Daily funding roundup - November 11, 2015

Amplyx Pharmaceuticals bagged $40.5M; Perfecto Mobile secured $35M; EventBoard raised $6.5M funding

- Last week an article in New York Magazine outlined a growing problem in businesses: the fight over meeting space. There are now 25 million meetings a day in the U.S., which is at least double the number since 1999. Not only is it hard to get access space, the truth is that most meetings are a waste of time. EventBoard is a company that wants to solve this problem by making it not only easier to schedule meetings, but to eventually start making them more cost-effective as well. On Wednesday it announced that it has raised $6.5 million in a Series A funding round led by Greycroft Partners with significant participation from Zetta Venture Partners and Origin Ventures.

- CircleUp Network Inc., a startup that connects accredited investors with consumer goods and retail businesses, has raised a $30 million round of Series C venture funding led by Collaborative Fund. San Francisco-based CircleUp, which is known as a fundraising platform for anything but tech startups, has been a dark horse in the emerging industry of equity crowdfunding in the U.S. Other investors in the round included QED Investors, a fund run by Capital One co-founder Nigel Morris and other former Capital One executives; Jon Winkelried, co-CEO of private equity giant TPG Capital; former Stanford Endowment Chief and a current managing director at Credit Suisse, John Powers; and Tom Glocer, the former CEO of Thomson Reuters and a current director with Morgan Stanley.

- Fiverr, a marketplace famous as the place where you can hire freelancers to do work for just $5 a pop, today announced that it has raised $60 million in late-stage funding led by Square Peg Capital, bringing the company’s total funding to $110 million. Other contributors include existing investors Bessemer Venture Partners, Accel, and Qumra Capital.

- ContentOro, an Ann Arbor, Michigan-based startup that delivers quality digital content for brands online, closed a $450,000 seed funding round. Backers included Michigan Angel Fund, Lis Ventures, and Invest Michigan. The company will use the funds to hire key personnel and complete their Content Marketplace.

- Tripvisto launched just over a year ago, in August 2014, and today the startup announced that it raised a $1 million series A investment from Shanghai-based Gobi Partners. With this investment, Tripvisto is the second Indonesian travel startup to raise a series A round – at least on record. The other one is ticket booking site Traveloka.

- Erik Blachford is part of a group of investors that have put a further $1.2 million into travel agent system TripScope. The company launched in January 2014 as a two-part service: a B2B white label mobile application for agents to get leads from consumers as well as a consumer-facing service for consumers to be connected to a marketplace of agents. Leading the round is PLC Ventures and includes Wavemaker Ventures, Amplify and ex-Expedia CEO and president Blachford. The company had previously received two tranches of $350,000 in funding.

- Israeli dynamic mobile application security-as-a-service AppDome has closed $13 million in Series A funding, led by Menlo Ventures. The round includes participation from original investors Jerusalem Venture Partners (JVP) and OurCrowd, together with new investor Draper Nexus. AppDome’s dynamic app wrapping technology protects enterprise and consumer apps along with their data. With offices in Tel Aviv and New York, the company was founded by CTO Avi Yehuda.

- VideoAmp , a screen optimization platform for the TV and video ecosystem, today announced a $15 million Series A funding round led by RTL Group , the leading European entertainment network. This investment brings VideoAmp's total funding to $17.2 million and will help the company rapidly accelerate development and drive adoption of its unique platform. Additional participation in the Series A funding for VideoAmp includes previous investors Anthem Venture Partners, Simon Equity Partners, Third Wave Capital, Wavemaker Partners, ZenShin Capital, and additional new investment from Startup Capital Ventures.

- Bango, a mobile payments company based in the UK that provides tech to app stores and carriers so that consumers can charge app store purchases directly to their phone bills, has raised another £11 million ($17 million) in funding, the company said in a market statement today, with a post-money valuation of £60 million ($91 million). Bango says the funding will be used to improve confidence among existing app store partners by strengthening is balance sheet, as well as to invest in market expansion and R&D.

- Indonesian ecommerce firm, Bhinneka, announced today an IDR 300 billion (US$22.1 million) funding round from VC firm Ideosource. The company said it will use the money to ramp up marketing efforts, continue to hire more talent and work to increase market share in more categories. With the funding came the announcement of key hires at executive positions within the company.

- Swrve, a mobile marketing engagement space, today announced that it has closed a $30 million funding and acquisition round. Swrve has acquired adaptiv.io, a data automation platform for mobile. These two announcements come on the heels of a period of significant growth for the company, including reaching one billion installs of the product. Swrve, whose platform enables brands to deliver contextually rich and relevant in-app mobile interactions, will use this funding to continue the company’s global expansion and market-leading product innovation. Leading the round is Evolution Media Partners (EMP), a partnership of CAA-backed Evolution Media Capital, TPG Growth and Participant Media, and the Ireland Strategic Investment Fund (ISIF).

- Perfecto Mobile, a Boston, MA-based provider of a platform to create and manage digital and mobile experiences for enterprises, raised $35 million in funding. Backers included new investor Technology Crossover Ventures (TCV), with participation from existing investors FTV Capital, Carmel Ventures, Globespan Capital Partners and Vertex Ventures. The company intends to use the funds to expand its product offerings and geographical reach, opening new offices and data centers in Australia, China, Japan and Toronto, Canada.

- Amplyx Pharmaceuticals, a preclinical stage company focusing on the development of small molecule drugs, today announced the company has closed on a $40.5 million Series B financing. The round was led by RiverVest Venture Partners, and included investments by New Enterprise Associates, BioMed Ventures and individual investors. Amplyx will use the funding to advance the clinical development of APX001, the company's broad-spectrum antifungal agent to treat life threatening fungal infections.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: foleytangroup.com

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

EventBoard

Startup/Business

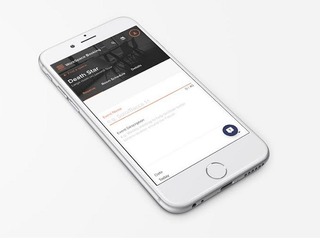

Joined Vator on

EventBoard’s intuitive room scheduling software was designed to run on existing iOS devices, such as Apple’s iPad™ and iPad mini™, thereby functioning as an interactive display screen. By mounting these EventBoard-enabled devices in highly visible and easily accessible locations outside conference rooms, users are able to obtain real-time room reservation status at a glance, view future availability of the room, and schedule room reservations. An easy-to-use online dashboard allows for simple and secure remote management of all devices running EventBoard.

Beyond scheduling capabilities, EventBoard also includes a powerful analytics framework that quantifies workplace activities by illuminating data that has previously been unavailable. This type of data includes knowing when and with what frequency conference rooms are being utilized, tracking average occupancy rates, and identifying underused and overused resources and spaces. EventBoard Analytics helps customers identify positive and negative trends in their workplace that will allow them to make important operational, financial and technological improvements.

Bessemer Venture Partners

Angel group/VC

Joined Vator on

In 1911, Henry Phipps founded Bessemer Securities to reinvest the proceeds of his sale of Carnegie Steel for the benefit of his descendents. The start-up investment operations were spun out into Bessemer Venture Partners, which now operates out of seven offices around the globe.

Siemer & Associates

Startup/Business

Joined Vator on

Siemer & Associates LLC is a global boutique merchant bank dedicated to offering candid insight and guidance to digital media, software and Internet companies throughout their business life cycles. Composed of industry veterans who have worked both inside and out of technology enterprises, S&A has successfully completed more than 50 transactions that aggregated over $3 billion in sell-side mandates and surpassed $1.5 billion in equity capital. Headquartered in Los Angeles with offices in New York and Hong Kong, S&A offers exceptional corporate capital raising, financial advisory services and M&A, specializing in complex cross-border transactions.

Committed to expanding the international technology ecosystem, Siemer & Associates promotes innovative entrepreneurs through its early-stage investment arm, Siemer Ventures, and its incubator, Wavemaker Labs. One of the most active investment funds in Southern California, Siemer Ventures claims more than 40 current portfolio companies and makes an average of 12 new investments each year in digital media startups. Based in Singapore, Wavemaker Labs is a joint venture between Siemer & Associates and Tholons that receives significant co-investment from the Singaporean government as an “approved technology incubator” under the Technology Incubation Scheme (TIS) of the Singaporean government’s National Research Foundation (NRF).

NEA

Angel group/VC

Joined Vator on

NEA is the entrepreneur’s venture capital firm.

When it is time to take a promising business or business idea to the next level, entrepreneurs want a venture partner who understands and believes in the power of big dreams, bold visions and fresh ideas that have the power to change an industry, a sector, the world.

Moreover, entrepreneurs want a venture partner who knows what it takes—through first-hand experience and carefully nurtured relationships—to make a company succeed, to turn an idea into an action, and to make a plan a reality.

For more than 30 years, NEA has been helping to build great companies. Our committed capital has grown to $13 billion, including a $2.6 billion fourteenth fund closed in 2012. We invest across stage and geography in technology, healthcare and energy.

Remaining nimble as we’ve grown—with more than 65 investment professionals working out of our offices in the US, India, and China and investing across the globe—NEA is the entrepreneur's venture capital firm, consistently ranking among the top firms in portfolio IPOs each year. Since its founding, the firm has backed more than 175 companies that have gone public and invested in more than 290 companies that have been successfully merged or acquired—more liquidity events than any other venture capital firm.

Whether you are seeking investment to get your idea off the ground or looking to propel a proven idea toward greatness, NEA is the venture partner who will be there—because we’ve been there—every step of the way.

Related News

Equity-based crowdfunding startup CircleUp raises $30M