well, the point that we just made: a lot of it has to do with relationships and goodwill. I mean there’s a reason that acquisition accounting has the term ‘goodwill’. These personal connections and personal trust are incredibly important, so if you want to switch VC with M&A you really need to start the moment that your technology is relevant to an acquire and make sure that at least one of the acquires in the space is either dependent or intensely enamored of your tech. And two others (or three others or four others) know about you, respect you, like you. You’ve been helpful; you went out of your way when you didn’t have to for somebody in some giant corporation that needed help.

And you’ll be the person that’s featured in Tech Crunch that causes everybody else to gnash their teeth. That being said, there are some hard metrics. I mean, increasingly major corporations do not do stuff that is not accretive. For every whizzy instagram, and God bless those guys for pulling it off, there are the bones of ten thousand wannabes littering the elephant graveyard of start-ups that thought that they didn’t have to be profitable and didn’t have to represent accretive revenue to their acquire. So keeping you’re really beady eye on whether your actually making the money for somebody, is incredibly important.

Tod: And since we’re talking about acquisitions, I’ll dive in maybe something and it’s a little more sensitive and may not be perceived as desirable which would be an aqua-hire. I’m not saying that’s why you set out to do anything, but let’s say you get a company up and going, it’s hard to raise capital, you aren’t accretive, and it’s not strategic. There are still other options, where your team or your vision, your concept may be really well suited to another platform.

And that you can build something of significance and be part of a great company, it’s just a little bit different than what you expected. So I’m not saying that’s what you should go out, set out to do, but I keep an open mind to that, because I’ve seen some people get aqua-hired in the Facebook or some great companies and do really well and become significant players in those companies and there’s lots of ways to do that.

I think a lot of things that have already been discussed is be important in your category, get to know the key players, and now there’s new platforms, like I don’t know if you heard about Exit Round but it’s a platform to help connect corporate M&A groups with entrepreneurs in an anonymous basis, so it’s kind of say “Hey, here’s kind of what we have, is it of interest?” and you can do a little bit of blind-dating that way.

Ezra: Hiring of friends.

Tod: Yeah. So it’s kind of interesting and it worked with different kinds of groups. So there’s – I think of more options today as things move on.

Mike: Okay. Yeah. Another thing I want to touch on, was the expectation from an investor’s standpoint, depending on the stage of the company. I know that from an investor’s standpoint, you’re gonna’ be looking at different things for a company looking to raise their Series, compared to a company in their Series C. Can you guys talk a little bit about what you look for, what you see out the market?

Matt: Yeah, we like at least three napkin drawings… only two, we’re not investing. Ha ha. Actually I wanted to follow up on an earlier point which is part of making sure you get your Series A done has tremendous dependence on everything that you did before. And I know that Michael and his team, in their careers has done disruptive stuff and were co-investors in some stuff that we believe is very disruptive. I know Tod in his prior career, did things especially in the networking space that a lot of people didn’t think were possible.

Me-too-ism is a good way to not get a Series A done. Fluffiness is a good way not to get a Series A done. If you’re the 19th menu optimization app, the 15th food delivery app, the 74th human resources improvement enterprise deal, you will probably die. You may be very brilliant, you may have great stuff, you may have hired a good team, and great designers, but you will probably die; statistically you will die. It’s like a restaurant, some crazy number, like 990 out of a 1000 new restaurants die. It’s true for start-ups, Aqua hire’s notwithstanding.

Do something really freakin’ hard. Go re-read Peter Thiel ranting and raving about the lack of innovation in Silicon Valley and get inspired by that. And it doesn’t have to be building a rocket or out glamorizing Elon Musk. You just have to be something that nobody else is doing that offers really crazy value to a core constituency that just has to have it. And so in terms of risk, if you show up in Tod’s office, my office, or Michael’s and say “Hey! I’m doing x.” You might still have an insane amount risk in your company, but if it’s highly differentiated, you’re more likely to get a Series A done, even if you have a Series seed type of risk. If you show up, even Series seed, and people realize that you are already facing fourteen different competitors, you are much less likely to get funded. And if you do get funded; you’ve geometrically reduced your likelihood of funding all the way through the other stages, so sorry about that just wanted to –

Mike: Oh no.

Ezra: I imagine that answers your question?

Mike: That would be good.

Ezra: That was in many ways the answer to the original question. Yeah.

Michael: I was just gonna’ say, building on Matt’s point, most of what we do is focus on is, the enterprise. And what we’ve been seeing in terms of profiles of successful seed investments, we’ve made that are going on to raise an A round of 4, 6, 8, or 10 million (which is kind of a new B round) with some anomalies of course, but typically as a clear product market fit, monthly recurring revenue, plus and minus a 150k or two million annual run rate with the clear path to proving out, building the sales model, and adding additional heads to get the revenue from call it, 2 million revenue run rate to 10. So clear customer traction, no having some paid pilots obviously there has been a few. There team has built great community, you don’t have customers or revenue but that’s the kind of been the sandbox.

Tod: And now you probably have some color as well as –

Matt: Just before Tod dives in, what I would say is incredible tech and rabid customer interest/dependency or fungible with traction. So I mean nobody up here’s an idiot, and if you show up with something entirely undifferentiated, you manage to be doing 20 million dollars a month; probably at a 10 million pre that’s pretty interesting. I’m being almost entirely facetious but these things really do trade off.

There’s no formula for that, but by way of example, I had a bunch of guys that wanted to talk to me, that believe that they can massively optimize the way that gasoline is moved around in the middle of the night between independent stations. Sounds stupid, but it turns out it’s a four billion dollar a year expense; these guys are all screwed! The refineries hate it. The people that they pitch to say, “I will sacrifice my neighbors on an altar of fire to get this optimization.” These guys aren’t making any money. They already took some seed funding, but that’s such a deep vertical, with so much dependency by the customer, that’s interesting for an A. To Michael’s point, if somebody showed up with 4 million bucks doing something less vertical or a little fuzzier then that’s where the trade off happens.

Tod: I think some of the key elements on an A round, they fall into, thinking, two main buckets: one is indication of customer interest or traction, that doesn’t mean millions of millions of people, depending upon the stage of company and how much you raise on your seed but if some indication that the customer life cycle can be viewed. People, you can acquire customer. They want the product, they use the product, and they refer it or somehow there’s a repeat purchase component to it.

That kind of data is very compelling! The second bucket is a very compeling team. A team that you just believe in! And maybe they don’t have as much proof but they have the experience. You just connect with them and you believe in the vision of the team. It’s almost like a continuum. The more compelling the team, maybe the less data you need to get comfortable. Or said differently, let’s say the team doesn’t have the experience so a lot of great companies are building teams that don’t have prior experience, but they show product market for that at some levels. Well, you can get on board with that. If you don’t have either of those, then I think you are no-man’s-land, that’s where it’s really tough.

Ezra: Also just from our client experiences, the other piece of the puzzle is just being in a style and category of company that venture capitalist find attractive, to your prettiest girl/person at the prom. I think that if you don’t have things pretty cleaned up, it is not clean deal. It’s not a category people find interesting.

We had a deal recently where we were actually gonna’ go more like an M&A route with it and we talked about a bunch of Santa Road VCs on behalf of our client; with our client. And the reality was, it just – it was just couple clicks off of the traditional VC deals that we keep to be in a very style of company, style of old built for that kind of rapid scale that has an incredibly cost efficient structure. And that actually is not an easy hurdle to get over. That’s actually – if you’re not born with that, it’s hard to just sort of becomes that.

Padma: This morning I was talking to a friend of mine about the team aspect of it because my perception, well my feeling in general, is that at the Series A there’s still a lot of volatility and there’s still a lot of risk. And so getting to know the team and the founders and all those things, you still have a really high dependency on their decision making, and their ability to execute on this still. And so I think over the course of last two year when, as I’ve been doing diligence for Matt and with Bullpen and others. I think I underestimated and am only now coming into my own mindset about this, how little is under my own control and how I’m looking at such a point in time of information and there’s still so much more that’s out of my control and it’s gonna’ be in control of this people I’m hand money to. And so, it’s just reiterating what Tod said.

Ezra: Actually, in many ways that’s also the opposite of any entrepreneur side as well. That once you take the money and commit to a plan, you’d better be darn ready to scale, because you are now locked into strategy that you need to execute upon, and you’ve convinced a lot of people that a lot of stuff is going to happen now. And if you don’t believe that, and you’ve taken the money because you need it, that is a recipe for a recap, so it’s a great way to lose your company.

Michael: One quick point on that front too, raising a massive A round like in some respects maybe you are raising you’re A and B at the same time and you know, the forty million post where the metrics are still very, very early. I’ve seen some opportunities, some instances where there are clear merits, but I’d be sensitive to valuations are obviously a illiquid, it’s funny money if you will.

So to Mike’s point, if you raise a large round at a really, really high pre or post and you don’t grow into the metrics, obviously things aren’t gonna’ look so rosy. We’ve had a couple of instances where the entrepreneur has raised really large rounds, a very, very high kind of illiquid valuations, hasn’t grown the metrics, their twelve or eighteen month ahead of the market and to Mike’s point –

Mike: Matt?

Michael: Recap.

Matt: Look, money is a milestone around your neck. It carries a huge number of invisible obligations. Associated with it, you better be damn well prepared to use that money intelligently and at the same time plan on a huge reserve, so I think Michael is dead on. What I was gonna’ say, I think Tod elucidated something important that I was getting at, which is (I was getting at less coherently than he did) a lot of the A actually does in some ways tie back to what we talk about before: its faith and good will. So a baller team is a chit that buys you faith, it buys the investors faith in doing the A. Traction is a token for faith that the team regardless of how impressive their credentials or lack thereof has in fact executed.

That’s generative of faith and deep dark amazing tech or client relationship some sort of incredible proprietary advantage that’s resonating emotionally with customers in the field regardless of traction, buys space so there’s really kind of iron triangle if you will. You can slide the points around, but all three of those things have to be present to some degree. And you can have one of them hypertrophied, so if Tod, Padma and Michael walk off thi panel and quit their day jobs and ask me to participate in A round, I would probably say, "Yes." It’s dependent on what they were doing and you can have somebody that has insane traction and nothing else.

Snap-Chat is being a good example thereof: great guys, not super deep tech and no real propriety advantage and very, very bright guys, but not a team that’s done it before. But these examples of hypertrophying, of being way far out along one of those of the triangle are rare. Really what I ask most entrepreneurs to do, is optimize all three the best they possibly can and make a virtue out of weakness where it’s necessary.

Mike: I did want to say, we’re gonna’ save a little time at the end for questions; if you have any questions we’ll save five or ten minutes just to put that out there. Let’s talk about valuation a little bit, you guys made reference to that numerous times. You’re a company thinking about raising Series A, from an investors standpoint what are you thinking about when you’re looking about valuations?

Ezra: I think you had a great point to call about valuation but oversize.

Padma: Oh, that it basically, I made a comment about how people are always going for the maximum valuation they can get, even though they may not have grown into it. Isn’t that the thing? And then the point is that nobody wants a down round, so you set the expectation that you’re gonna’ do better in next time. And so if you’re not even there yet, up ‘til like the trajectories in the plan that you’ve put out, if you don’t hit them, there’s no wiggle room basically left. And, so it’s not always to your best interest to optimize for the highest valuation, because you know your business better than VC’s know your business actually too. So that was the –

Ezra: Yeah, yeah. I agree I think all things existing in equilibrium. I read, I thought it was a funny article in 2008 on Vator in 2008, when everything is like going bad and my friends would call me up saying “What I do, I get no leverage. What do I do, what do I do?” And I said, "Look the reality is, investing is part of an equilibrium and most of that hairy terms in the financing come from over reaching a valuation. If you don’t want ratchets, you don’t want participating preferred. If you don’t want redemption rights, and you don’t want twenty other things that can go into financing round, then find a reasonable valuation where everybody is gonna’ make money."

Entrepreneurs get into this weird kind of like feeding frenzy mode where they believe that all of a sudden the VC is their enemy in that process, and they get the best possible deal at the highest possible return. That’s not true. They're actually the most, on the same team with you over a long period of time, helping you build your business. You want them to make a lot of money on that investment, so find a round that’s going to be very team building for everybody and makes everybody a lot money, not just “Hey I can really stick it to them this time around.”

And I think that’s a bad plan. I think you should really be thinking, particularly in the Series A which is so early. You should be thinking about who they are, what their reputations are, are they gonna’ be supportive of you, do they have good networks? All investors are not created equal, so I think it’s such a multivariate equations, it’s not just about the value.

Matt: So, I think Ezra has some points. One of most interesting statistics and where big data and deep compute investors would be kind of hypocritical if we didn’t apply that to our own business. One of the most interesting statistics that we found in the venture business looking at successful deals, literally over the last forty years, I mean going all the way back to days of Deck when it was starting is that tremendous long lasting franchises rarely took, and when I say rarely, I mean single digit percentage points, rarely took the highest venture investment offer that they had.

The folks who have built gigantic durable franchises picked based on personality. Could they work for the next seven, ten, twenty years with the people whose money they were accepting? To Ezra’s point, value of network, expertise, you know maybe you don’t want VC doing a code review, but you certainly if you’re doing a technical company, Big Bob Snotlewick pulling up in his Bentley on his phone going “are we rich yet?” is probably not the guy that you want. No matter how good an enterprise salesman he is or isn’t, and most folks forget this. And again there’s been a disturbing swing towards this kind of adversarial behavior. And as sure as it is now summer, but it will also be winter very soon. Nothing is forever. If you live through the booms and bust, I know Tod had a long career like mine. You know VC had a flowering in the 1970’s that which crushed out in the early ‘80s with the collapse of the PC industry. There was a mini-collapse in the networking business in the late ‘80s.

There was a recession in the early 90’s. Over and over and over again, when people say, “Oh everything is changed,” and literally we can be jerks and it doesn’t matter which side. Whether VC’s are being jerks; the entrepreneurs are being jerks. There’s the price to be paid down on the road. So pick base on goodwill, personality match, skilled network, value added, think about the fact you’re literally going to be in bed with this person for the next twenty years, if you are building an enduring franchise, and don’t be a jerk. Dial in a valuation that lets everybody make money and you are much no likely to get your round done.

Tod: The only thing I’ll add on this is, I encourage entrepreneurs to think about valuation, kind of, by stage. So your seed round is typically a person with a vision and you’re trying to cobble together some money to get going. Most of the seed investors are as active. They typically take their friends or industry folks. When you’re in the A round, you are choosing a partner sitting at the board room, at the board table, for five to seven to ten years.

I’m always think of it as ‘setting the table’. Choose people you want to build the business with, as you go to the next stages, that’s where I think you want to play valuation: the B, the C, the D, because the people are not going to be as involved, especially in that kind of C round. And so, think about raising the amount of capital in each round to get you to that next stage, where that next stage is a really healthy up tick for your current investors and for you and then you can raise more money at the next round at a higher valuation.

Think about each round kind of jumping up the stairs that way vs. trying to get it all in the A round because sometimes that may not work out, you may end up at the wrong price or the wrong partner, so I always encourage to think of is, as an escalating thought process on this.

Matt: Yeah I have, to your point Tod, I have three companies within the last ninety days, went from very constrained, very sort of conservative seed in A rounds. I mean, where the A rounds were in low teens, let alone the seed which had been much lower than that. And each of this three company has now raised a substantial amount of money well north of a hundred million dollars.

And lest you think that this is a kind of a backdoor way for me to blow my own horn, in two out of those three companies, I was just a fortunate smaller investor through a variety of circumstances, so I don’t claim any credit for that. But the folks that the entrepreneurs picked, added so much value, to Tod’s point, that they were able to raise much larger amount of money from much less differentiated investors when the time was right. So greed does not pay, I think is message.

Mike: Yeah that’s right. All right, we will wrap things up here. We have time for one question from the audience, if there’s one. Yes, at the back corner.

Audience: What do you look, when you are investing into a first time entrepreneur and he’s raising his Series A round?

Matt: Where do you put your personal money, Padma?

Padma: Do I have any? I think it comes back to, especially to Matt’s point. You’re triangulating. It’s easy to look at a high class resume and you could use that as a data point, but if it’s a first time you have nothing to go on, so the getting-to-know-you again and watching them through the process, there’s just no substitute. Honestly, because otherwise I don’t know what to base my decision making on.

And I’m probably newer to this than any of these guys, and it’s been a hard lesson for me, honestly, to understand, that again I’m looking at a point in time. And especially with the first time, I’ve never or there’s no reference point for me to say that you have the ability to execute on this, and so getting-to-know-you over time is really my answer to everything, I guess.

Tod: I think that’s a great question. That used to be, we’d look for people who’d done and who have been in the industry boom, boom, boom. Now it’s totally different, technology is changing everything, people’s ability to make progress. What I look for is the intensity of the entrepreneur and their vision of the customer need. Are they seeing something that nobody else is seeing?

Or maybe kind of a crazy idea, but do they see something others aren’t seeing into and do they have a intensity about it? Not just go ‘I’m gonna’ work all day and all night,’ but an understanding of what that customer wants and needs and has a drive to get there, because this stuff is really hard and if you don’t have that, if you don’t have raw intellect and intellectual horse power to dodge and weave, as all these challenges come along, because it’s going to get hard.

So what we look for – it’s not a resume, it’s not a school background, it’s not even a company background. It’s kind of somebody who sees something with an intense passion, sees it differently and very importantly, we think, can recruit a good team.

Audience: Yeah, yeah.

Tod: Because if you’re just an individual crazy man, that’s probably hard to all the team. But if you can be that, and build a good team, that’s an awesome combination.

Mike: All right, I think we’re out of time here, but thank you very much to the panel.

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsVCs from Canvas Ventures, McKesson Ventures, Sequoia Capital, Xfund at Splash Health 2017

Read more...At Post Seed 2016, Founders and Partners discussed about Post Seed and Small A Round

Read more...At Post Seed 2016, CEOs and Partners talked about the size of their funds and investment

Read more...

Joined Vator on

Duncan is a serial entrepreneur turned venture capitalist who co-founded Bullpen Capital, a seed fund which focuses on the "post seed" round to get to a Super-Sized A round

Joined Vator on

Advisor-to and commenter-on emerging ventures

Joined Vator on

Tod Francis is with Shasta Ventures. He focuses his investing activity on early stage companies that leverage technology to improve consumer experiences.

Joined Vator on

I focus on direct to consumer products whether digital or real. Currently, I work towards starting my own consumer company as I advise several VC firms and companies.

Joined Vator on

Mike is an audit senior manager in KPMG's Silicon Valley office. Mike specializes in providing audit services to software and SaaS companies.