M&A roundup - week ending 12/3/16

Twitter bought Yes; Apple acquired Indoor.io; Fandango purchased Cinepapaya

Read more...

Facebook acquired FacioMetrics, a developer of vision-based customer solutions. No financial terms of the deal were disclosed.

FacioMetrics products will be shut down and key members of the team, including both founders, de la Torre and CTO Francisco Vicente, have been hired at Facebook.

Founded in 2015 as a spin-off company from Carnegie Mellon University, FacioMetrics developed algorithms for facial feature tracking, and its products included FacioLytics, a library for facial behavioral analysis and demographics from video; FacioSwap, a face swapping tool; and FacioID, a library for facial identification.

Hulu acquired The Video Genome Project, a structured database of video content. No financial terms of the deal were disclosed.

Hulu plans to combine The VGP’s proprietary technology with its own recommendation engine. The company expects to fully incorporate VGP's data into its recommendation system by the first quarter of 2017. A small group of VGP employees will be joining Hulu.

Founded in 2013, The Video Genome Project had raised funding from Segel Group Limited.

ContextMedia, a provider of digital health information, acquired patient education media company AccentHealth, it was announced on Wednesday. No financial terms of the deal were disclosed, but it was revealed that it was an all-cash purchase.

AccentHealth's channel is currently seen in over 30,000 physician waiting rooms, serves over 70,000 medical practitioners nationwide, and reaches 173 million patients each year. ContextMedia will invest in bringing its technologies into AccentHealth's network of practices and, as a result, will reach 55,000 healthcare locations.

At the present time, AccentHealth will continue to operate as a distinct brand and platform, independent of ContextMedia. Both firms and their teams will operate with no changes in the short term.

A joint Accent-Health ContextMedia team will be evaluating the platforms to determine the best way to grow the combined business in the future. ContextMedia also plans to make a significant investment in the technology, footprint and future of the combined platform.

The transaction is expected to close by the end of the year subject to customary closing conditions.

J.P. Morgan Securities LLC acted as exclusive financial advisor and Kirkland & Ellis LLP acted as legal advisor to ContextMedia. JPMorgan Chase Bank, Goldman Sachs and Citizens First Bank will provide financing. Moelis & Company acted as exclusive financial advisor and Alston & Bird LLP acted as legal advisor to AccentHealth.

Doctena, a medical booking platform, acquired Doxter, an online appointment and review system for physicians. No financial terms of the deal were disclosed.

Doxter co-founder Ron Lehnert is staying on and will become CEO of Doctena Germany.

Doxter’s patient portal will be rebranded as Doctena.de. Doctena Germany mobile apps for Android and iOS will also be rolled out.

Verizon acquired LQD WiFi, a developer of Smart Cities and ubiquitous WiFi. No financial terms of the deal were disclosed.

LQD's assets will be integrated with the smart community infrastructure from Sensity Systems, which Verizon acquired last month.

LQD and Verizon are currently designing solutions for municipalities, private developers, academic institutions and entertainment venues. Verizon also sees opportunity to promote civic innovation and deliver data driven solutions leveraging the open data platforms of cities. These solutions will help communities better inform and engage with their constituents.

Founded in 2014, LQD had raised $1.73 million in funding.

Verizon also acquired SocialRadar, which develops social and location-based space applications for users to connect and interact with others around them. No financial terms of the deal were disclosed.

Verizon will use SocialRadar’s technology in MapQuest. SocialRadar will keep its existing offices, but the six-person team is already working closely together with the MapQuest team in Denver and other AOL offices to integrate its data and services with MapQuest’s existing tools.

Founded in 2013, SocialRadar had raised $12.75 million in funding from New Enterprise Associates, Growth Tech Ventures, NextGen Venture Partners, Dave Morin, and Ted Leonsis, among others.

GE Digital, which connects streams of machine data to analytics, acquired ServiceMax, a provider of cloud-based field service management solutions. The deal is worth $915 million.

With this acquisition GE plans to add analytics and insights into the ServiceMax logistics, workforce optimization and deployment models. GE estimates there is a market-wide opportunity to improve service productivity by $25 billion through the use of analytical tools.

The acquisition of ServiceMax is expected to close in January, subject to customary closing conditions, including receipt of applicable regulatory approvals.

Morgan Stanley acted as exclusive financial advisor to ServiceMax with Gundersen Dettmer LLP serving as legal counsel for ServiceMax. King & Spalding, LLP served as legal counsel for GE Digital.

Founded in 2007, ServiceMax had raised $204 million in venture funding from Cloud Apps Capital Partners, Crosslink Capital, GE Ventures, Mayfield Fund, Salesforce Ventures and Kleiner Perkins Caufield & Byers, among others.

GE Digital also acquired Wise.io, a provider of machine learning tools for automating customer service. No financial terms of the deal were disclosed.

The acquisition will enable GE Digital to further accelerate development of advanced machine learning and data science offerings on the Predix platform. The Wise.io technology deepens GE’s machine learning stack and the team will spearhead innovative solutions in GE’s vertical markets to develop intelligent systems offerings.

Founded in 2013, Wise.io had raised $3.58 million in venture funding from Alchemist Accelerator, Citrix Startup Accelerator and Voyager Capital.

xAd, a location intelligence provider that drives sales, acquired WeatherBug, a provider of weather information services. No financial terns of the deal were disclosed.

The acquisition included WeatherBug mobile, desktop and iWatch apps, WeatherBug.com, and WeatherBug connected TV assets.

Founded in 1993, WeatherBug has over 20 million unique users per month and an average time on site of 25 minutes. The company had raised $34 million in venture funding from Allegiance Capital, HarbourVest Partners, Outcome Capital, Polaris Partners and Sequoia Capital.

Marvel, a Web and app design platform, acquired POP, an app that transforms sketches into click-through prototypes. No financial terms of the deal were disclosed.

All POP projects will be converted into Marvel projects. That means prototypes and designs will continue to be accessible and editable within Marvel. The POP Web app will redirect to Marvel.

Founded in 2012, POP has over 500,000 users. Earlier this year the POP team joined Priceline.

The compant had raised $700,000 in venture funding from 500 Startups, Amino Capital and Golden Gate Ventures.

Samsung acquired NewNet Communication Technologies, a company operating Rich Communications Services. No financial terms of the deal were disclosed.

The acquisition reinforces Samsung’s commitment to RCS as mobile networks transition to IP-based networks and services.

NewNet Canada, based in Halifax, Nova Scotia, will continue to operate independently under the existing leadership of Brent Newsome and Gavin Murphy as a wholly owned subsidiary of Samsung Electronics Canada Inc.

Samsung also acquired audio products and electronic systems manufacturer Harman. The price was $112.00 per share in cash, or total equity value of approximately $8 billion.

Harman has more than 30 million vehicles currently equipped with its connected car and audio systems, including embedded infotainment, telematics, connected safety and security.

Approximately 65 percent of HARMAN’s $7 billion of reported sales during the 12 months ended September 30, 2016 are automotive-related, and its order backlog for this market at June 30, 2016 was approximately $24 billion.

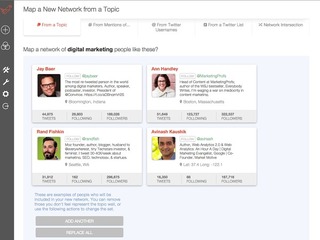

Sprinklr, a social media management platform, acquired Little Bird, which analyzes social data to deliver insights for smarter enterprise marketing. No financial terms of the deal were disclosed.

Little Bird’s technology will enhance Sprinklr’s audience insights, segmentation, advertising, and analytics capabilities as part of the only unified platform for enterprises to engage customers and manage their experience at scale.

Founded in 2011, Little Bird raised $3.37 million in venture funding from Mark Cuban, the Oregon Angel Fund and Jason Calacanis’ AngelList Syndicate.

Google acquired Undecided Labs, which was developing technology to turn online searches into purchases. No financial terms of the deal were disclosed.

Cathy Edwards, founder of Undecidable Labs, now oversees engineering and product development for image search at Google.

Undecidable Labs gad raised less than $1 million in funding.

Verint Systems, a [provider of Actionable Intelligence solutions, acquired OpinionLab, a provider ofomnichannel Voice of Customer feedback solutions. No financial terms of the deal were disclosed.

The purchase allows Verint to extended its Customer Engagement Optimization portfolio.

Founded in 1999, OpinionLab had raised $15 million in venture funding from SSM Partners,

Jones Day served as legal counsel to Verint on the acquisition transaction. Piper Jaffray served as the exclusive financial advisor to OpinionLab and DLA Piper served as legal counsel to OpinionLab on this transaction.

FetchFind, a provider of e-learning and career advancement for the pet care services industry, acquired PawedIn, a platform for pet parents. No financial terms of the deal were disclosed.

FetchFind will leverage PawedIn’s two-sided marketplace, businesses and pet owners, to provide their current business client base greater visibility to pet owners.

PawedIn was founded in 2015.

DateTix, a mobile and location-based social platform, acquired Noonswoon, a mobile dating app. , It bought 700,000 shares of the company;s its penny stock worth $212,000.

Founded in 2013, Noonswoon has created 350,000 dating connections. The app will continue to operate as normal, and team now will become the Bangkok branch of DateTix.

Noonswoon raised $400,000 from 500 Startups and Golden Gate Ventures.

Hangar, a company developing an autonomous data capture ecosystem for drones, acquired Autoflight Logic, the maker of a flight automation software for DJI drones. No financial terms of the deal were disclosed.

Autoflight Logic boasts over 150,000 autonomous flights in over 190 countries flown using its ground control software.

The existing software will continue to be sold and supported for current users, and the development team will all join Hangar where founder Jim McAndrew will serve as CTO.

Travel agent app Lola acquired hotel metasearch site Room 77. No financial terms of the deal were disclosed.

Lola sais it intends to maintain Room 77's current operations. The platform will also provide strategic insights for helping Lola deliver the best hotel deals through the best channel for its customers.

Founded in 2009, Room 77 had raised $43.8 million in funding from Concur Technologies, Expedia, Felicis Ventures, General Catalyst Partners and Sutter Hill Ventures, among others.

TDS Broadband Service, a subsidiary of Telephone and Data Systems, acquired InterLinx Communications and its subsidiary Tonaquint Networks. No financial terms of the deal were disclosed.

The agreement includes over 170 miles of fiber optic transport.

All employees will be offered positions and encouraged to stay with TDS to support customers locally, in addition to helping advance the network throughout Utah. Employees from Tonaquint Networks, InterLinx and TDS will operate out of the current InterLinx office space in St. George.

The deal is pending regulatory approval at both federal and local levels.

DataStax, a provider of database software for cloud applications, acquired DataScale, a provider of cloud-based management services for data infrastructure. No financial terms of the deal were disclosed.

DataStax also announced the forthcoming availability of DataStax Managed Cloud, a fully-managed database service. DataStax Managed Cloud will be available in early 2017 on Amazon Web Services, followed by other popular public cloud providers.

DataStax will offer customers the opportunity to enroll in the DataStax Managed Cloud beta program starting in early 2017.

Versara Lending, a consumer lender, acquired Peerform, a personal loan marketplace lender. No financial terms of the deal were disclosed.

The acquisition reinforces Versara’s commitment to rapid growth in the consumer lending space. Peerform will operate out of the Versara Lending offices.

Founded in 2010, Peerform had raised $5.3 million in venture funding from Corporest Development.

Daily fantasy sports companies FanDuel and Draftkings merged into a single company No financial terms of the deal were disclosed.

When the deal closes, DraftKings CEO Jason Robins will become CEO of the newly combined company, while FanDuel CEO Nigel Eccles will become Chairman of the Board. The rest of the Board will be composed of three directors from DraftKings, three directors from FanDuel and one independent director, none of whom have been named at this time.

The combined company will be co-headquartered in New York and Boston.

DraftKings and FanDuel revealed that they will remain separate, standalone companies through the 2017 NFL season, while the deal is being finalized. Once the transaction, which is expected to close in 2017, is done, it's not clear which brand it will be operating under.

Founded in 2011, Draftkings has raised just under $600 million from 21st Century Fox, Atlas Venture, FirstMark Capital, GGV Capital, Major League Baseball Ventures, Major League Soccer, National Hockey League and Melo7 Tech Partners, among others.

FanDuel has raised over $416 million from KKR, Google Capital, Time Warner/Turner Sports, Shamrock Capital, NBC Sports Ventures, Comcast Ventures, Pentech Ventures, Piton Capital and Bullpen Capital.

Ivie & Associates, a provider of marketing solutions acquired BuzzShift, a digital strategy agency. No financial terms of the deal were disclosed.

BuzzShift is a Google Premier Partner headquartered in Dallas with 24 employees. Foumders Cameron Gawley and Eddy Badrina will continue to oversee BuzzShift’s current client base as well as support Ivie’s ongoing expansion into SEM, social media advertising, digital content creation and conversion optimization.

Founded in 2010, BuzzShift’s client roster spans industries includes Verizon, Evernote, Everlane, Twilio, and RISE.

Warner Bros. signed an agreement to acquire Machinima, a global programming service focused on fandom and gamer culture. No financial terms of were disclosed.

Machinima will operate as a wholly owned part of Warner Bros. Digital Networks, a division founded in June 2016 to grow the Studio’s digital and OTT offerings. As part of Time Warner’s overall strategy to reach audiences directly through company-owned current and yet-be-launched OTT services, WBDN works closely with Time Warner’s divisions Turner and HBO.

Founded in 2000, Machinima had raised $91.55 million in funding from Google, MK Capital, Raine Vetures, Redpoint, and Warner Bros. among others.

ABRY Partners, a private equity firm, acquired Nuspire Networks, a provider of managed security services. The price was $35 million.

Founded in 1999, Nuspire's Service Level Agreements take responsibility to provide 24/7/365 protection to enterprise networks with geographically dispersed locations.

Antares Capital served as administrative agent.

JFrog, a DevOps accelerator, acquired Conan, an open source C/C++ package manager. No financial terms of the deal were disclosed.

The acquisition represents a strategic move by the company to expand the functionality of its platform of DevOps tools, and to support one of the most significant programming languages available.

Diego Rodriguez-Losada and Luis Martínez de Bartolomé, primary OSS contributors, will join the JFrog team to build new C/C++ capabilities into JFrog's existing and new products - Artifactory, Bintray, Xray, and Mission Control.

LiveRamp, a provider of omnichannel identity resolution, entered into definitive purchase agreements to acquire Arbor and Circulate, two companies that publishers connect people-based data to the marketing ecosystem. The two companies were bought for approximately $140 million.

Arbor and Circulate double LiveRamp's publisher partnerships to more than 450 and bring strong "mobile-first" technology, international reach, and impressive teams to LiveRamp.

Founded in 2004, Arbor had raised $9.05 millon from from Canaan Partners, First Round, FoundersGuild, Great Oaks Venture Capital, Jim Payne, Nat Turner and Zach Weinberg.

Founded in 2009, Circulate had raised $17.4 million from Aol Ventures, Auren Hoffman, Bullpen Capital, Chris Dixon, Felicis Ventures, First Round, Great Oaks Venture Capital, NAV.VC, Roger Ehrenberg and Shervin Pishevar.

Togetherwork, a provider of group management software and payments, acquired CircuiTree, a provider of camp management software. No financial terms of the deal were disclosed.

CircuiTree will become an independent operating company within Togetherwork, with veteran manager and camp expert, Tom Newberry serving as President.

Founded in 2006, CircuiTree serves more than 500,000 campers annually.

Advent International, a private equity investor, acquired a majority stake in Ansira Partners, a data-driven, technology-enabled marketing solutions provider. No financial terms of the deal were disclosed.

Advent acquired its stake from KRG Capital Partners in partnership with the company’s management who will continue to retain a substantial ownership position in the company.

Ansira’s management team will continue to lead the company following completion of the transaction. Advent independent Operating Partner Dan Springer will assume the role of Chairman of Ansira’s Board of Directors.

The acquisition is subject to customary closing conditions and is expected to be completed by the end of 2016. M&A advisory firm AdMedia Partners acted as exclusive financial advisor.

Inmar, an operater of intelligent commerce networks, entered into a definitive agreement for to acquire Collective Bias, a provider of shopper-focused influencer marketing. Financial terms of the deal were not disclosed.

Collective Bias will retain its name and operate as its own entity; Bill Sussman, President and CEO of Collective Bias, will remain as President, and will take on additional responsibilities as an SVP at Inmar, and report directly to Inmar Chairman and CEO David Mounts.

Founded in 2009, Collective Bias has 145 employees. In 2015, the company generated 2 billion impressions. The company had raised $11 million in funding.

LendingTree, an online lending exchange, acquired Iron Horse Holdings, which does business under the name CompareCards, an online source for side-by-side credit card comparison, comprehensive credit education and credit health management. The purchase has a possible total consideration of $130 million.

The price consists of $85 million in cash at closing and contingent consideration payments of up to $22.5 million in each of 2017 and 2018, subject to achieving specified growth targets.

Founded in 2004, CompareCards delivered revenue of $54.1 million and EBITDA of $11.3 million for the nine months ended September 30, 2016.

Vista Point Advisors, a San Francisco based boutique investment bank, acted as the exclusive financial advisor to CompareCards.

Avnet, a distributer of electronic components, acquired a majority interest in Hackster, a community for hardware hackers. No financial terms of the deal were disclosed.

The acquisition is the first step of a two part transaction in which Avnet will acquire the remainder of the company in January 2017.

Hackster engages with nearly 90 technology partners, and maintains 100 Hackster Live ambassadors that support a network consisting of close to 200,000 engineers, makers and hobbyists.

Founded in 2013, Hackster raised funding from SOSV.

Globant , a digitally native technology services company, acquired L4, a digital services company. No financial terms of the deal were disclosed.

With this acquisition, Globant expands its US footprint leveraging L4's presence in Seattle.

Founded in 2008, L4 has 65 employees. It's clients including Sesame Workshop, Seattle Cancer Care Alliance, Chicago Public Media and Sony Pictures Television. To date, L4 products have been downloaded more than 100 million times.

The company had raised money from Omnes Venture Capital, OTC Asset Management and Seventure Partners.

(Image source: hotelmilosantabarbara.com)

Twitter bought Yes; Apple acquired Indoor.io; Fandango purchased Cinepapaya

Read more...Oracle acquired Dyn; Tesla completed the deal for SolarCity; Google bought Qwiklabs

Read more...Adobe bought TubeMogul; Google acquired Leapdroid; Facebook acquired CrowdTangle

Read more...Startup/Business

Joined Vator on

Room 77 is a fast and powerful search and booking engine that offers the most advanced hotel shopping experience on the Web. Travelers can simultaneously compare pricing across every major online travel agency and more, shop across a variety of room types, and book more than 120,000 hotels worldwide, all with the confidence Room 77 will help them score a great room.

Startup/Business

Joined Vator on

Hubdub Ltd is a VC funded start-up based in Edinburgh and San Francisco that aims to be the world’s largest developer of premium social games for sports fans. Its main product, FanDuel, transforms traditional fantasy sports ($1bn, 30m people market) into an instant gratification daily game where users win cash prizes every day. It is played on FanDuel.com, via white label partners such as Philly.com, and in future on Facebook and mobile.