While Amazon has remained notoriously silent on Prime subscriptions–other than to say they’re in the “millions,” a report released Tuesday by Morningstar analyst R.J. Hottovy is shedding some light on what turns out to be a pivotal part of Amazon’s overall business.

The service, which offers free two-day shipping on all orders and unlimited streaming via Prime Instant Video, has exploded since the Kindle Fire came on the scene. The report estimates that subscribers have topped 10 million this year, up from some four million at the end of 2011. As the report reveals, the Kindle Fire played a critical role in promoting Prime, the growth of which was somewhat sluggish until Amazon started offering a free 30-day trial with each Kindle Fire purchase. And the report shows that most Prime subscribers are converted through these 30-day trials.

Then BOOM—subscriptions shot up. What does that mean for Amazon? The report reveals that Prime subscribers are a coveted consumer, spending twice as much on Amazon as the average non-subscriber. To be specific, Prime members spend an average of $1,200 a year on Amazon, while non-subscribers spend approximately $500. Currently, one half of all Prime subscribers have had their membership for less than a year.

While Prime subscribers only represent about 4% of Amazon’s 182 million active users, they represent 10% of all purchases.

Even better: that $79 annual subscription fee? Pure profit. Specifically, Amazon pockets $78. It breaks even on shipping and all of the other things it offers Prime subscribers, but that $78 per subscriber works out to make up one-third of Amazon’s consolidated segment operating income in 2012, according to the report.

But what makes Prime subscribers so valuable isn’t just the fact that they spend more or they pony up $78 in profit to Amazon—it’s that they’re fiercely loyal. Hottovy noted, Prime subscribers spent an average of $1,200 on Amazon last year, while the average online consumer spent a total of $1000 on an online purchase last year. The takeaway from that is that Prime subscribers spend more in general—and that they’re doing ALL of their shopping on Amazon.

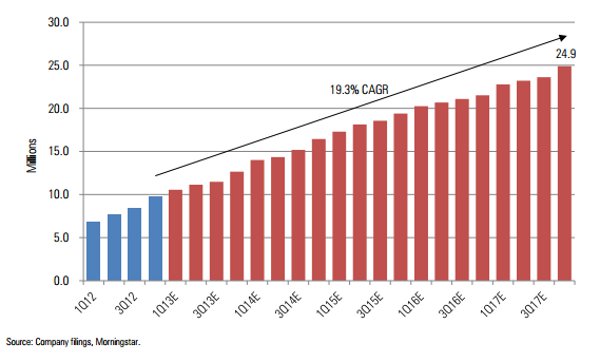

Additionally, researchers at Morningstar anticipate that Prime subscriptions will more than double over the next four years to 25 million by 2017.

“We expect Prime to become an increasingly vital contributor over the next five years. Management’s continued trial membership bundling with Kindle Fire purchases and rapidly expanding digital content library should be key catalysts for Prime membership growth in the years to come,” wrote Hottovy in the report. He added that while the rest of the retail world will probably experience difficulty this year with turbulent consumer spending due to payroll tax increases and higher gas prices, Amazon Prime will likely reap the benefits, much the same way Costco saw its membership base jump during the recession.

Image source: fortunebrainstormtechfiles