M&A roundup - week ending 12/3/16

Twitter bought Yes; Apple acquired Indoor.io; Fandango purchased Cinepapaya

Read more...

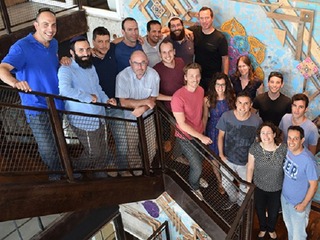

Oculus, the virtual reality startup that was purchased by Facebook last year, acquired Pebbles Interfaces, an Israeli company that develops hardware and software that facilitate 3D gesture interaction in computing and electronic device.

No financial terms of the deal were disclosed, though it is being pegged at $60 million by the Wall Street Journal.

Pebbles will be winding down their business as they integrate with Oculus, and key members of the team, including founder/CTO Nadav Grossinger, will be joining Oculus.

Founded in 2010, Pebbles had raised a $450,000 seed round in 2011, followed by an $11 million round in 2013.

Online dating site PlentyOfFish was purchased by The Match Group. The price of the purchase was $575 million.

Given that The Match Group is the global operator of a series of digital dating products, such as Match, Tinder, OkCupid and Meetic, it is likely that PlentyOfFish will continue to operate as an independent brand under that umbrella, much like those other services.

PlentyOfFish has been bootstrapped since 2003, when it started, The company now has over 90 million registered users, with over 55,000 signups every day, and 3.6 million people loggoing in daily. The company says that it creates 1 million relationships every year.

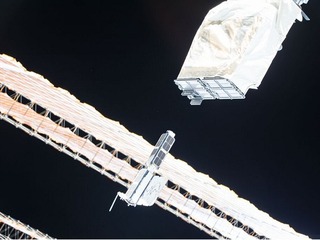

Satellite deployment company Planet Labs purchased geospatial companies from BlackBridge, including the RapidEye suite of core offerings. No financial terms of the deal were disclosed.

Once the deal is final, BlackBridge and the RapidEye assets will be folded into Planet Labs and the respective teams will work together, but mainly continue work on their existing work streams. The RapidEye constellation will continue operating at full capacity. Customers will continue to have access to the complete RapidEye archive and new imagery acquisitions.

The combined total employees of Planet and BlackBridge will be 309 and for the foreseeable future the company plans to keep BlackBridge’s Berlin and Lethbridge offices open with business as usual. There are no planned staff reductions.

BlackBridge had raised a $22 million funding round from the Bank of Montreal and the Business Development Bank of Canada in May of last year.

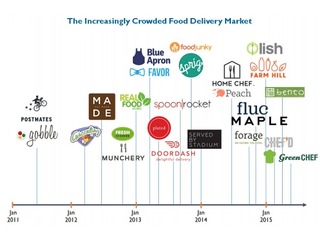

Food delivery is a fast growing space. The latest to see the opportunity is Groupon, which acquired food delivery marketplace OrderUp. Financial terms of the deal were not disclosed.

For Groupon, this acquisition has a clear purpose: to significantly boost the company's presence in the food ordering and delivery sector, which it says is currently worth around $70 billion. For OrderUp, becoming part of Groupon gives it access to the company's 25 million active North America customers.

The Baltimore-based OrderUp, which was founded in 2009, gives Groupon the ability to hit the groun running in this space. The company has processed more than 10 million orders and is available in 26 states around the country.

OrderUp had raised $10 million in funding.

Local discovery app Yeti was acquired by a group of private investors, including Jim Armstrong, a Managing Director at March Capital Partners, one of the largest investors in Hyphos, which is Yeti’s parent company. The financial terms of the deal were not disclosed.

Alex Capecelatro, the CEO and co-founder of Yeti, will be shifting his focus to a new venture, but will continue to work with the company as a strategic adviser. Andy Mazzarella, a serial entrepreneur with 30 years of experience in tech and finance, will be taking over as Yeti’s CEO.

Japanese e-commerce company Rakuten acquired Fits.me, a virtual fitting room startup. Financial terms of the deal were not disclosed.

Rakuten expects the innovative tech startup to further strengthen its e-commerce offerings and marketing solutions. Fits.me will operate as a stand-alone business within Rakuten, Inc. and continue to support and grow current and future clients.

Fits.me was founded in Estonia and had raised $14.3 million from Conor Venture Partners, Entrepreneur’s Fund, Smartcap, Contour Venture Partners and Primary Venture Partners, as well as CEO James B. Gambrell and several angel investors

Mobile remittance app Remitly acquired Talio, a picture and videp messaging app. Terms of the deal were not disclosed.

Remitly made the purchase to continue its messaging development, especially on mobile.

Talio’s entire team, including founders, developers and engineers, to Remitly. Talio’s founders, Piragash Velummylum and Jordan Timmermann, both former Amazon employees, will join Remitly to continue new product development efforts at the company.

With the acquisition, Talio’s investors, including Principal of William Blair & Co. Richard Kiphart, Vulcan Capital, Zillow CEO Spencer Rascoff, Seattle super angel Rudy Gadre, and former Expedia CEO Erik Blachford, among others, will become investors in Remitly.

Mobile shopping startup Wish made its first acquisition in Locket ,an intelligent personalization platform that brings breaking news and other content to smartphone lock screens. No financial terms of the deal were disclosed.

Yunha Kim, Founder and CEO of Locket, will be joining the Wish executive team as Head of Growth to lead growth initiatives and communications for Wish and its family of mobile shopping apps, including Wish, Geek, Cute, and Mama.

Founded in 2013, Locket has reached more than one million users and raised $3.2 million from investors including Tyra Banks and Turner Broadcasting.

On the eve of its split from PayPal, eBay entered into a definitive agreement to sell eBay Enterprise, its company that specializes in creating, developing and running online shopping sites for brick and mortar brands and retailers.

It is being bought by a consortium consisting of Sterling Partners, Longview Asset Management, and Innotrac Corporation, a Sterling Partners portfolio company, together in partnership with companies owned by the Permira Funds.

The total price was $925 million.

Tune, a third-party measurement company, acquired Artisan Mobile, a company that helps marketers engage app users through notifications and in-app messages. Financial details of the transaction are not yet disclosed.

Artisan’s features include cohort analysis, A/B and multivariate testing, push notifications, and in-app messaging, as well as geo-targeting and optimal-time messaging.

Artisan Mobile has raised $7 million in two rounds from FirstMark Capital, among others

HR software provider company Workday really wants to get into data science. Not only did it launch its own venture fund for that purpose, but it also acquired data science company Upshot, a startup that developed a mobile app that allowed users to make natural-language voice queries on data in customer-relationship management tools. Terms of the deal weren’t disclosed.

The acquisition was made in February, and was an acqui-hire, with Upshot's engineers coming to work at Workday. Founders Thomas Kim and Joseph Turian, along with Upshot developer Alex Nisnevich, also joined Workday as a result of the deal.

Upshot won a $1 million prize in a 2013 Salesforce hackathon.

Microsoft reached an agreement to acquire FieldOne Systems, a provider of field service management solutions that allow organizations to better manage and deliver service to their customers in the field. Terms of the deal weren’t disclosed.

For Microsoft, the opportunity to bring a fully integrated field service solution into the Microsoft Dynamics group, pairing it with the powerful capability of applications like Azure, Parature, Cortana Analytics and Power BI, led to a natural conclusion that it made perfect sense to acquire FieldOne.

Because FieldOne is built on the Microsoft Dynamics CRM platform, Microsoft customers will gain immediate value from FieldOne’s functionality.

Online casino and poker firm 888 entered into a deal to buy Bwin.party Digital Entertainment in a cash and stock deal worth almost 900 million pounds ($1.4 billion).

888, which offers casino, poker and bingo games, has enjoyed strong growth as gamblers move online via tablets and mobiles. In acquiring Bwin, the firm will significantly boost revenues from its fledgling sports betting business, and can apply its stronger technology platform and management to Bwin's business.

A combined group will have revenue of over $1 billion and be a leading online gambling operator in Belgium, Denmark, Germany, Italy, Spain and the UK.

The two companies said they would also considering spinning-off Bwin.party's 'Studio's technology business.

(Image source: blog.orderup.com)

Twitter bought Yes; Apple acquired Indoor.io; Fandango purchased Cinepapaya

Read more...Oracle acquired Dyn; Tesla completed the deal for SolarCity; Google bought Qwiklabs

Read more...FanDuel and DraftKings merged; Facebook bought FacioMetrics; Hulu acquired The Video Genome Project

Read more...