Digital health news, funding roundup in the prior week; December 06, 2021

Harrison.ai raised $92.3 million USD, Droplette secured $15.4M,

Read more...

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: bbj.hu

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsHarrison.ai raised $92.3 million USD, Droplette secured $15.4M,

Read more...Amazon Health sells healthcare services to Hilton; Athenahealth acquired for $17 Billion

Read more...How Microsoft can transform healthcare delivery; Trusted has raised $94M; Aptihealth landed $50

Read more...Angel group/VC

Joined Vator on

In 1911, Henry Phipps founded Bessemer Securities to reinvest the proceeds of his sale of Carnegie Steel for the benefit of his descendents. The start-up investment operations were spun out into Bessemer Venture Partners, which now operates out of seven offices around the globe.

Angel group/VC

Joined Vator on

Many venture firms would be best described as a collection of free agents who pursue their own deals and share offices and overhead with their partners. They are more mercenary than missionary and will tell you to focus more on the individual partners and less on the partnership. We hope to have the opportunity to show you how we are different.

We are true partners who have built our own firm together, brick by brick; the same way you are building your company. When we commit to supporting your company, each and every partner in our firm commits to contributing his or her network, creativity and resources towards achieving your success. We are big believers in the power of teams.

We believe you will want an investor with whom you can build a close, supportive relationship over a number of years, yet who will be bold enough to challenge your thinking and your expectations. If Index looks like a good fit, we encourage you to learn about us through the stories and news articles on this website. We invite you to read about the companies we have invested in, and to speak to the entrepreneurs we have partnered with. Their experience is our best reference.

Startup/Business

Joined Vator on

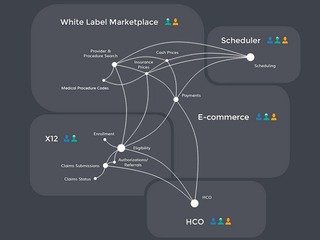

Provider of a cloud-based application programming interface (API) platform designed to make healthcare transactions more efficient and streamline the business of health. The company's platform enables third-party developers such as payers, health systems and digital health companies to process eligibility checks, claims, scheduling, payments, and other business transactions, enabling hospitals and health systems to build new patient-centered experiences. With DokChain, an evolution of PokitDok’s platform utilizing blockchain and other distributed technologies, PokitDok seeks to remove even more waste from healthcare administration while enabling new value creation by healthcare and other industry stakeholders for the consumers they serve.

Startup/Business

Joined Vator on

DoubleDutch is an award-winning provider of mobile event applications, with a unique focus on capturing and surfacing data from live events. The first to bring a data-driven technology approach to the event industry, DoubleDutch customers include SAP, Proctor & Gamble, Audi, Verizon, UBM, Estee Lauder, and more. Founded in January 2011, DoubleDutch has raised $37.5M total in financing from top investors including Mithril Capital Management, Bessemer Venture Partners, Floodgate Fund, and more.