NTT Docomo establishes new $125 million fund

Japanese mobile also creates new incubator for smartphone and tablet related startups

NTT Docomo, the largest phone operator in Japan, is establishing a new ¥10 billion, or $125 million, fund, meant to help new businesses develop for smartphones and tablets, it was announced Friday.

In addition, the company also announced the formation of the Docomo Innovation Village, a new incubation program. Both the fund and the incubator are set to launch by March 31, 2013.

“The Docomo Innovation Fund will invest in promising startups and venture companies, primarily in Japan, that possess innovative business models or advanced services or technologies related to mobility and have the potential to be developed as all-new or upgraded offerings from parent DOCOMO,” the company said in the release.

An operating company will be established to manage the Docomo Innovation Fund, also by March 31.

Some of the companies that Docomo will be investing in with the new fund will come from the news Docomo Innovation Village incubation program.

The incubator will provide support and resources to the startups and venture companies, including office space. Docomo will also be giving presentations from corporate managers, to help give the startups advice on management and development. The Innovation Village will also be collaborating with other domestic incubators.

Docomo is using the fund and the incubator to develop, and invest, in companies in eight fields: Media/Content, Finance/Payment, Commerce, Medical/Healthcare, Machine-to-Machine (M2M), Aggregation/Platforms, Environment/Ecology, and Security/Safety.

Docomo already has a U.S. based subsidiary called Docomo Innovations, which it uses to invest in startups. Docomo will continue to use this to invest in startups in North America.

Docomo is Japan's largest mobile phone carrier with 60.79 million subscribers as of the end of September.

Other Docomo news

Docomo also released its quarterly report Friday, which showed that the mobile operator saw its net income fall 13% year to year, from ¥140.27 billion to ¥121.59, due to increase in operating expensives.

The company’s operating profit also fell 13%, to ¥208.48 billion from ¥240.79 billion, on revenue of ¥1.135 trillion, a 6.5% increase from ¥1.066 trillion the previous year.

The company also revised its earnings outlook. It expects net profit to go down from ¥557 billion to ¥507 billion, but expects revenue to go up, from ¥4.45 trillion to ¥4.52 trillion.

In July, Docomo announced that, after a year of talks, it had partnered with Chinese search giant Baidu.

NTT Docomo secured a $22.5 million investment and became is a 20% shareholder in a new mobile content distribution platform. Baidu retained the remaining 80%.

Other funding news

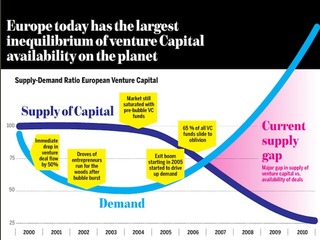

There has been a ton of funding news coming out this year.

Just yesterday, it came out that Atomico Ventures had raised a $286 million fund.

Kleiner Perkins Caufield & Byers closed a $525 million fund In May. In April, early-stage venture capital firm First Round Capital announced that it was going to raise its fourth fund, with a target of $135 million, while Berlin-based Earlybird raised a $100 million fund. In March, Groupon investor NEA filed with the SEC to raise $2.3 billion, while DST, one of Facebook's biggest investors, was looking to raise $1 billion.

Andreessen Horowitz secured a $1.5 billion fund in January, announcing it had raised $2.7 billion in three years. While it has only been around since 2009, Andreessen Horowitz is already a top VC firm, raking in siginificant management fees.

In June, Khosla Ventures announced a new fund for an undisclosed amount, while Madrona Venture Group closed a $300 million fund.

In August, Sequoia Capital surpassed its goal of raising $975 million for three early-stage funds, and just yesterday Nexus Venture Partners, a venture firm whose major focus is on India-based technology startups, announced Thursday that it's raised $270 million for its third fund.

Thrive Capital closed a $150 million fund in September, and in October Trinity Ventures began targeting a $325 million fund.

In the second quarter of 2012, 38 VC firms raised a total of $5.9 billion, according to the National Venture Capital Association.

(Image source: https://www.bloomberg.com)

Related Companies, Investors, and Entrepreneurs

Atomico

Angel group/VC

Joined Vator on

We are entrepreneurs with a global perspective who invest in passionate entrepreneurs with disruptive, powerful ideas.Through our experience building Skype, Joost and Kazaa, we understand the value of game-changing business models and have created a worldwide network to help accelerate the growth of the companies in which we invest.

Related News

Thrive Capital raises $150 million fund

Sequoia Capital surpassing fundraising goal

Atomico raises $285 million for third fund

Andreessen Horowitz secures $1.5B fund

Docomo buys 20% interest in China's Baidu platform

Q2 VC financings are the biggest since the dot-com boom

Trinity Ventures looking to raise $325 million fund

Nexus Venture Partners closes $270M fund

VC firm Madrona Venture Group closes $300M fund

Berlin-based Earlybird closes $100M Fund IV

Outlook good for VC investments in the U.S.

Kleiner Perkins Caufield & Byers closes $525M fund

NEA seeks to raise $2.3 billion fund