Digital health funding declines for the third year in a row

AI-enabled digital health startups raised $3.7B, 37% of total funding for the sector

Read more...

Last month, The San Francisco Board of Supervisors passed the so-called "Airbnb law," thereby clearing the way for the company to legally operate in the city. Many San Francisco residents have long resisted the influence of Airbnb in their city, which has long struggled with issues of availability and affordability.

Now you can add one more detractor of the law: vacation rental marketplace HomeAway, which has decided to sue the city of San Francisco over its passing.

The complaint accused the city of violating the Commerce Clause of the Constitution "because it discriminates against interstate commerce through differential treatment of San Francisco-based and non-San Francisco-based interests that benefits the former and burdens the latter."

Basically, what HomeAway is accusing the city of crafting a piece of legislation that was designed to help its hometown platform, Airbnb, while making it harder for out of state platforms, like the Austin-based HomeAway to operate.

The ordinance, the complaint says, discriminates against non-permanent residents, who rent or lease, while favoring those who own their property instead. Many HomeAway listings are people's second homes or vacation properties, and are not the full time residences of their owners.

"First, by its express terms, the Ordinance allows only permanent San Francisco residents to rent out on a short-term basis (which the Ordinance defines as thirty days or less) residential property they own or lease in San Francisco. Non-permanent residents of San Francisco who own or lease property in San Francisco are barred on the face of the Ordinance from renting out their property on a short-term basis."

The city of San Francisco, HomeAway says, has not made it clear what benefit it is to the city of only allowing short term rentals in permanent residences.

Second, HomeAway accused the city for of, again, favoring rental platforms from San Francisco by requiring them to "conform their business operations in San Francisco to one particular model, and no other, under pain of monetary penalties." That model happens to be the one currently used by Airbnb.

"This anti-competitive measure forces those seeking to rent property to turn over control of selecting short-term tenants to entities that operate the type of Hosting Platform model sanctioned by the Ordinance and to pay whatever fees those entities might charge today or in the future," it said. "While facially neutral, the Ordinance’s Hosting Platform rules have the purpose and effect of discriminating against non-San Francisco-based interests."

HomeAway allows travelers to have direct contact with the listing owner, or the owner or lessee of an individual residential property, who then has control over the transaction and is able to, chooses whom they will rent to, when they wish to rent, and how and when they wish to be paid.

Airbnb, on the other hand, takes an "Agency" model, where it control the communication between the two sides, and sets policies that both sides have to follow.

The law imposes a hotel tax that HomeAway simply cannot pay because, unlike Airbnb, it doesn't manage the payment transaction between the renter and home owner. While Airbnb makes its money by charging guests a 6-12% fee and taking a 3% cut from hosts, HomeAway has never charges guests. Hosts front the whole of the costs by either paying a subscription fee or handing over a cut of each booking.

According to HomeAway, the ordinance essentially makes Airbnb's model the default, and discriminates against the way that others do business.

"It makes illegal any competing business model, such as HomeAway’s, that does not require the Listing Owner to act as an agent in the collection and holding of Listing Owner information, fees, and taxes and allows the Traveler to contract directly with the Listing Owner, who sets his or her own policies and leases the property to the Traveler."

"Airbnb is focused on fair rules that allow regular people to share the home in which they live. If other companies feel differently, that's up to them," Nick Papas, the Director of Public Affairs PR at Airbnb, told VatorNews.

The "Airbnb Law"

The measure, which was passed by a vote of 7-4, does allows Airbnb to operate legally, but not without some clear caveats intended to stop landlords from possibly indulging in some of their worst practices.

It reversed a law that had previously barred residential rentals of less than 30 days, something had been put in place to protect renters from landlords kicking them out. That law had made the company, which is based in San Francisco, technically illegal in its home city.

While the new law did make rentals of less than 30 days legal in San Francisco, it also subjects landlords to new restrictions and taxes.

Not only do hosts have to register with the city, but they also have to pay hotel taxes. Each listing has to carry $500,000 in liability insurance, and they have to pay a fee toward the Planning Department so that they can send inspectors to make sure the guidelines are being followed.

The most important new rule, though: rentals are limited to only 90 days out the year, meaning landlords cannot turn their rental properties into de facto hotels. The new law takes effect in February 2015.

Airbnb has been a major disruptor to the hotel business and therefore, has come under attack in numerous cities, including New York, where the Attorney General subpoenaed Airbnb last year over illegal listings. A judge threw out that subpoena in May, but the fight is hard from over.

Since its founding in 2008, Airbnb has served more than 11 million total guests. In now operates in over 34,000 cities in 192 countries and has over 600,000 listings around the world.

This lawsuit was first noticed by TechCrunch on Monday.

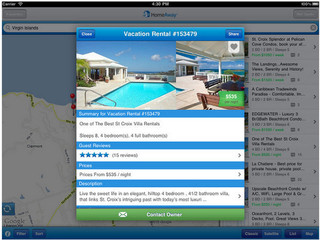

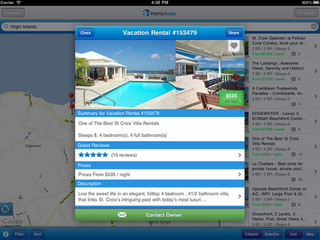

(Image source: homeaway.com)

AI-enabled digital health startups raised $3.7B, 37% of total funding for the sector

Read more...OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Startup/Business

Joined Vator on

Airbnb.com is the “Ebay of space.” The online marketplace allows anyone from private residents to commercial properties to rent out their extra space. The reputation-based site allows for user reviews, verification, and online transactions, for which Airbnb takes a commission. As of June, 2009, the San Francisco-based company has listings in over 1062 cities in 76 countries.