Oxford Cancer Analytics raises $11M to detect lung cancer via a blood test

OXcan combines proteomics and artificial intelligence for early detection

Read more... Next week at Splash Spring 2016, we have several sessions dedicated to what has been dubbed the sharing economy, the collaborative economy, and the on-demand economy, best exemplified by well-established companies like Uber and Airbnb as well as fast-growing startups like Handy and Vinted.

Next week at Splash Spring 2016, we have several sessions dedicated to what has been dubbed the sharing economy, the collaborative economy, and the on-demand economy, best exemplified by well-established companies like Uber and Airbnb as well as fast-growing startups like Handy and Vinted.

If this emerging, world-changing market interests you, be sure to register before prices jump at the door! You’ll get to see a long list of founders and venture capitalists onstage at the epic, historic Scottish Rite, and then join us for an awesome after-party right on Lake Merritt.

But back to the Uberization of everything.

In one of our sessions at Splash, we’re labeling this new category of companies the “zero-waste economy” because it has so much to do with activating the untapped potential in people that need work, cars that are sitting around (Uber), parking spaces that aren’t occupied (SpotHero), old clothes you’re not wearing (Vinted), and so on.

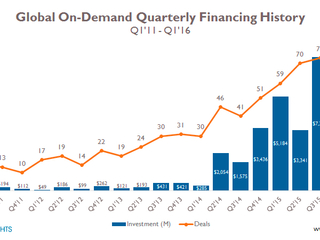

While the space saw a huge surge in funding last year and startups continue to attract funding to this very day (check out Rebagg and their Series A here), there are signs the sector has peaked.

For example, if you look at on-demand companies specifically, venture capital funding dropped for the second straight quarter, according to CB Insights, from $2.0 billion in Q4 2015 to $1.3 billion in Q1 2016, a 35.0 percent decrease. That puts the sector a long way off from approaching the $17.9 billion raised by on-demand companies in 2015.

Not only that, but a 35.0 percent drop in dollars is especially massive compared to the trend in the broader industry. While overall number of VC deals dropped slightly from Q4 2015 to Q1 2016, dollars invested actually increased from $26.6 billion to $30.0 billion, according to Pitchbook. (Weirdly, the opposite was seen in on-demand: dollars went down but number of deals went up.)

One could argue that CB’s data on “on-demand” companies doesn’t properly encompass the entire zero-waste economy, as the descriptor doesn’t include peer-to-peer lending platforms like Prosper or clothes swapping marketplaces like Vinted.

A wider-reaching (though not entirely complete) barometer of the broader funding climate can be found in Jeremiah Owyang’s Collaborative Economy Funding spreadsheet, which seems to show that funding hasn’t peaked. In the first quarter of 2016, these companies raised approximately $3.7 billion in funding, according to this data, which is higher than what they raised in the same period of 2015 ($3.0 billion) and almost as high as the figure from Q2 2015 ($3.9 billion).

Another factor potentially skewing the data are the vast fundraisings from giants in the space. Uber, Didi Kuaidi, Airbnb, Lyft, WeWork, and Ola have each raised over $1 billion in funding, with Uber alone pulling in nearly $9 billion since its founding. As these companies mature (i.e. slow down fundraising and draw nearer to IPO), the overall market may look like it’s not raising as much.

In any case, it’s clear by the rich, diverse set of “zero-waste” founders and CEOs we have speaking at Splash, that the space is alive and well. It will be interesting to see what they have to say next week, and in the coming year, just how the space evolves.

OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...