Oxford Cancer Analytics raises $11M to detect lung cancer via a blood test

OXcan combines proteomics and artificial intelligence for early detection

Read more...

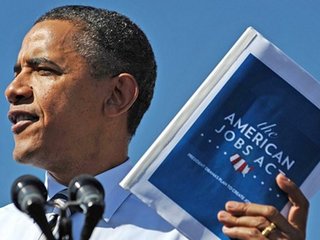

Venture Shift got off to a rockin’ start with opening remarks from Vator's Bambi Francisco on the merits and downside of the JOBS Act, and Bullpen Capital's Paul Martino on the changing VC landscape. We also heard about Marissa Mayer’s ascension to the upper echelons of the elite Fortune 500 CEO club, and we saw cute photos of Bambi Francisco’s new baby. Then we promptly got down to brass tacks: Are we in the middle of a seed bubble? Buzz kill.

The panel consisted of Corey Reese from Ness, Jessica Alter from FounderDating, Rich Levandov from Avalon, Marcus Ogawa from Quest VP, and Dave Samuel from Freestyle Capital. Moderator Matt Ocko from Data Collective jumped into it: What is a bubble? Matt Ocko posits that a bubble can be defined by inflated PE Ratios and venture capital that is concentrated more than 2x. Now, by that definition, are we in a bubble?

Dave Samuel: Bubble is a strong word. When freestyle looks to partner with an entrepreneur, we want the deal to be fair on both sides. I believe it to be frothy. The big change that you’re seeing is what you’re able to do with a million dollars. Ten years ago, you couldn’t go very far with a million dollars. But today, in a year to 18 months, you can do a lot, you can even have a pivot in there.

Corey Reese: I think it may not be the most helpful tool to think about what’s going on. What we should be talking about is resource allocation. How many of you out there have played Starcraft? (A few hands raised). It’s all about resource allocation. That’s like Silicon Valley, there are resources that everyone’s fighting over. Some of the largest public tech companies are making a huge demand for the most talented engineers—they’re one of the scarce resources entrepreneurs need.

Jessica: No. Not in a bubble. As an entrepreneur, I have zero interest in PE ratios and I don’t follow them. But I think we’re experiencing a fundamental shift in our economy. We’re moving toward an entrepreneurial economy. No one is going to wake up 35 years from now and say “I want to work for this company.” It’s never been more possible to be an entrepreneur. The fundamentals are not going away. It’s easier to make supplemental income. And it’s not just tech—if you want to start a restaurant, you can get a food truck. There are going to be more entrepreneurs around the world, and the availability of money is going to be increased by the JOBS act.

Rich Levandov: Being on the buy-side of capital, I’m circulating between New York, Boston, and San Francisco, and I do see fundamental differences in valuation. I’ve done lots of investments that have been one million dollars in capital in New York, but that would never happen in San Francisco because that would be a seed deal. There’s plenty of money and people around—the ecosystem is speeding up. Every single person has a browser on them—that’ll be every single person on the planet who can walk. Every part of the economy will be touched by the Internet.

Marcus: I think there’s always a bubble somewhere at some time. Bubbles tend to be driven by over-emotional driving of deals. The recession tends to be driven by deals fueled by negative logic. I think it’s pivotal that people make decisions together—not just by emotion, but with logic too. I believe that it’s a strong fundamental systemic change in the way investments are being made. People can’t just put money in the stock market like they could in the past because there’s so much volatility among all the different sovereign nations around the world. It may not be a bubble, but it’s a systemic change in the way people are investing.

Matt Ocko: If there is a surplus of capital which creates the illusion that there’s a bubble, is that limited to certain sectors and geographies? I grew up half in Boston, half in North Carolina. To me, it feels like there is some kind of bubble here. My personal view is there are allocation issues.

Jessica: In the last two months, we’ve expanded to 14 cities across America. We’re in the usual places like San Francisco and New York, but we’re also in places like Las Vegas, Chicago, Salt Lake City. It’s all bottom-up—they’re all rallying to join our network. I definitely think there’s an allocation issue with capital. I think as better tools take hold, that will start to be democratized.

Dave: My wife asked me to move to North Carolina—we lived in Raleigh. But having been in the Bay Area for 15 years, it was a very different environment. I moved back to the Bay Area and I think when we talk about resource allocation, there are so many resources in this bubblish area, that at least with Freestyle, I’m willing to pay a little more of a premium for people in the Bay area. If you look at the 36 deals we’ve done in the last year, 27 have been in the south market. Most of the south market today, they’re around seven million pre. We’re willing to pay more for the excellent workforce in the bay area.

Jessica: Can I just disagree for a second? With love. I don’t think there are just better people here. There’s a bit part of investing where there’s a lot less numbers. It’s about social proof, and getting social proof in Vancouver is harder because you don’t have Demo Day and things like that.

Corey Reese: Companies are moving to San Francisco. Companies like Square who are pulling together the greatest tech talent are able to do it in San Francisco, but aren’t able to do it in other places.

Marcus: I think there’s definitely a bubble where capital pools together more, like New York or Silicon Valley. Resources are scarce out here so we need to raise more money to pay engineers’ $175k salaries. There’s more money chasing after these guys in general, hence leading back to my systemic change point.

Rich Levandov: Zynga wouldn’t have been able to grow to the size it is if it hadn’t been in Silicon Valley.

Matt: Are bubbles just nasty high school popularity contests? Are cool companies like Facebook or Instagram sucking up talent? Are we going to look around 10 years from now and say “life expectancy hasn’t changed”?

Corey: Yes, absolutely.

Dave: I’m excited about all the activity happening in the space. When a company has an exit that the investors, founder, and employees all have an equal benefit, I’m excited about that.

Rich: Despite the warping the press would make us feel, I think all sectors are being served aggressively.

Marcus: I think it’s completely inefficient. In the next couple of years, you’ll see a shit ton of photo sharing apps. It’s a waste of money—but I don’t want to live in a planned economy. I don’t think planned economies are what drive innovation. So I do believe that it’s inefficient, but in the macro element of it—it IS efficient.

Matt: For what it’s worth, I AM looking forward to the next optical networking bubble.

OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...

Joined Vator on

Marcus is a Managing Partner of Quest Venture Partners, and is responsible for new investments, evaluating and closing seed / A rounds and working closely with management from portfolio companies. He enjoys strategy games and Greek mythology.

Joined Vator on

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.

Joined Vator on

Joined Vator on

Joined Vator on

David Samuel is a seasoned entrepreneur, internet pioneer and enabling investor.