Video: Mario Schlosser at Vator Splash Health 2017

Reinventing health insurance

Read more...

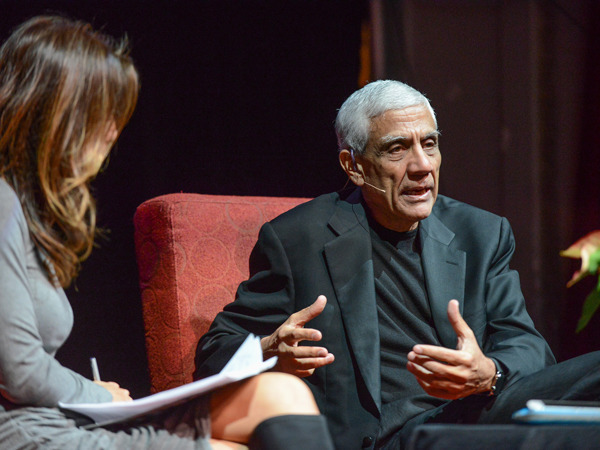

At Post Seed 2015, hosted by Bullpen Capital, Vator and Venture 51, Vinod Khosla, Founder of Khosla Ventures, sat down with Bambi Francisco (Vator) over a Fireside Chat.

Fireside Chat with Vinod Khosla (Khosla Ventures) & Bambi Francisco (Vator)

[Introductory music]

Francisco: So Vinod, thank you so much for joining us here. I’m so honored because many investors here, we’ve been talking a lot how there have been 300 new VCs that have emerged since 2009, many of whom are here, so I would say that Vinod, having started off as a VC at Kleiner in 1997, I would say that no one here has the experience that he has, maybe a tenth of the experience, maybe a percent of his success. Keith Rabois was on stage last year and he said that you led Series A rounds in eleven companies that went on to have $1 billion exits. Is that true?

Khosla: I’m sure he was right with the numbers. I do think that we have quite a few of those.

Francisco: That’s it, very impressive track record. So, for many of the investors, a lot of investors here, there’s a lot of startups here, this is really relevant to both. You have been very public about saying that 90% of VCs don’t add value and I would have to agree that a lot of VCs, especially the new ones, are making rookie moves and probably aren’t adding value, so for all of us here, for startups who want to look for the right VCs and VCs who want to do a better job, what is it that grates on you? What do they do that does not add value?

Khosla: So, let me start by asking a question. How many are entrepreneurs here? Can I have a show of hands? And put those down. How many VCs here? Okay.

Francisco: 80% entrepreneurs?

Khosla: Yeah. Let me start by saying a few things that you have embedded in your question. You started with what we have, x number of companies with billion dollar valuations. Frankly, that almost doesn’t matter. It’s the wrong way to look at a company because there’re lots of ways to get billion dollar valuations, that aren’t good ways to get billion dollar valuations. I always say, and it’s funny – yesterday, I was talking to another VC and they were talking about a $10 billion number and I said, “Not revenue?” I was speaking to revenue and they were speaking to valuation. And I said, “It’s fundamentally wrong to focus on valuations.”

If you were a public company, your valuation changes two to one very easily, but your basic business does not change. Valuation is about perception. The business you build is about the long-term value of what you create. So, I always tell entrepreneurs, first you have to – valuations can be important in lowering valuation, raising money, all that kinds of things, but your primary goal should be what’s valuable about your company? Revenue is one metric, but there’s many other metrics. How much of a proprietary mode are you building? What kind of team are you building? How unique is your offering? How unique is your IP or technology?

Focusing on valuation often leads to the wrong goals for entrepreneurs. I mostly like to speak to entrepreneurs. That’s really really important and – but the press all wants to talk about valuations and – “Are they over-valued? Are they under-valued? Will it go down or up?” The core business is much more important.

Francisco: Let’s talk about it. I wasn’t going to bring up valuations anyway, not so early, but if you are – so one of the pieces of advice you would say to a startup is, “Stop focusing on valuations, focus on your core business,” but in the early stages, many of these startups are here, are in the early stages. Because there’s so much more money in the early stages, some of them are having a hard time raising money. As we mentioned earlier, one out of ten seed funded companies are managing to close a Series A, but some of them are thrown a ton of money just because there’s just an abundance of it.

And somebody said, an investor on stage said, “Well, you know, if the market’s rocky, you may as well take as much as you can,” and that also would coincide with a higher valuation.

Khosla: I’m not saying valuations are not important, but they are peripheral to the long-term success of your business. So, they’re important in fundraising, whether you can get it, but the most important thing is what kind of assets are you building so your business survives three, five, seven years? And the people who focus on valuation lose focus on what are the primary drivers of their long-term success. That raises this other question of one, how do you judge an investor and how do you judge an entrepreneur?

If an entrepreneur is unrealistic about how much money they want to raise, for example, or what valuation they want, it tells a lot about the quality of the entrepreneur. Many people who are so unrealistic, we say it’s not even worth meeting with them. So, every single thing you do as an entrepreneur gets judged, the quality of your jacket, how you approach people, what you say you want, all those are important. And by the way, you asked for too high a valuation or too low, it’s a bad mark on you.

Francisco: Should you not even ask for valuation? Should you wait for the –

Khosla: The most important thing is to say, “Where are you today? What are the next sets of risks you have before you that you want to eliminate over, say, 12 to 18 months?” People want to plan for two or three years. I’m generally not a fan of – People will say, “Here are the most important risks in my business: one, two, three and four. And over the next 12 months, I’m going to systematically eliminate or reduce those risks and here’s how much money, here’s the most cost-effective strategy to do this. Hence, I need extra Y million dollars.” That’s a thoughtful entrepreneur. That counts for a lot in my book.

Francisco: All right. They were talking about making the cut where one of the panels, there were about five VCs, one of the things they didn’t like the entrepreneur saying was, “I’m going to be a billion dollar company.”

Khosla: Yeah. You know, being unrealistic is a bad idea, but being unambitious is a bad idea too. So, just yesterday, we were looking at a company that had very good technology and what I would call a plan that was too sensible. That means it didn’t show enough ambition. They built a good business, but for the technology they had, they should’ve been shooting for an awesome business. These are nuances. And I said, you know, to one of my partners, “You want to work on that?” Great, but I didn’t see the ambition.

You know, for those of you who are on the VC side, and it’s also true for entrepreneurs, I should’ve said the way to approach investing in a company is a company that has a good base camp. That means you have a business you can get to that’s a decent, stable business, but usually, that will result in decent returns, not great returns from the investor side or the entrepreneur side. So, I sort of like people who think big and act small, or another way to say it, people who think about climbing Everest, but their tactics are geared towards getting to base camp.

Francisco: Right. So, it’s okay to say I do think that this is –

Khosla: I mean the big index returns come from going to base camp to Everest, but if you know getting to base camp first, you’re not being realistic. On the flip side, and this is back to the original question you asked me, I’ve sort of said most VCs add no value, enough VCs are scared of ambitious entrepreneurs that they talk them into less ambitious plans. That means they get to base camp but base camp set up without sight of how to ascent Everest is a bad base camp. That means you can have a good base camp or a bad base camp.

A good base camp gives you the assets to get you learning about, or asset that says this is how you make the business larger. Most returns in the VC business come from going to base camp to Everest and I find most VCs, in order to make a company safer or more predictable, reduce the possibility of getting to Everest. That means they think of base camp as a goal, not an intermediate point. This is sort of a nuance. I like to say what frustrates me is when people reduce risks to the point where your probability of success goes up, but the consequences of success are inconsequential. I don’t mind a higher probability of failure, but the consequences of success being very consequential.

Francisco: To put this in sort of baseball terminology, it’s VCs who like to go for singles and doubles and not homeruns, but what if they’re aligned with the entrepreneur who just wants to hit a single and double and what’s wrong with being conservative? I mean there’s nothing –

Khosla: There’s nothing wrong with being conservative and it makes sense for certain people. It’s not where the returns in the VC business comes from.

Francisco: Sure.

Khosla: Okay? So, you can go run – baseball is a bad analogy because you can do a single and a double and get to second base and third and home, or go for a homerun swing. I’m not a suggesting a homerun swing. I’m sort of suggesting the Everest analogy because there’s a huge difference between –

Francisco: Base camp and Everest.

Khosla: Base camp and Everest

Francisco: I’ve been to base camp, I know.

Khosla: -- while the bases are all 90 feet apart. You want to collect assets for your big ascent and you want to scope out the bad and understand the environment while getting to a stable place at the business. People who go for Everest directly seldom make it. Occasionally, they do. But if you look at Uber as an example, because it’s such a visible example, they went after a fairly narrow base camp, of people wanting blocked cars in a different way. They weren’t even going after the taxi business. Now, they’re going after all of transportation and maybe all of delivery and all of everything else. That’s a pretty good strategy.

Francisco: Right. Go for something somewhat achievable.

Khosla: Yes, but achievable in a way that collects valuable assets on the way to achieving something much larger.

Francisco: Right.

Khosla: That’s the base camp in the right place. If you get to some place achievable, that’s not building up – so for example, very often entrepreneurs will say, “Okay, I’ll license this to somebody and collect revenue.” That’s a bad base camp because you’re not learning how to go to market, you’re licensing it to somebody else or a partner, really bad idea generally with the occasional exception or two. So that’s an example of a bad base camp versus Uber as a very good base camp.

Francisco: Right.

Khosla: Now, back to your original question, VCs who don’t help an entrepreneur think the right way because our style of investing, if you want very large heads, it’s not appropriate for every entrepreneur. It’s not the right match for everybody. Are you really trying to be ambitious? Then, I think 90% of VCs still need something that can be sold for two or three x their money and get too conservative or not focused on building the right team to do the ascent. You can’t do an ascent of Everest without the right team just because it burns a little more money or something like that.

So these are nuances and it sort of depends for the entrepreneurs on the goal they have and not everybody should have the same goal. Goal is an internal thing. What do you want to achieve?

Francisco: Well, there’s different ways to achieve that and there’s different qualities in a VC that can help you achieve that. If there was an entrepreneur who had multiple VCs to select, choose, and one VC had domain expertise, another VC really did a great job in recruiting, another VC was great as business development and another VC was really good with getting them to follow one round. Which of those qualities should – I know they’re all needed, but which two, let’s say, do you think are the most important?

Khosla: Here’s what I would say. It depends on the entrepreneur’s goals and it depends on the market. Domain expertise is not that important most of the time. Probably the single biggest help a VC can give an entrepreneur is help them figure out who they need on their team. I have a blog on my website that’s a very long blog about 15 pages on engineering the gene pool of a startup. So, figuring out who you need and helping you both assess and then recruit people. Most of the people you really want aren’t recruitable. Who can help you recruit that team?

I have a saying that a company doesn’t become the plan it has. The company becomes the people it hires. And that, to me, is the essence. You can hire A or B and have very different companies starting from the same point. And most entrepreneurs I know underestimate the value or the implications of that kind of hiring decision.

Francisco: They probably have to experience making a bad hire to really internalize that.

Khosla: It’s not really a bad hire. If you’re doing a – say, a digital health startup today, really interesting area. If you hire somebody from the healthcare business or you get a healthcare investor, I hope there aren’t very many, you’re going to go down one path that I find mostly uninteresting and boring. So, I generally will not co-invest with healthcare investors and healthcare startups. I find it a bad idea because their cultural beliefs are too wrong.

Now, you hire somebody –

Francisco: They do have the domain expertise, but they don’t have vision.

Khosla: They don’t have vision and they have too much experience in the wrong way to build companies, if you’re trying to build something disruptive. Now, you hire somebody out of the Google machine learning group, they really understand how to change matters. And so, one hire could – a CEO of healthcare versus a CEO of Google or Facebook could completely change where your company ends up.

Francisco: Yeah, no, I agree. Okay, so out of those four qualities in a VC, you think the number one quality would be somebody who can help you recruit the right people.

Khosla: Right. The second most important quality is, I call it some mix of understanding startup culture and really understanding which risks you should take and which risks you shouldn’t take. Startups face a lot of risks, many that they don’t understand they’re taking. So, understanding the risks and saying, “Hey, for this money, let’s go eliminate these three risks firsts before we try these four other things.” That sequencing is very important and it’s partly cultural.

Francisco: What kinds of mistakes do they make by taking the wrong risks or -- ?

Khosla: Like many people start scaling before their technology is ready. You know, there’s always a risk. Let me give you an example. You might hire more engineers and build a more complete product. Now, you’re reducing market risk but you’re increasing financial risk because you have a higher burden. Those are risks we have to make. Entering a large market, maybe a risk, entering a niche, maybe the right way or the wrong way. If the niche is sort of in the wrong base camp, then it probably forever mires you into the swamp on the side. But if the niche, like Uber, leads to a much larger market, it’s the right niche.

These are risks that you’re managing, which market to enter, what burn rate to sustain, how complete a product to have, how much to deploy a sales force or marketing campaigns before you have the product done right. Those are all very intricate risks and frankly, I find people, especially investors, who haven’t done it themselves, aren’t very good at understanding how visceral these decisions are and how hard they are to make for an entrepreneur.

Being an entrepreneur is really tough. The highs are high and the lows are really low. Entrepreneurs have to make these really tough calls and I find most board conversations pretty naïve about those kinds of things. And somebody who can help figure it out. So my flip thing to an entrepreneur is, you know, you don’t get money. You get a board member who may or may not have earned the right to advise an entrepreneur. You don’t get the right to be a board member by having a fund you can invest. You get the right to be a board member in understanding all the issues an entrepreneur goes through.

And the best way, not the only way, the best way to learn it if you have gone through being an entrepreneur yourself. So generally, I prefer people who have been entrepreneurs as good investors just because they know how hard it really is, how difficult each decision is, how lonely the CEO’s job is, all these nuances that get lost in board decks and, you know, what are your financials?

Francisco: Or grew a business unit would be somebody comparable, right? In a company? I mean if you look at Jeremy Lou, he’s pretty successful.

Khosla: Look. There are lots of people who do well without –

Francisco: Yup.

Khosla: But, by and large, unless you’ve been in a small company and grown it, you don’t really understand how scary it gets, how risky it is, like you’re hiring – you know, if you ever had to hire somebody, in the back of your head you’re saying, “Will I be able to pay him in six months?” and, “Will my wife be mad at me?” That’s a really hard decision.

Francisco: Yeah.

Khosla: Convincing somebody to leave a good job, join you and then in six months, you’re out of money or something that’s nagging you comes to be true –

Francisco: Oh, yeah.

Khosla: Now, you’ve got a –

Francisco: I think about that all the time. It’s a lot of pressure to have people working with you and you feel so responsible for their livelihood. But I want to talk about, you mentioned machine learning. I definitely want to touch on that, but I also want to understand that a lot of people here are wanting to make sure we touch on a couple of things because everyone here is interested in post-seed and really how early stage strategies have change and this is for entrepreneurs too. I mean, they would want to understand – this is how they can maybe even evaluate a venture capitalist.

Now, you have been around for – you started Khosla ten years ago, you started at Kleiner in 1987, that’s 30 years of wisdom. How have early stage strategies change, let’s just say, in the last ten years because they’ve changed a lot and how have they changed in a good way and how have they changed in a bad way?

Khosla: First, whenever money is more freely available, a lot more people will waste their time. They’ll get seed money, then it’s hard to breach into an A because the plan wasn’t easily thought through, but you got the money anyway. Now, for an entrepreneur’s point of view, that may be good or bad. My first startup I did, I’m an investor and I got my first funding. I just come from India, gone to school, got my funding, go do a startup –

Francisco: How much was that?

Khosla: It was $375,000.

Francisco: That’s quite a bit.

Khosla: And it was sort of like, I said to the VC, we had an open fund conversation, I said, “I love this deal. If we win, we win. If we lose, you lose because all I can possibly lose is my student loans .” I didn’t have anything else to lose, it was a great deal. And I was coming from India, I said, “Nobody would give me that deal in India.” People don’t realize how lucky we are in this country.

Francisco: That’s impressive. That’s a lot of money. Even today, that’s a lot of money.

Khosla: Yeah. But, back to your question, when money becomes more freely available, people don’t spend as much time refining their thinking about what they want to do, about why and what the risks are. Right? So, and this is good advice for all of you entrepreneurs, if you can get money from multiple places, go with the people who ask you the hardest questions, not the easiest. You don’t want a friend. You want somebody who will help hone your plan, challenge you, push you, maybe push you to greatness.

But more importantly, with their questions, they let you think about all the risks in your business, not just the ones you thought about. That’s really important and it’s natural and instinctive to say, “Oh, they don’t get it. They’re asking too many questions. I’ll go with the person who says, ‘Oh, I love this. I’ll write you a check.’” The other part of what I tell entrepreneurs, if you’re really smart, you start to [inaudible] as many VCs as you can even if you’re not raising money. Why? Because you want those questions about what people are afraid of about your business. They’re extremely valuable in identifying your risks because your job as a starting up entrepreneur is to identify all your risks, including the ones you couldn’t think of but VCs gotten burnt in other ways, can think of.

Some of them may be valid, some of them will not, but find all the risks and then say, “Here’s the plan to eliminate these risks one by one.” That’s a good business plan, that’s a thoughtful business plan.

Francisco: That’s good advice. When you have too much money, sometimes you make far more expensive mistakes. I ask this question to Alfred Lin, still along the same lines around early stage investing and how it’s changed. When Peter Thiel was on the stage last year, I asked him, “Is seed stage, early stage investing harder or easier?” And he said it’s harder because there’s just more competition, more money.

When I asked Josh Kopelman, “Is it harder or easier?” he said it’s actually easier because the companies are far more prepared, they’re more like teenagers and not like toddlers. So, for you, how is – is it harder or easier than ten years ago?

Khosla: What I’d say is in general. The naiveté of the entrepreneurs has decreased which means by reading all the press, all the stories by an ecosystem where there’s a lot of entrepreneurs that show up to conferences like this that they can talk to, generally, friends, everybody knows people who are entrepreneurs, you can learn much faster and most entrepreneurs today are more sophisticated than they were before.

On the flipside, there’s a lot more money available. And so, I can see from a Sequioa point of view, people have many options and it becomes harder to talk sense into an entrepreneur, like, “Be worried about X, Y and Z, don’t rush there too fast.” They may be less prone to take advice, they may have over-expectations of the valuation. Very often, we’ll pass on something because the entrepreneur has expectations of valuations that are really high or they’re naïve about listening because three people are writing them term sheets.

I always say, “If you want to do that, go ahead and do that, but I feel sorry for you because you miss the essence of building this business.” Again, it comes back to this: valuations in money are not real. What’s real is the value you build, the assets you build in building a long lasting business. It circles back to that issue. And that’s why I was saying go with the VCs who ask you the hardest questions, who make you think the most about your business. So, that’s really, really important.

Francisco: Yeah, no, it’s great. You’re right. Thinking about valuations or over-thinking valuations, you do start forgetting the big picture, the long-term, doing the right thing. I know you don’t want to talk about corrections and –

Khosla: Let me give a very specific example. If an entrepreneur is saying, “Here’s the risks, here’s how we can test them and here’s the ones we have no idea how to figure out, but we will,” I much rather invest in that entrepreneur than the one who says, “Oh, this is very clear, I know how to do this, no risks, I just need money,” much less likely to be successful.

Francisco: Yeah. You don’t want somebody who just walks in and says, “I just need money.” Obviously, they need to have a vision and a mission. So firstly, I want to say that again, we’re going to take questions and I am looking at the microphone so if you are open to questions, we have 15 minutes. I want to talk to Vinod about, now, some trends, not just financing trends, but some trends. He wrote a very compelling article about machine learning and income inequality. Do you remember that?

Khosla: Yes.

Francisco: You wrote that in Forbes and he –

Khosla: Last November, 2014 in Forbes.

Francisco: He cited a report that identified about 350 jobs at risk. It was actually about 700 with 47% of them were cited as being at risk for being automated. Khosla Ventures has invested in a number of companies already that are replacing humans in farming work, warehousing, hamburger flipping, and healthcare. Out of the jobs mentioned in that report you cited, which ones are you most excited to automate that you haven’t invested in yet?

Khosla: Let me answer that in a more general way. I think the impact of machine learning on society will be larger than the impact of mobile on society. That’s a pretty radical statement. I can then apply that to any area. You’re talking about legal, I can tell you why machine learning will impact that. You’re talking about agriculture, I can tell you why machine learning will impact that. You’re talking about robotics or, you know, advertising, financial tech or fin-tech, almost any area I look at, machine learning will have a large impact.

That is an opportunity for all the entrepreneurs there and investors here. There clearly are massive opportunities to be had, that’s why Google is betting so heavily. Others are too.

Francisco: Let me – and some people are probably saying, how could they have a much larger impact? Is this what you’re saying? Because in the essay, you said that essentially, machine learning will replace most jobs. So, human employees may be rendered unnecessary, or at least, command low pay. So the impact really, mobile created new jobs, machine learning, unlike any revolution, will actually start overpowering humans. That’s actually a dire –

Khosla: That wasn’t what I said. Here’s what I said.

Francisco: Well, sort of. Okay.

Khosla: I said we’ll get abundance and income equality increasing at the same time.

Francisco: Right.

Khosla: And so the problem before society will be the one word we don’t like in capitalism, which is income redistribution.

Francisco: Right. So, we don’t want to move towards that.

Khosla: My assumption is, in 50 years, we’ll have more than enough resources to pay everybody who doesn’t want to work, 50 grand a year or more in equivalent dollars and say, “Now, you can work on the things you want to,” whether they’re productive from an income standpoint or not.

Francisco: So, you would redistribute income –

Khosla: I’m not saying what I would do –

Francisco: That’s an idea?

Khosla: I’m telling you what society’s problem will be.

Francisco: Okay.

Khosla: This is a nuance distinction. I personally believe we’ll have to do something about income inequality.

Francisco: Right.

Khosla: What that is, whether it’s redistribution or something else, is a much more complex question, probably not worth spending a lot of time for entreprenuers because they don’t worry about 2050 very much. If they’re worried about 2050, they’re not very good entrepreneurs.

Francisco: But it’s interesting because if you see the future and you’re a problem solver, I would imagine that there are ways to – beside redistribution, there are ways like focusing on the sharing economy or focusing on education because part of what – you know, to get wealth parity is to educate people, so I would imagine – you know, if we want to do –

Khosla: Let me give you some examples. If you don’t need farm workers on a farm, if you don’t need hamburger flippers at a McDonald’s restaurant, nobody to cook the food or take the orders, if you don’t need legal researchers in a law firm, if you don’t need radiologists in a hospital, and I’m purposely covering a very broad range. Google, of course, doesn’t want Uber drivers in an Uber car. Look at all these functions. They’re all easily automatable. What I hypothesize is more than 50% of jobs today will disappear.

That’s a problem because there’ll be income disparity or inequality, unless we do something large. But for entrepreneurs here, each one of those is an opportunity to create that technology.

Francisco: What idea have you heard recently to automate a particular industry that you just said, wait, that’s way too far out there and the market is not there for it?

Khosla: Some of the emotional elements of human interaction. So, you know, I often say, 80% of what doctors do will be replaced, but that may or may not be 80% of doctors. The emotional connection that a human being can establish with another patient human being may be very valuable. In fact, we know it’s valuable from the placebo effect. The perceptions are very important in matters. That means you can do most of what the doctor does, order testing, recommend or do a diagnosis, recommend treatment, monitor the patient, all those could be automated, but you may not replace the human element there.

Now, you may not need high IQ students to get into Standford med school today. You may need high EQ students who get into USC [inaudible] school instead because they’re much better at a human element. So there’ll be shifts, but all those are possible.

Francisco: How about venture investing?

Khosla: I don’t know, and I’m not saying it can’t be, but I don’t know that the emotional part of what a human being does can’t be replaced or can be. Hard question. We have an interesting company called ToyDoc. They’ll have conversations with kids that are very human. In fact, this Christmas, Barbie is going to introduce that technology in a Barbie doll that talks to kids.

Francisco: A Barbie doll, do you have a deal with Mattel? Is it Mattel?

Khosla: Yup.

Francisco: To put that technology in a Barbie doll?

Khosla: This hasn’t been publicly announced.

Francisco: I’m just saying that they will talk to kids. [inaudible 00:37:28] or they just talk to kids?

Khosla: Just talk to kids.

Francisco: Okay. What do they say?

Khosla: Whatever they want to talk about. The key is [inaudible 00:37:42] Some people will be [inaudible 00:37:47]. There’s a full range of conversation possible. A lot of people will have that conversation over here. [inaudible 00:38:00] every single area is a huge element. [inaudible 00:38:11] but machine learning area isn’t the only area for [inaudible 00:38:25] and so, for those of you who are not into machine learning area yet, there’s still a lot of technology driven innovation possible. 3D printing is really exciting. I can’t wait to have homes built with 3D printing instead of the way we do them today.

Francisco: Do you have a 3D printer at home, right now?

Khosla: I do have one but –

Francisco: What does it print?

Khosla: I play around with prints. I printed my first thing over five years ago through a service. That’s not the point. The technology is early so many more printing capabilities will show up.

Francisco: What do you think is the biggest --

Khosla: And because – just finishing the thought.

Francisco: Sorry.

Khosla: Because of that, many more business models will show up in how you manufacture things, how you stock inventory, how you repair parts, all those things will show up. So, 3D printing, this is an area that’s very exciting, overlaps quite a bit with machine learning but there’s a lot, without the machine learning aspect. Thinkpack is a really promising area, lots going on there. I think most of the current financial system can and most likely will be disrupted, but it’ll take time. The incumbents are very powerful and it will take a long time to fully replace them. But look, Square was a four-person company four, five years ago.

Francisco: Right. Four, five years ago, that’s –

Khosla: There are lots of areas – even enterprise computing is changing a lot.

Francisco: How do you think the venture industry is going to change? Do you think more public investors are going to be investing in private markets and private startups?

Khosla: You know, I have no idea. I don’t worry about that. And frankly, I think it’s not predictable. My general view is there’ll be a period when more people will come in, returns will decline, then people will say, “This industry sucks,” and most people will go out. We’ll see cycles go up and down. From an investor’s point of view, or from an entrepreneur’s point of view, investors have only two emotions, fear and greed. They bounce between those two walls. Don’t want to miss out? That’s greed. And then, when things start collapsing, and then they fear more and they over [inaudible]. That’ll happen and keep happening for a long, long time.

Francisco: Does anyone have a question? I wanted definitely to save some time here for anyone who has a question for Vinod. Don’t be shy. You can even – there’s somebody, unless she’s – No.

Khosla: There’s a question over there.

Audience 1: Hi. I am a current investor. And so, I just wanted to get your thoughts, hear your frustrations with folks that you’re [inaudible 00:41:25], but I also hear you say that you want to see startups [inaudible 00:41:37] help identify risks and understand how to get to base camp, so I’m just curious what are your thoughts on when somebody who does come, do you have awareness of the problems of the industries that we can take stock and identify what the risks are and what’s possible? How do you recommend -- ?

Khosla: Sure. Let me be clear what I said. What I do isn’t very compatible with healthcare investors. I did not say, and it’s important to parse this correctly, there are no good opportunities for healthcare investors. They’re good at some thing, they do it well, great. There’s nothing in common with what I like. Or very little. Okay? But then, there are still good healthcare investors who will do well from a rate-of-return perspective in their funds. Okay?

There’s a separate questions you asked which is – you need domain knowledge to be in the healthcare business. And so, how do you accommodate that requirement if somebody out of Google is doing a healthcare startup or out of Facebook is doing a healthcare startup. Here’s what I would say to that. Too much knowledge of an industry generally leads you to too much experience is too many biases about how things are done. Innovation doesn’t come from applying advices. Some of them are really good and some of them are really bad, but by and large, experience, which to me is biases both good and bad, lead to less innovation because you take more of the assumptions of that industry as a core truth.

People who did electric cars with homage to the car industry failed. Elon Musk said, “I’ll ignore everything the car industry says is true.” Did very well, but probably took a much larger risk in doing that. I think in healthcare, if you’re trying to build modest startups, healthcare industry is the right way to go. Look, there are many areas of traditional healthcare like bundled payments, or taking on risks, those are all good opportunity areas for healthcare investors. I won’t attempt to do those – is what I’m saying.

I much rather go build a tesla with a new set of assumptions and the naiveté that comes with it. Innovations are generally associated with naiveté. Now, good entrepreneurs, when they got to enough of their belief system will hire people who know the industry to help them identify the risks inherent in going to an industry or getting a CPT call or getting a Medicare reimbursement right later. But if that starts driving how you build a plan, then you’re likely to go down a different path and a different base camp from my point of view.

Francisco: Great. Well, we’re out of time, but I wanted to let Vinod leave – you know, he’s such a 50,000 foot view thinker or 18,000 feet base camp thinker and so, I want you to give us one bold prediction. You’re always out there making predictions so give us a new prediction, what we’re going to see in the next ten, 15 years.

Khosla: Which area do you want a prediction at?

Francisco: Whatever area.

Khosla: I was asked that question recently and I said, “It’s very likely, with driverless car technology and Uber-esque models.” It may be Uber, it may be Google, it may be others. We might see the death of all public transportation or most public transportation. That’s not something anybody is talking about.

Francisco: The death of transportation, the death of –

Khosla: Public transportation.

Francisco: Public transportation, right.

Khosla: Or, you know, this is the nuance. You know, I don’t know what a muni ride here costs, but if it costs you a few bucks, if an Uber that’s driverless is cheaper, anywhere to anywhere, it’s a buck, which will happen easily. Uber pool is six bucks today. Can you reduce that cost by 80% with the driverless car and related developments and enough density? Absolutely. Now, it’s cheaper to get an Uber than get a Muni. Muni would have to respond.

You may still need public transportation from San Francisco to Pa4lo Alto and Caltrains, but how you could – and what you do at either end may be dramatically be different. So that’s just one example. What I’d say is most of the things that technology drives changes on are not predictable. So, it’s much easier for me to say, “There are going to be rapid changes in healthcare, in transportation, in education.” It’s much harder for me to say what the changes will be and I’m smart enough to know that I’m not smart enough to know that.

So, I’m smart enough to know I can’t predict any of these things and people who do, generally, are wrong. But one has to be agile and learn a lot and engage and figure it out.

Francisco: We know what you’re looking for. You’re looking for machine learning, you’re looking for technologies that can replace public transportation. Any entrepreneurs have those ideas, I’m sure Vinod will talk to you.

Khosla: Thank you, everybody.

[Audience claps]

[ End]

Editor's Note: Our annual Vator Splash Health 2016 conference is around the corner on February 23, 2016 at Kaiser Theater in Oakland. Speakers include Helmy Eltoukhy, PhD (Founder & CEO, Guardant Health), Ryan Howard (Founder & Chairman of the Board, Practice Fusion), Sonny Vu (CEO & Founder,Misfit Wearables), Lynne Chou (Partner, Kleiner Perkins) and more. Join us! REGISTER HERE.

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsReinventing health insurance

Read more...Staying human while becoming immortal

Read more...What would it be like if our doctors were perfectly matched to who we are and to our needs?

Read more...Angel group/VC

Joined Vator on

Khosla Ventures offers venture assistance, strategic advice and capital to entrepreneurs. The firm helps entrepreneurs extend the potential of their ideas in both traditional venture areas like the Internet, computing, mobile, and silicon technology arenas but also supports breakthrough scientific work in clean technology areas such as bio-refineries for energy and bioplastics, solar, battery and other environmentally friendly technologies. Vinod was formerly a General Partner at Kleiner Perkins and founder of Sun Microsystems. Vinod has been labeled the #1 VC by Forbes and Fortune recently labeled him as one the nation's most influential ethanol advocates, noting "there are venture capitalists, and there's Vinod Khosla." Vinod Khosla founded the firm in 2004.

Joined Vator on

Joined Vator on

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.