Unlike other social networks, LinkedIn has a diverse revenue stream not dependent on advertising

When looking at how companies make money, LinkedIn is an interesting case.

When I compared LinkedIn to Facebook in the past, I talkeded about it in terms of how much money each one makes, how many users each one has and who they appeal to. And don't get me wrong, all of that is important, and are statistics that I'm sure both companies fret over constantly.

But one thing I did not go into was how each one makes money. And that is a crucial piece of information to understand the potential future of any social network, especially when it comes to LinkedIn.

You see, LinkedIn is a bit of an anomaly in the social network space. Whereas a network like Facebook makes upwards of 80% of its revenue from advertising, a number that goes above 90% for Twitter, LinkedIn doesn't rely on advertising as much.

LinkedIn has multiple sources of revenue, and could conceivably survive even if a number of its advertising partners decided to pull out all at once. Facebook and Twitter are more reliant on that revenue source.

So what are these other revenue sources that LinkedIn relies on?

Talent solutions

The majority of LinkedIn's revenue comes from what it calls Talent Solutions, a.k.a. where recruiters, and corporations that are looking for potential employees, have the ability to pay LinkedIn to connect with members of the network.

Talent Solutions brought in $524 million in 2012, and accounts for 54% of the company's $972.3 million in revenue for the year.

In the third quarter of this year, Talent Solutions took in $224.7 million, or 57% of the company's total revenue. That was up 62% from a year ago, when it accounted for 55% of total revenue.

When most people think of LinkedIn, I bet they think of it as a professional social network, one that they can use to keep in touch with business contacts that they made need to connect with again in the future.

Users probably do not even realize that the information they are putting out there is being used to show whether or not they are a being considered as a potential employee for companies that are looking to hire.

And the reason for that is because LinkedIn does not bill itself that way. This is not Monster, where people are actively looking for a job by putting out their resume; instead, LinkedIn users are passive. It is the recruiter or company that does all the work, and will find the right candidate.

LinkedIn has been trying to make it even easier for recruiters to find talent in recent months by bringing recruiting tools to mobile.

It also released of Showcase Pages, which allow businesses on LinkedIn to show off what they are most proud of, and Talent Updates, which help businesses turn their followers into potential employees by letting them share status updates, including recruiting events, company blog posts and employee videos, with their followers.

LinkedIn offers two plans for recruiters:

- Recruiter Lite for $99.95 a month on an annual basis, which includes mobile access, the full names and profiles of everyone on their network, the ability to send direct messages to anyone on the network, and the ability to track notes, messages, and activity history for every prospect.

- Recruiter Corporate for $719.95 a month on an annual basis, which also includes full profiles for over 225 million LinkedIn members, the ability to tap into the company's network with Inside Opinion and company follower search, more tools to share data and work with a team, and ustom fields, tags, and statuses.

Marketing Solutions

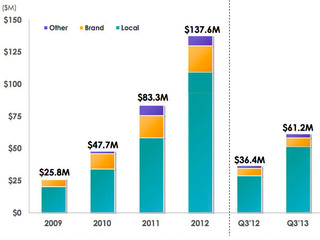

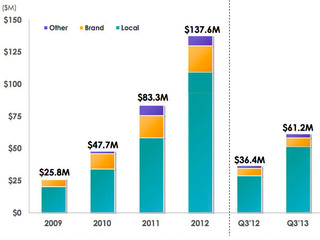

LinkedIn may not rely on advertising, but it still is a substantial portion of its revenue. After its recruiting tools, the company's next biggest revenue stream is advertising, or what it calls "Marketing Solutions."

Revenue from Marketing Solutions was $258 million in 2012, and accounted for roughly 26% of LinkedIn's total revenue.

They were $88.5 million during the latest quarterly earnings, an increase of 38% year-to-year. It accounted for 23% of total revenue, compared to 25% in Q3 2012.

These efforts include display advertising and Sponsored InMail.

The company seems to be looking to make advertising a larger part of its revenue stream. Just this summer the company unveiled Sponsored Updates, which allows business that have Company Pages to display their advertisements to all 225 million LinkedIn users.

LinkedIn's Marketing Solutions are currently used by 50% of the Fortune 100, including Citi, Chevron, General Electric, Hewlett Packard and Dell.

Premium Subscriptions

The final 20% of LinkedIn's total revenue is brought in from the money paid for premium subscriptions. It brought in a total of $79.8 million in the latest quarter, up 61% year to year.

Revenue from Premium Subcriptions was $190million in 2012, and accounted for roughly 19% of LinkedIn's total revenue.

LinkedIn offers three separate premium plans:

- Business, which is $19.95 a month, and includes three InMail messages a month, 15 introductions a month, four premium searches, and 300 monthly profile searches

- Business Plus, which is $39.95 a month, and includes 10 InMail messages a month, 25 introductions a month, four premium searches, and 500 monthly profile searches

- Executive, which is $74.95 a month, and includes the ability to see full names of 3rd degree and group connections, 25 InMail messages a month, 35 introductions a month, eight premium searches, and 700 monthly profile searches.

A good sign for the future

LinkedIn seems to have put itself into a good position going forward. The company has been on a hot streak, consistently beating Wall Street expectations every single quarter since it went public in 2011.

But should the network start to slow down, and advertisers begin to peel away, the company has revenue coming from enough other places that it will not have to panic if that happens.

Twitter could learn a lesson here.

(Image source: https://mashable.com)

Related News

How does Amazon make money?