As we face down the end of another year, get ready for companies to start to do their look backs for 2013. We will find out what the most popular Yahoo searches were, what we were listening to on Spotify, what we were pinning on Pinterest, what we talked about on Facebook, and anything else you want to know.

We here at Vator have even started to do our own look back, starting with the most notable acquistions of 2013.

And now the venture capital firms are getting in on the action as well, starting with Google Ventures, which released its summary of its 2013 investments on Monday. And, in all, it seems like it was a pretty good year for the firm.

Back in November of last year, Google Ventures was infused with more cash, going from having $200 million to invest in companies to $300 million. And with that new money, Google Ventures invested in 75 new companies.

Google Ventures participated or led rounds that included: $21.6 million in local social network Nextdoor; $2.5 million in crafting/DIY site for parents Moonfrye; $361.2 million in e-hailing service Uber; $7 million in back office as a service solution BackOps; and $1 million in messaging app MessageMe.

Google Ventures also saw nine exits this year, including three acquisitions: cloud-based platform Parse, which was picked up by Facebook; Yahoo’s purchase of personal assistant Astrid; and Google’s acquisition of energy company Makani Power.

The other six exits were IPOs, including coupon destination RetailMeNot, cancer diagnosis company Foundation Medicine and Silver Spring Networks, a networking platform and solutions provider for smart grid energy networks.

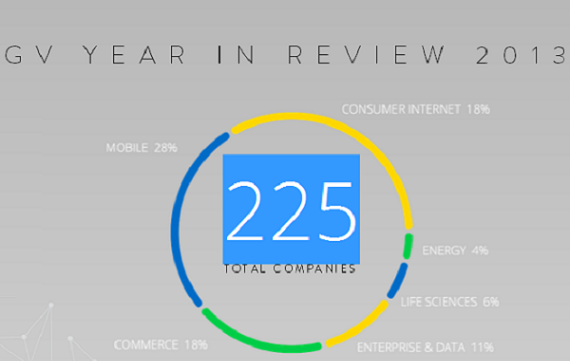

When broken down, Google Ventures put the largest share of money into mobile, with 28%. That was followed by consumer internet, and commerce, both of which were infused with 18% of all investment cash. Enterprise and data saw 11%, then 6% for life sciences and only 4% for energy.

The four year old firm has now invested in a total of 225 companies.

The state of the VC industry

Despite the overwhelming consencus that there is a Series A crunch going on, the state of venture capital is stronger than it has been in a while, it seems.

In the third quarter of 2013, 62 venture firms raised funds, the highest number of funds raised since the fourth quarter of 2008, when limited partners plunked down $7.1 billion across 69 funds.

Meanwhile, the amount of money invested in the third quarter was $8.1 billion, the highest since second quarter of 2012.

As for who’s the most active VC? It was Google Ventures, with 23 total investments in the quarter.

(Image source: www.gv.com/2013)