Some digital health startups that could go IPO in 2019!

Livongo and Grail are already reportedly considering it, while Oscar, Clover and Bright Health wait

While there are big expectations for tech companies looking to go public in 2019, surprisingly there aren't many digital health companies on that list. That's despite a record $8.1 billion that was invested in the space in 2018, a 42 percent increase over 2017’s $5.7 billion, which was the record at the time.

While monster companies like Airbnb, Uber and Slack have all said they will IPO this year, there are also a number of companies in digital health that have raised large amounts of money, and it stands to reason that, eventually, some of them will decide to test the public market as well.

So far this year, biopharmaceutical companies Gossamer Bio and Alector went public, raising $276 million and $176 million, respectively. Livongo, which Applied health signals companies Livongo is reportedly already looking to go public this year, as is diagnostics company Grail.

This is a list of some of the companies that could be included in the 2019 IPO class:

Editor's note: On April 4, we're taking the topic of mental and behavioral health back on stage with our first salon of 2019: Future of Mental and Behavioral Health.

Register now so you can reserve a seat. There are 250 available. Join Aydin Senkut (Felicis), Sonia Arrison (Author, 100 Plus), Alex Morgan (Khosla Ventures), Dr. Archana Dubey (HP), Mark Goldstein (UCSF HealthHub), Eva Borden (Cigna) and executives from Talkspace, Happify, Omada Health and more!

Founded: 2014

Disrupting market: Pharma, health systems

Description: Mountain View, Ca-based Livongo is a digital service for people with diabetes and other chronic conditions. The company's product monitors patients glucose and gives them real-time data that is shared with Livongo coaches. This 24/7 monitoring creates more personalized actionable treatment options. Livongo sells directly to self-insured employers, as well as healthcare systems, such as Humana and Blue Cross (both of whom are investors). Livongo sells its service to more than 600 employer-sponsored health plans and insurers at between $60-$70 a month per employee, and is on track to generate more than $100 million a year, by servicing 120,000 patients, according to the WSJ. The company also treats other chronic conditions, such as obesity and heart disease. The typical outlay for a person with diabetes is more than $10k a year. So self-insured employers are motivated to find solutions, such as Livongo, to improve their employees' conditions.

Amount raised: $240 million

Investors: Zaffre Investments, M12, Logo of Merck Global Health Innovation Fund Merck Global Health Innovation Fund, Kinnevik AB, Kleiner Perkins, General Catalyst, 7wire Ventures, Sapphire Ventures, DFJ, Echo Health Ventures

Valuation: $800 million

Founded: 2012

Disrupting market: Insurance

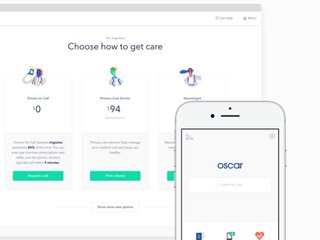

Description: Oscar Health is a tech-driven health insurance company that takes a concierge-like approach to healthcare. Rather than having the insurer be a faceless middleman, Oscar's mission is to be more personal -- treating patients like customers and giving them tools to be more proactive. Oscar provides a concierge team, including care guides and a nurse, who provide all sorts of services, from referrals to specialists to managing your condition. You can also use their Doctor on call service (text or call) to fill a prescription or just ask for advice. Have a dry patch of skin? Take a photo and text to Oscar. You can get answers in minutes. Oscar is also testing out brick-and-mortar clinics with its Oscar Center, facilitating wellness programs, such as yoga. Oscar Health was born during the Obamacare era when private exchanges were encouraged. Oscar's Mario Schlosser believed that in the new healthcare paradigm, consumers would be greater charge of their healthcare, including their ability to select their plans and keep them as they move from employer to employer. While the exchanges haven't worked as well as expected, Oscar has continued to thrive, with 257,000 members across nine states.

Here's a great interview between Bambi Roizen and Mario Schlosser and Brian Singerman of Founders Fund about the beginnings of Oscar.

Amount raised: $1.3 billion

Investors:

Valuation: $3.2 billion

Founded: 2015

Disrupting market: Insurance

Description: Bright Health, based in Minneapolis, Mn, is another tech-centered healthcare insurance company, with a mission to decomplexify (our words) the complicated world of insurance. Unlike Oscar, which has a network of nurses, coaches, doctors that make up its concierge and doctor-on-call team, Bright Health partners with clinics and local partners and works with their teams. In 2019, Bright Health started offering individual, family and Medicare Advantage plans in Ohio, Tennessee and New York, adding to its presence in Arizona, Colorado and Alabama.

Amount raised: $440 million

Investors: Declaration Partners, Meritech Capital, Bessemer Venture Partners, Cross Creek Advisors, Flare Capital, Greenspring Associates, Greycroft Partners, New Enterprise Associates, Redpoint Ventures, Town Hall Ventures

Valuation: $950 million

Founded: 2013

Disrupting market: Insurance

Description: Clover is another new tech-and-patient-centric healthcare insurance company born in the last decade to revolutionize the insurance industry. The company also partners with physicians and has its own care team working to assist members. Unlike the other two insurers we mentioned, Clover works specifically on Medicare Advantage (Medicare sold via private insurers).

Read Clover CEO Vivek Garipalli's thoughts on How big data is improving patient outcomes.

Amount raised: $925 million

Investors: Greenoaks Capital , DNA Capital, GV, Expanding Capital, Nexus Venture Partners, Refractor Capital, LifeForce Captial, Spark Capital

Valuation: $1.2 billion

Founded: 2012

Disrupting market: Telemedicine

Description: Doctor on Demand allows patients to have virtual visits with their doctor, allowing them to connect to physicians using video visits, with each one costing $40 for a 15-minute appointment. If the call goes over the allotted time, patients have the ability to pay another $40 for the same amount of time. In 2017, the company also began providing patients with fully integrated laboratory services, so when a doctor orders a lab test, patients can choose the lab experience that best fits their needs according to price, location, and insurance rather than having a provider or institution dictate the experience. Patients then receive results and next steps through the app. The company connects over two million patients nationwide and has hundreds of enterprise customers including four of the Fortune 10 companies, and over two dozen health plan partners.

Amount raised: $106.7 million

Investors: Princeville Global, Goldman Sachs Investment Partners, Venrock, Shasta Ventures, Tenaya Capital, Lerer Hippeau Ventures, Qualcomm Ventures, Sir Richard Branson, Sherpa Ventures, World Innovation Lab, Blue Cloud Ventures, Ridgeview Asset Management

Valuation: Undisclosed

Founded: 2016

Disrupting market: Genomics

Description: Grail hopes to detect cancer at the point it can be cured. It focuses on understanding the the human genome -- our body's genetic information -- to provide medical breakthroughs in oncology. Grail is riding on the drop in cost to sequence the human genome, which cost $100 million in 2003, and under $50 today.

Amount raised: $1.6 billion

Investors: China Merchants Securities, Hillhouse Capital Group, Ally Bridge Group, WuXi NextCODE, Blue Pool Capital, Sequoia Capital China, 6 Dimensions China, HuangPu River, Capital, ICBC International, ARCH Venture Partners

Valuation: $3.2 billion

Founded: 2015

Disrupting market: Genomics

Description: Like Grail, Helix is part of the next-gen sequencing (NGS) revolution. Its mission is to democratize human-genome testing, enabling app developers to make DNA testing products that consumers can buy online on the Helix marketplace. Developers leverage Helix's library of human genomes processed via NGS, which apparently are more data-rich than genomes tested using genotyping. "Using a book analogy, genotyping is like looking at a few scattered words on a page, whereas sequencing is like reading entire sentences, paragraphs and chapters. Most products for DNA test kits are based on genotyping, because it’s an older technology and sequencing used to be too expensive," according to Chris Glode, Chief Product Officer at Helix. Helix has more than 35 DNA products, consisting of those that test your ancestry as well as health.

Amount raised: $300 million

Investors: Sutter Hill Ventures, Mayo Cliic, DFJ Growth, Kleiner Perkins, Illumina, Temasek Holdings, Warburg Pincus, LaunchCapital

Valuation: Undisclosed

Founded: 2013

Disrupting market: Insurance

Description: Collective Health another tech-driven health insurance company focused on working with self-insured employers and helping them navigate the complex healthcare ecosystem. Their value-add to employers is helping their employees understand health insurance in a way they're used to: with more user-friendly interfaces and easy-to-understand text -- something our tech-savvy society has become used to. Only 4 percent of Americans understand common health insurance terms, according to Collective. The company wants to change that by simplifying coverage details and processing of claims and documents, which in some cases still use fax machines!

Amount raised: $229 million

Investors: Mubadala Investment Company, Founders Fund, GV, NEA, Green Bay Ventures, Sun Life Financial, Maverick Ventures Israel, RRE Ventures, MSA Capital

Valuation: $1 billion

(Image source: future-customer.com)

Related Companies, Investors, and Entrepreneurs

Doctor On Demand

Startup/Business

Joined Vator on

Oscar Health

Startup/Business

Joined Vator on

Oscar Health is a technology-driven, consumer-focused health insurance startup in the individual and small group markets founded in 2012 and headquartered in New York City. Oscar, the first health insurance company to make telemedicine services completely free for members, uses technology, data and personalized service to guide members through the health care system and empower them to choose quality, affordable care. Oscar’s member experience includes a dedicated Concierge team that proactively reaches out to members to help them with their care, simple plan designs and clear enrollment tools, and a tightly integrated, curated network of first-rate physicians and hospitals. Members can easily manage their care and access their health history and account information through a beautiful mobile and web app experience. Backed by a renowned set of investors and advisors, Oscar currently serves nearly 100,000 individual and small group members in New York, California, and Texas with plans for continued expansion going forward.

Helix

Startup/Business

Joined Vator on

At Helix, our mission is to empower every person to improve their life through DNA. We believe in a world where everyone benefits from their biological information and is able to help all of humanity lead better lives.

Related News

Mario Schlosser: Exchanges are not in a 'death spiral'

As the InsurTech space heats up, Bright Health raises $200 million

Mario Schlosser: ACA had nothing to do with Oscar's vision

Oscar Health says government owes company $200M

Medicare Advantage provider Clover Health raises $500M

A conversation with Helix Chief Product Officer Chris Glode

Top tech IPOs that could go public in 2019

Oscar Health launches new product for employer-based care

KPCB and Jafco pour $15M into Zephyr Health