It’s looking more and more like 2011 is going to be the year of the market rebound as some of the highest profile Web companies are said to be gearing up for their public debuts. Last week, Demand Media and Nielsen got the party started, and then LinkedIn filed its S-1 to go public. Add to that Skype’s imminent IPO and rumors that Facebook and Groupon could go public this year, and the market’s future is starting to look pretty bright. So who is up to bat this year and what can we glean from similar IPOs of yesteryear?

LinkedIn now, Monster then

The public offering that seems the most likely to happen sooner rather than later is that of LinkedIn, which filed last Thursday to great fanfare. The company has not yet disclosed how many shares it plans to offer or what the starting price will be, but its numbers look promising. The company brought in $161 million in revenue in the first nine months of 2010, up 34% from $120 million in the whole of 2009. The company also turned a profit for the first time in 2010, pocketing $10 million in net income. In addition, it’s seen a near doubling of users. The number of registered members in 2010 was 90 million, up from 55 million in 2009, and unique visitors also doubled to 65 million in 2010 from 36 million in 2009.

Compare this to Monster Worldwide, which went public in 1996 back when it was an advertising services provider. The company priced its 4.8 million shares at $14 each, saw a slight rise to $14.25, and closed the first day at $14. Monster’s offering raised $80.5 million, and today its market cap stands at $2.78 billion.

Where Monster stopped at resumes and recruitment, LinkedIn took it to the next level by applying it to the social graph—reaffirming the truth of that old adage: it’s not whatyou know, it’s who you know. In addition, LinkedIn focuses less on direct recruitment than general networking—again, a far cry from Monster.com, which takes more of an online job fair angle.

Skype now, AOL then

While reports emerged last week that Skype plans to delay its public offering until the latter half of 2011, many expect the company to top $1 billion. When eBay sold Skype back in 2009, the company had a valuation of some $2.75 billion.

Skype filed an S-1 form last August, leading many to believe that the company planned to go public in early 2011, but in a surprise move, the company swapped out CEOs in October and brought in former Cisco Systems exec Tony Bates to run the company. Inside sources told the Wall Street Journal that the company plans to wait until Bates has his sea legs before it goes public.

But some are worried about Skype’s overall health. While the company has had no problem attracting users, analysts have questioned how it plans to generate revenue from its user base, which consists mostly of unpaid subscribers. Of 124 million monthly users, only 8.1 million (6%) actually pay for the service. In the first six months of 2010, Skype’s revenues totaled $406 million, a 25% increase over 2009, when it reported $324 million in revenues. Its income, on the other hand, totaled a sparse $13.1 million.

One might think back on the AOL IPO of 1992. Back then, AOL was described The Journal’s Walt Mossberg as “a provider of computer-based services.” Mossberg praised AOL’s groundbreaking platform and compared it to its then-rival Prodigy: “Both feature graphics on the screen, display texts in variable sizes and fonts, and let users navigate through the various databases by selecting commands onscreen with a mouse pointing device.”

That’s right. Mouse-pointing device. Some kind of…pointing, clicking hoopatchoo…

AOL went public in March of 1992 and initially priced its shares at $11.50, but closed at $14.75, 28.3% above its starting price. The company has since gone through some rough years and still—amazingly—relies primarily on its dial-up service for revenue, but it’s still bringing home the bacon. Share prices closed on Friday at $23.82, and the company has a market cap of $2.54 billion.

So why compare Skype and AOL? Remember that Meg Ryan/Tom Hanks movie “You’ve Got Mail”? That’s why. Even before social was social, AOL made a name for itself with its online communication tools. Today, as AOL moves into the content arena, Skype is pioneering the online communication phenomenon that AOL once represented.

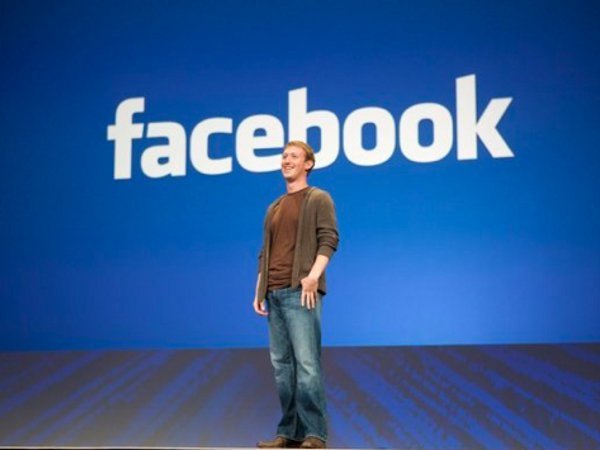

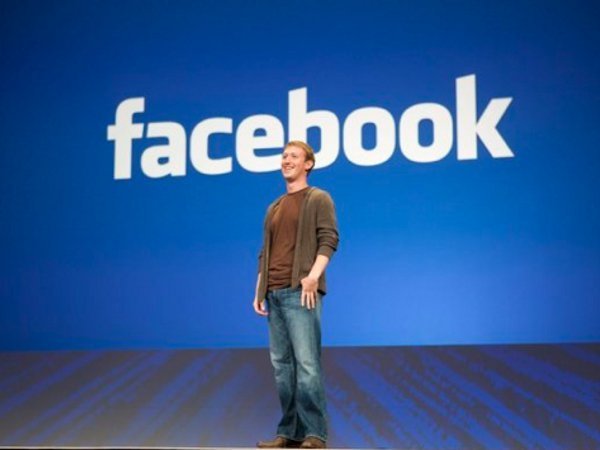

Facebook now, Google then

This one is obvious. The two companies can only be compared to one another because they essentially stand alone in their categories. Facebook broke ground on the social graph, just as Google turned search inside out.

Facebook is rumored to be gearing up for an IPO later this year and has been valued at some $50 billion. The company has raised $2.34 billion in financing—including its most notable $1.5 billion in funding from Goldman Sachs. Goldman Sachs came under fire, however, for its “special purpose vehicle,” created to allow its high-net-worth clients to invest in Facebook, which would allow them to bypass the S.E.C.’s requirement that companies with more than 499 investors disclose their financial results. Goldman Sachs’ special purpose vehicle would count them all as one investor.

What it points to is the fact that everyone wants to get in on the Facebook action in preparation for the big debut. And it will be big.

How big? Let’s look back on Google’s 2004 IPO. When the company went public, it initially priced its shares at $85 a piece, and the sale of $1.67 billion gave Google a market cap of $23 billion and made many Google employees instant millionaires. Today—some six and a half years later—Google shares are trading for more than $600 (GOOG closed Friday at $600.18) and has a market cap of $192.18 billion. Cha-ching.

Groupon now, Amazon then

And then of course there’s the Groupon beast. No one saw it coming. Founded in 2008, the company went from a handful of employees to more than 4,000 in just two years. Profitable after only eight months, it has inspired a legion of clones—more of which seem to keep cropping up every day. Recently, the company raised nearly $1 billion from more than 30 different investors, which—as in Facebook’s situation—is indicative of the swarm of investors who want to get a piece of the Groupon pie.

Two weeks ago, the collective buying behemoth was rumored to be meeting with bankers in a series of “bake-off” meetings in preparation for an IPO that could value the company at $15 billion or more. Groupon has not commented on the rumors, other than to say that it is exploring all of its options—of which an IPO is only one.

What might a Groupon IPO look like? To get an idea, it might help to look back on Amazon’s IPO. Why Amazon? Because Amazon was the Groupon of the Google era. Sumeet Jain, a Principal with CMEA Capital, recently told me that he believes that in a few years, more commerce will be done on Facebook than Amazon, because the social graph will inevitably become the fabric of every Web exchange.

Amazon made its initial public offering in May of 1997, pricing its shares at $18. Shares soared 30% above their starting price and the company raised $54 million for a market cap of $438 million. Fourteen years later (my God!), Amazon’s share prices are in the healthy $170 range and the company has a market cap of $76.81 billion.

As the ever-fickle market begins to revive, we may see some big numbers down the line.

Image source: freefoto.com