How does Course Hero make money?

The company offers a freemium model, where users can pay to access more content and ask questions

Read more... The pandemic changed many of our behaviors, for better or worse, at least in the short term, and likely in the long-term as well. In many cases, trends that were slowly getting started, and may have taken years became the norm, were suddenly a part of our daily lives. So, for example, a lot of people have figured out what they don't need to go to an office to do their work, or to a gym to get their exercise.

The pandemic changed many of our behaviors, for better or worse, at least in the short term, and likely in the long-term as well. In many cases, trends that were slowly getting started, and may have taken years became the norm, were suddenly a part of our daily lives. So, for example, a lot of people have figured out what they don't need to go to an office to do their work, or to a gym to get their exercise.

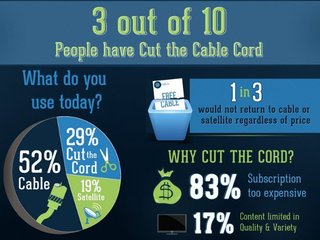

That extends to the way we consume our entertainment as well; even before the pandemic people were going to the movies less often, with even as box office climbed. People also started cutting the chord on their cable, in favor of getting their movies and TV shows when and how they want them through streaming.

To see these trends on display, you just have to look at a company like Redbox, which started out as service that allowed people to rent DVDs from a kiosk, but which has been shifting over the last few years toward becoming digitally enabled service, allowing its users to rent TV shows and movies, sometimes while they're still in the theater.

Though the vast majority of the company's revenue still comes from what it calls its "legacy business," aka fees for renting DVDs, it's clear which side of the business is growing quickly.

Redbox's legacy business

The company divides its revenue into two buckets, the first being its legacy business, which includes the 40,000 or so self-service kiosks where its users can rent or purchase DVDs and Blu-ray discs. The company gets revenue from the fees charged to rent or purchase a movie, including the roughly $2 a night that customers are charged to rent, plus late fees if they don't return it by 9 pm the next day. For example, if the DVD is $1.85 per day to rent, and they return it two days later by 9:00 p.m., they will be charged $5.25 plus tax.

If the users keep an item through the maximum rental period, that item is theirs to keep and they'll have to pay the maximum charge, which varies depending on the type of disc being rented; for a DVD that would be $29.75, and for a Blu-ray disc that is $34.

Finally, Redbox has a service business, with a team pf more than 1,000 field workers who manage kiosk installation, merchandising and break-fix services. In addition to maintaining Redbox’s own kiosks, the company also supports other kiosk businesses, and the company has service agreements with multiple companies; for example, since June 2020, Redbox has been the primary vendor for Amazon's locker locations.

Redbox's digital business

The other revenue segment for Redbox is its digital business, through which customers can buy and rent movies and TV shows on-demand.

Redbox On-Demand launched in December 2017, with new release prices typically ranging from $5.99 to $24.99, and catalog movies prices typically ranging from $1.99 to $3.99. Since 2020, customers have also been able to digitally rent movies that are still in theaters through Redbox’s Premium Video-On-Demand service.

The company also has some ad supported digital streams, including Redbox Free Live TV, which it launched last year; it currently has more than 95 channels, including three Redbox-branded and programmed channels. Free Live TV has gained more than 8 million users in its first 12 months. In December 2020, the company also launched its Free On Demand service, which has more than 1,500 movies and TV episodes.

On top of that, Redbox is planning on launching a subscription channels product, which will give consumers the opportunity to subscribe to multiple third party premium SVOD channels through the Redbox app. Redbox plans to collecting 100% of the subscription revenue before paying the SVOD channel owner’s revenue share.

Finally, Redbox operates a media advertising business which monetizes hundreds of millions of monthly display ad impressions across the mobile app, web, e-mail and kiosk network. Advertising revenue comes from a mix of programmatic advertising and direct sales.

Digital revenue is growing

In all, Redbox's net revenue declined 36.4% in 2020, from $858.4 million to $546.2 million, which the company says was a result of the pandemic and its effect on the movie business.

"Physical movie rentals were negatively impacted by the COVID-19 global pandemic due to a material decline in new movie releases available to consumers resulting from broad-based movie theater closures and a material slowdown in new productions, both beginning in March 2020 compounded by regulatory restrictions on retail stores intended to prevent the spread of COVID-19, meaningfully reducing customer traffic," the company wrote in its SEC filing.

However, even as its legacy revenue declined 37.5 percent year-to-year, from $809 million in 2019 to $506 million in 2020, its digital revenue doubled in the same time from, going from from $20 million to $40 million in the same time frame. That meant digital went from being just 2.4% of total revenue in 2019 to 8% in 2020. And that number is only going to continue to grow in the company years, according to Redbox's own projections.

While it see its legacy business continuing to grow as well, especially once we're fully emerged from the pandemic, Redbox expects it's digital revenue to continue to climb at a much faster rate. From 2021 to 2022, the company is projecting that digital revenue will grow by 175%, and then by another 99% in 2023, until it's more than a third of the company's total revenue.

While it see its legacy business continuing to grow as well, especially once we're fully emerged from the pandemic, Redbox expects it's digital revenue to continue to climb at a much faster rate. From 2021 to 2022, the company is projecting that digital revenue will grow by 175%, and then by another 99% in 2023, until it's more than a third of the company's total revenue.

"Redbox is undergoing a significant business expansion and digital transformation. Redbox has transitioned from a pure-play DVD rental company to a multi-faceted entertainment company that provides tremendous value and choice by offering movie rentals as well as multiple digital products across a variety of content windows including transactional (TVOD), ad-supported (AVOD), and subscription (SVOD) and being a distributor of feature films with a growing library of original content," the company wrote.

Publicly traded

In May, Redbox announced it would be going public via a SPAC merger with Seaport Global Acquisition Corp. which valued the company at $693 million. That includes $145 million of cash held in the trust account of Seaport Global Acquisition, and a fully committed PIPE of $50 million led by Ophir Asset Management.

The company went public in October, and is trading at $13.23 a share, up 37.5% from its closing day price.

(Image source: media.istockphoto.com)

The company offers a freemium model, where users can pay to access more content and ask questions

Read more...The company sells a premium version of its free product to parents, schools and districts

Read more...Initially a platform for renting textbooks, it now makes 90% of revenue from software subscriptiions

Read more...