Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

Apple shares were down more than 10% to $460 Thursday morning after the company's less-than-stellar earnings call Wednesday afternoon.

"The stock’s sharp decline last night was driven by a widening chasm between Apple’s fundamentals and investor expectations," wrote J.P. Morgan's Mark Moskowitz in a research note Thursday morning. "The new guidance commentary did not help either. Investors are fearful that iPhone growth has peaked and consolidated gross margin is going to collapse. In contrast, we believe a still-ramping iPhone 5 can drive reaccelerating revenue growth, particularly as more wireless networks roll out LTE."

Nevertheless, J.P. Morgan has lowered its price target for Apple to $725 from $770.

Apple announced Wednesday that it grossed $54.5 billion in revenue, which came in just shy of the $54.6 billion in revenue that Wall Street was anticipating. Net profit was mixed, coming in at $13.1 billion or $13.81 per share, while Wall Street consensus had profit pegged at $13.35 per share.

It feels weird to say that a company making $54.6 billion in revenue didn’t do so well. They’re making $54.6 billion per month more than me, so they’re obviously onto something I’m not. But the numbers are nevertheless disappointing to investors who are concerned that the technological behemoth may be receding from its high water mark.

Apple shares were down a surprising 10.47% in after-hours trading to $460—the lowest Apple shares have been in over a year.

While many were hoping for a solid first quarter buoyed by strong iPhone sales over the holiday season, such was not the case. While analysts like Toni Sacconaghi of Bernstein Research were expecting 50 million iPhones sold last quarter and Mark Moskowitz of J.P. Morgan was expecting 48 million, Apple came up short with 47.8 million units sold. Additionally, iPad sales were lackluster as well, with 22.9 million units sold compared to the 27.3 million Bernstein Research was expecting.

Additionally, Mac and iPod sales were both down. Apple sold 4.1 million Macs last quarter, compared to 5.2 million in the same quarter last year. The company sold 12.7 million iPods, compared to 15.4 million the year before.

Gross margin also saw a dip, coming in at 38.6% compared to 44.7% in the same quarter last year.

During the call, CEO Tim Cook addressed the ongoing Maps issue.

“We’ve made a number of improvements since the introduction of iOS 6 and we’ll roll out more improvements over next year,” said Cook. “Users can already see many of these improvements, such as improved satellite view, improved local information… Usage in maps is significantly higher than it was prior to iOS 6.”

Guidance for the following quarter is $41-43 billion with a gross margin of 37.5% to 38.5%.

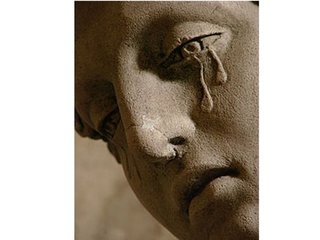

Image source: eyesonauburn

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...