Digital health funding declines for the third year in a row

AI-enabled digital health startups raised $3.7B, 37% of total funding for the sector

Read more...

Bad news if you’re trying to cash in on Twitter’s fame and fortune by building a company that will provide a Twitter-based feature as a third-party app. According to a recent report from CB Insights, financing for such startups has dropped precipitously.

Between June 2009 and May 2010, venture capitalists and angel investors poured $10.4 million into pure-play Twitter apps. That's a 50% plunge from $21.6 million invested into pure-play Twitter apps, during the same period the prior year. The number of startups that received funds didn't dip much. This year saw 10 investment compared to 11 last year, which translates to less money being invested per startup or an average of just over $1 million versus over $2 million last year.

The watered-down financing likely has much to do with uncertainty over the future direction of Twitter’s ecosystem. Several startups had scrambled to fill the holes in Twitter's platform, but were undermined earlier this year when Twitter acquired Atebits and turned the Tweetie app into the official Twitter for iPhone app, thereby putting several of its own features in direct competition with the startups who had jumped in to hitch a ride on the Twitter gravy-train.

In May, angel investor Chris Dixon likened Twitter to “a drunk guy with an Uzi, killing partners left and right,” and he warned that investment in the Twitter ecosystem would “drop significantly.” He posted his thoughts on his Twitter page.

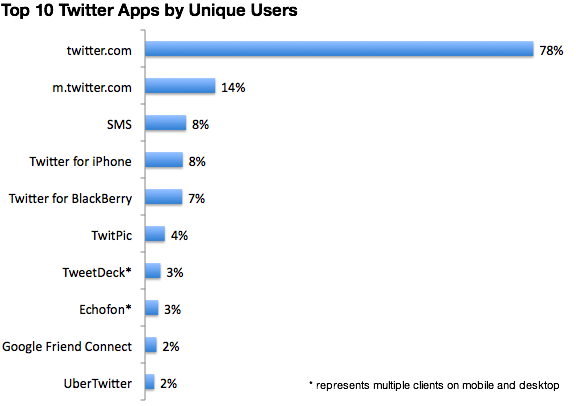

The numbers were laid out in pretty black-and-white terms last week in Twitter CEO Evan Williams’ official blog, which posted a chart tracking the percentage of users who access Twitter through the official Web site, the mobile Twitter Web site, text messages, and third party apps. While Williams maintained that a large chunk of users continue to access Twitter through third-party apps like TweetDeck and Echofon (3% each), their numbers are small compared to the traffic seen by the Twitter Web site and official apps for SmartPhones.

Some third-party app developers have nonetheless been successful in raising funds. TweetPhoto, now known as Plixi, raised $2.6 million in its series A round back in April, and Oneforty raised $2 million last January.

The sudden drop in funding for Twitter third-party app developers comes in direct opposition to Apple’s iPad and iPhone ecosystem, which has seen a 220% increase in funding over the last year.

Twitter, itself, has had no problem raising funds to flesh out its features and drive its expansion. In September 2009 the company raised $100 million, which quadrupled Twitter’s valuation to $1 billion at the close of 2009. Thus, while investors may be backing away from third-party Twitter app developers, they see an ever-promising future for the company itself.

Facebook, which has 10 times the number of users that Twitter has, was recently valued at $23 billion.

Twitter could not be reached for comment, but as the company continues to unfurl its banner to snatch up new ground, companies who are trying to take the territories they thought Twitter had overlooked will need to watch out.

Image source: Mashable.com, CB Insights, Twitter.com

AI-enabled digital health startups raised $3.7B, 37% of total funding for the sector

Read more...OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...