Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

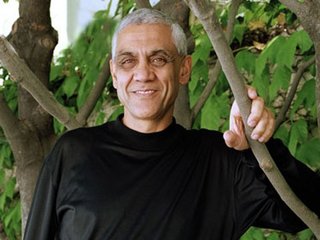

Venture capital firm Khosla Ventures has entered into a strategic partnership with consulting firm RiceHadleyGates, formed by members of the George W. Bush administration, it was announced Thursday.

RiceHadleyGates, which includes former Secretary of State Condoleezza Rice, along with former National Security Advisor Stephen Hadley, former Secretary of Defense Robert Gates, and former State Department official Anja Manuel, will provide strategic and political context to help Khosla’s portfolio companies make critical business decisions regarding expansion into new markets, like China, India and Brazil.

The firm will also assist Khosla’s portfolio companies with achieve their goals in key industries, including technology, energy, security and healthcare.

RiceHadleyGates, which has offices in Silicon Valley and Washington, DC., works with senior executives of companies, typically in the technology sector, in order to help them expand in major emerging markets and assists with handling the national security and public policy challenges of offering products and services to a global marketplace.

“RiceHadleyGates shares Khosla Ventures’ vision and passion for helping the next generation of entrepreneurs change the world for the better,” Rice said in a statement. “We look forward to putting our network and experience to good use by helping the Khosla companies navigate the tricky waters of political, policy, and regulatory issues around the world.”

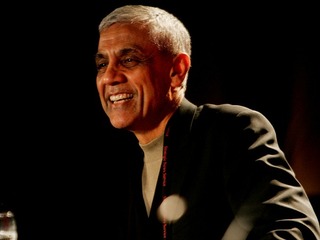

“Khosla Ventures continues to be dedicated to building lasting companies, with strong leaders and new technologies that have the potential to disrupt markets,” Vinod Khosla, founding partner of Khosla Ventures, said in a statement. “The RiceHadleyGates team brings vast experience and unique insight to the table, which will extend and elevate our venture assistance model by directly contributing to the operational and strategic success of our portfolio companies.”

This is not the first time that Kholsa has partnered with a political figure, bringing in former British Prime Minister Tony Blair in May 2010 to become a senior advisor to the firm.

Menlo Park, California based Khosla Ventures was founded in 2004 by Vinod Khosla, a former partner at Kleiner Perkins Caufield & Byers.

Khosla Ventures raised a $1.05 billion fund in October 2011, called Khosla IV, half of which was set to be invested in clean technology. It also closed two funds in July 2009 which raised $1 billion collectively.

Several biofuels and biochemical companies in Khosla’s portfolio have already seen some big exits, including industrial biofuels company Amyris, which raised $84.8 million in its IPO in 2010; Bio-isobutanol producer Gevo, which raised $123.3 million in its IPO in March 2011; and renewable fuels company KiOR, which raised $150 million in its June 2011 IPO.

Khosla led a $25 million round for cloud storage platform Niravnix and participated in a $30 million round for video startup Viddy in May; led a $7 million round for OneID in April; and led a $2 million round for e-signing service SignNow and an $85 million round for social networking system Yammer in March.

In June it was announced that Khosla was getting ready to raise a new seed fund with an unspecific fundraising goal. This would be its second seed fund; its previous fund, Khosla Ventures Seed, raised $300 million in January 2010.

(Image source: https://www.politico.com)

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...Angel group/VC

Joined Vator on

Khosla Ventures offers venture assistance, strategic advice and capital to entrepreneurs. The firm helps entrepreneurs extend the potential of their ideas in both traditional venture areas like the Internet, computing, mobile, and silicon technology arenas but also supports breakthrough scientific work in clean technology areas such as bio-refineries for energy and bioplastics, solar, battery and other environmentally friendly technologies. Vinod was formerly a General Partner at Kleiner Perkins and founder of Sun Microsystems. Vinod has been labeled the #1 VC by Forbes and Fortune recently labeled him as one the nation's most influential ethanol advocates, noting "there are venture capitalists, and there's Vinod Khosla." Vinod Khosla founded the firm in 2004.