Nasdaq scores the highly coveted Facebook IPO

Facebook picks "FB" symbol for a May stock market debut

The countdown continues on the Facebook road to the public stock market. Word has come out that Facebook will be traded on Nasdaq under the ticker symbol “FB,” according to The New York Times.

So it looks like Nasdaq won a battle with the New York Stock Exchange for one of the highly largest tech IPOs ever -- Facebook. Nasdaq hosts Apple, Microsoft, Amazon and Google, while the NYSE have smaller public tech companies like LinkedIn, Yelp and Pandora Media.

The social networking company that has been marching ever forward toward the public market is preparing a $5 billion IPO for sometime in May.

Word is also circulating that Facebook has halted the trade of its shares in secondary markets SharesPost and SecondMarket over the last few days.

SharesPost sent out an e-mail last week saying in part, “At Facebook’s request, SharesPost will cease facilitating transactions in Facebook stock as of Friday end of day to help ensure the company’s orderly transition into the public markets.”

The auction end date was then moved up from April 2 to this Friday, March 30.

In January, the company halted shares, raising speculation that the IPO would be right around the corner. Now, it's being speculated that the debut day will come some time in May, according to Bloomberg.

By halting the trading of shares, however, Facebook would certainly be letting the market settle down before it goes public. It would end price fluctuations and allow investors to determine its valuation, which is expected to be around $100 billion.

Facebook filed to raise a $5 billion IPO with the SEC in February.

Earlier this month, Facebook took out a $5 billion line of credit and $3 billion 364-day bridge loan.

It was also announced last week that Facebook would only be paying its 31 underwriters, which include Morgan Stanley, J.P. Morgan, Goldman Sachs, Bank of America, Barclays, Citigroup, Wells Fargo, Goldman Sachs, and Allen & Co., a 1.1% fee.

The SEC has even begun cracking down on trading companies who they say were misleading investors looking to buy Facebook stock.

SharesPost, and its CEO Greg Brogger, were accused of not registering as a broker-dealer but still engaging in securities transactions. SharesPost and Brogger agreed to settle and pay penalties, without denying or admitting to guilty to the charges. SharesPost will pay $80,000 and Brogger will pay $20,000.

The company generated $3.7 billion in revenues in 2011, and $1 billion in profits. Net income was $1 billion.

Profits grew 65% last year from $606 million in 2010. And revenues grew 88%.

Up until this point Google's $1.9 billion debut has been the largest U.S. Internet IPO.

The public spent the last three months estimating just how big the company and its bankers were going to go with in the S-1 form -- with many estimates placing the valuation of the company near $100 billion and the total amount the company would raise in its public debut near $10 billion.

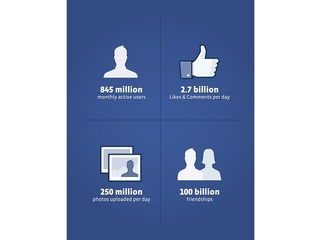

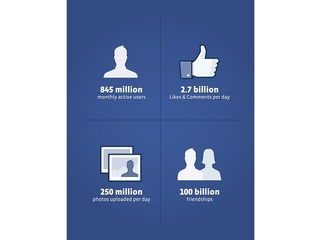

In the filing, Facebook disclosed that it has 845 million MAUs as of Dec. 31, 2011, an increase of 39% as compared to 608 million MAUs as of Dec. 31, 2010.

In November, when reports first started trickling out that the company was on the verge of filing paperwork for its IPO with a planned date to hit the markets in May.

Following up the less-than-stellar showings of several recent tech IPOs (from the likes of Pandora, Groupon and Zynga), Facebook appears to be leaning on the conservative side in order to insure a stronger clamor for shares out of the gate.

Related News

Social media on the NYSE: LinkedIn IPO set

Techstartup RIP 10.15.08: Nasdaq and SkyRider

Zynga sees stock jump after Facebook IPO financials

Peter Thiel: Facebook IPO in 2012 at earliest