Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

If there’s one thing to expect from an Amazon quarterly report, it’s to expect to be surprised. One quarter, Amazon might post stellar gains, the next it might post steep losses. This quarter…was the latter.

Amazon announced Thursday that it suffered a net loss of $7 million, or -$0.02 a share, in the second quarter of 2013, compared to a net profit of $7 million in Q2 2012. Meanwhile, revenue came in at $15.7 billion, which is up 22% from Q2 2012, when the company generated $12.83 billion in revenue. That’s slightly below Wall Street’s estimates of $15.73 billion. The loss is particularly blindsiding to analysts, who were expecting an EPS of $0.05.

Additionally, operating income was down 26% to $79 million, compared to $107 million in Q2 2012.

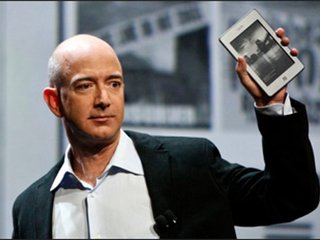

In some interesting news, CEO Jeff Bezos said in a statement that its top 10 best-selling items of Q2 were all digital products—Kindles, Kindle Fire HDs, accessories, and digital content.

“The Kindle service keeps getting better. The Kindle Store now offers millions of titles including more than 350,000 exclusives that you won’t find anywhere else. Prime Instant Video has surpassed 40,000 titles, including many premium exclusives like Downton Abbey and Under the Dome. And we’ve added more than a thousand books, games, educational apps, movies and TV shows to Kindle FreeTime Unlimited, bringing together in one place all the types of content kids and parents love,” said Bezos.

Analysts were expecting revenue guidance of $16.39 billion to $17.71 billion in Q3, but Amazon is setting its Q3 financial guidance at $15.45 billion to $17.15 billion in revenue, with an operating loss of $440 million to $65 million. Ouch.

Nevertheless, Amazon has had a pretty good year so far. Amazon recently swiped a multi-year deal with Viacom out from under Netflix’s feet, giving Amazon Prime members access to titles like Dora the Explorer, Spongebob Squarepants, along with shows from MTV and Comedy Central. Additionally, Amazon pilots Alpha House, Betas, Annebots, Creative Galaxy, and Tumbleaf are going into production and will debut later this year.

“Beyond the broader market, we believe the recent stock appreciation over the past month is largely due to excitement around AWS, the AmazonFresh launch in LA, stronger Prime Instant Video content, and potential for International Media to reaccelerate,” wrote JP Morgan analyst Doug Anmuth in a research note.

Amazon shares dipped 2.07% to $297.12 in after-hours trading.

Image source: bentonpena.com

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...