Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

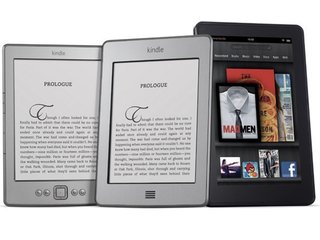

I won’t lie: one of my favorite things about the holiday season is Amazon’s Kindle sales announcements, because they make less sense with each passing year. For example: Amazon announced Tuesday that Kindle device sales were double that of last year’s Thanksgiving weekend sales. So how many Kindles and Kindle Fires did Amazon sell? No idea.

As you may recall, Amazon doesn’t release sales figures for its Kindle products, so we have no way of knowing how many devices were actually sold, but Amazon LOVES to hint evasively at the number by saying “oodles and oodles of Kindles were sold!”

Last year, Amazon claimed that Black Friday sales of Kindle devices were up 4X over the previous year. So…if you want to know how many devices were sold, you have to solve for X. It’s like trying to sort through a bunch of Russian nesting dolls to find the smallest one.

(My favorite announcements are when Amazon says something like “Kindle sales over the weekend topped Kindle sales from October and November combined!” Congratulations would be in order if I had any idea what that meant.)

Amazon fleshed out today’s announcement a little bit by adding that Cyber Monday was the biggest day ever for Kindle sales worldwide (this was also the case last year). Additionally, the top four best sellers worldwide are Kindle e-readers and Kindle Fires, with the Kindle Fire HD being the most gifted and the most wished for product on Amazon worldwide.

If you happened to check out Amazon over the weekend, you may have noticed that Kindle Fires were on sale for $129, which the company says became the biggest Cyber Monday deal ever for Amazon.com.

In the announcement, Amazon also mentions that consumers can purchase a Kindle Fire in-store at Best Buy, Radio Shack, and Staples. Earlier this year, both Target and Walmart announced that they would no longer be selling Kindle devices, even though they continue to sell the iPad, Nook, Nexus 7, Galaxy, and other tablets. Walmart was vague on its reasons for cutting ties with Amazon so suddenly. A spokesperson told me only:

“Our customers trust us to provide a broad assortment of products at everyday low prices, and we approach every merchandising decision through this lens. This decision is consistent with our overall merchandising strategy.”

Because Walmart is awesome like that.

Target, which cut ties with Amazon in May, made its reasoning much more clear: the company was sick of online-only retailers like Amazon using Target stores as a showroom, encouraging customers to check out products in-person in brick-and-mortar stores (like Target and Wal-Mart) and then undercutting their prices.

Amazon really pushed it last holiday season when it offered a 5% off promotion for customers who used its Price Check app. In other words, it encouraged customers to go into a brick-and-mortar store, scan an item, and then purchase it through Amazon instead. (The Price Check app was already a little evil to begin with, since it’s literally designed to target and redirect customers as they’re getting ready to make a purchase in a brick-and-mortar store.)

It will be interesting to see if Amazon’s jerk move ends up costing it over the holiday season, as Target and Walmart—the biggest brick-and-mortar retailers in the U.S.—continue to sell Amazon’s competitors’ tablets. Jeff Bezos recently admitted that the Kindle Fire is sold at breakeven prices, with effectively no margin whatsoever, since Amazon uses the tablets and e-readers as vehicles to sell more content and products from its online store.

Image source: i.i.com.com

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...