(Come mingle with hundreds of top venture capitalists representing $10B-plus in capital under management, including Khosla Ventures, Greylock and Javelin Venture Partners, and learn from founders/CEOs including Marco Zappacosta, Co-founder & CEO of Thumbtack and Adam Goldenberg, CEO of JustFab, Slava Rubin, Founder & CEO of Indiegogo, at Vator Splash Oakland on April 22nd and 23rd. Get your tickets here!)

It’s really starting to feel like Facebook, which used to be an innovator in the social media space, is now constantly trying to catch up to Snapchat. It’s not a good place for the company to be.

A few months ago, Snapchat revealed that it has teamed up with Square for a new payments feature, one that would allows user to send each other cash from their debit card to other users for free person-to-person payments in-app. Now take a guess what Facebook just announced on Tuesday. Yup, that’s right: free in-app peer-to-peer payments.

The new feature will be added to Messenger, and it “gives people a more convenient and secure way to send or receive money between friends,” Facebook said.

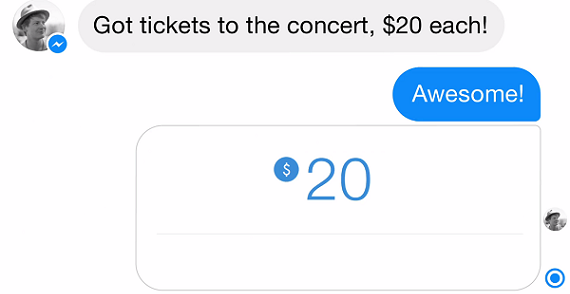

Here’s how it works. In order to send money, all a user has to do is start a message with a friend, then tap the $ icon and enter the amount they want to send. Once they tap “Pay” in the top right, and add their debit card to send money, it will be transferred immediately.

On the receiving end, all that user has to do is open the conversation from their friend and then tap “Add Card” in the message to add their debit card to accept money for the first time. It may take one to three business days for the money to be desposited, depending on the user’s bank.

This feature will be rolling out over the coming months in the United States.

Facebook also highlighted how seriously it is taking security, as well as it should with such potentially sensitive information being sent.

“Incorporating security best practices into our payments business has always been a top priority. We use secure systems that encrypt the connection between you and Facebook as well as your card information when you ask us to store it for you,” said Facebook.” We use layers of software and hardware protection that meet the highest industry standards. These payment systems are kept in a secured environment that is separate from other parts of the Facebook network and that receive additional monitoring and control.”

The first time a user sends or receive money in Messenger, and they add a debit card, they can create a PIN to provide additional security the next time they send money. On iOS devices users can also enable Touch ID.

In addition, Facebook has a team of anti-fraud specialists monitor for suspicious purchase activity to help keep accounts safe.

It should be noted that Facebook has been talking about adding in-app payments for a while now, and that Mark Zuckerberg has said that it will be a part of Facebook’s efforts to monetize Messenger.

Messenger, which was broken off from the main Facebook app, this past summer, now has at least 500 million monthly active users.

And that’s not even as many as WhatsApp, the mobile messing service Facebook bought last year for more than $20 billion. That app recently announced that it has a total of 700 million MAUs, and that over 30 billion messages are being sent every day.

The reason why I mention that is because WhatsApp, which charges each user a dollar per year, but also gives the app away for the first year as well, has been looking for ways to monetize. That could include in-app purchases, fees for feature or, possibly, peer-to-peer payments.

It will certainly be interesting to watch and see if this feature eventually makes its way onto Facebook’s other big messaging app as well.

(Image source: