Daily funding roundup - August 12, 2015

PokitDoc closed $34M; Infogain secured $63M; Soothe raised $10.6M

- If there's a service that I often book with little time in advance, it's getting a massage. It's hard to predict when you're neck or back will ache, and when you have a free hour. So I often call on-demand, though invariably, I have to wait a few hours to get in. Now there's Soothe to the rescue, where you can request a massage therapist and have a massage at your home in an hour. The LA-based startup, which refers to itself as a mobile massage service, just raised $10.6 million, led by The Riverside Company. Much of the funds will be used to get the word out.

- PokitDok has raised $34 million in a Series B round of funding, led by Lemhi Ventures. The company had previously raised $5.6 million, including a $4 million Series A round of funding in June of 2013. Previous investors in the company include New Atlantic Ventures, Rogers Venture Partners, Charles River Ventures, George Zachary, Jonathan Sposato, Geoff Entress, Albert Prast, Jason Portnoy and Zac Zeitlin. The company has now raised a total of $39.6 million in total funding.

- Applied Life Pvt Ltd, which owns Sheroes, a jobs and career community for women, has raised an undisclosed amount from Quintillion media, start-up accelerator 500 Startups and a group of angel investors such as Paytm founder Vijay Shekhar Sharma, Google executive Rajan Anandan, Flipkart co-founder Binny Bansal and Freshdesk founder Girish Mathrubhootham. Mekin Maheshwari, chief people officer at Flipkart, Indus Khaitan, founder of Bitzer Mobile which was acquired by Oracle, and Krishna Mehra, co-founder of Capillary Technologies, also participated in the round.

- Provata Health, an evidence-based worksite wellness, received $1.4 million in Small Business Technology Transfer (STTR) Phase II funding from the National Institutes of Health (NIH). The funding will further the development and widespread dissemination of a state-of-the-art digital platform and wellness program to firefighters.

- Genee, a scheduling system that instantly coordinates the right meeting times in the best interest of everyone, providing the productivity and efficiency of a personal assistant, today announced that the cloud-based Genee platform has entered public beta. In conjunction, Genee has closed a first round, receiving $1.45 million in funding from Uj Ventures, Streamline Ventures, Garnett Ventures and additional angel investors.

- OneAssist Consumer Solutions, a company providing consumer-friendly assistance and protection programmes in India, has raised US$7.5 million in Series B round of funding, led by US-based Assurant, a provider of specialty protection products and services. The round also saw participation from existing investors Sequoia Capital and Lightspeed Venture Partners. OneAssist will use the funding to expand and deepen its distribution particularly in the online and digital areas as well as building category awareness for its existing and new products. It also plans to allocate significant investments to technology development.

- Questback, Europe's supplier of solutions for Enterprise Feedback, Social CRM and online surveys, is raising capital from existing investors. The transaction will strengthen the equity base by approximately GBP £12 million (around $18.8 million). The largest investors are Reiten & Co Capital Partners VII L.P. and First Fellow Oy. Other existing investors are also offered to participate.

- After launching two of the most popular photo editing apps for iOS, Israel’s Lightricks announced that it has taken its first round of venture capital. The company raised $10 million from Carmel Ventures, also based in Israel, to help it accelerate product development.

- Illumitex Inc., a maker of high-tech lights used in offices and by indoor farmers, completed a $16 million Series C-1 round of funding. The Austin company disclosed that the funding was led by WP Global Partners, a Chicago investment firm. The deal increases to $76.8 million the amount of investment capital Illumitex has raised since launching.

- Front Row Education, Inc., which provides an adaptive, gamified, and data-driven math education program for K-8 students, landed a $5.3 million Series A funding. The round was led by Amasia and joined by Harrison Metal, Baseline Ventures, and key existing investors. This brings the total raised by the organization to $6.6 million.

- Checkmate Pharmaceuticals, a biopharmaceutical company focused on developing novel approaches for cancer immunotherapy, announced their $20 million Series A financing from Sofinnova Ventures and venBio. In addition, the Company has exclusively licensed a clinically validated virus-like particle (VLP) platform from Cytos Biotechnology Ltd (six:CYTN) for the field of oncology, that includes the clinical product (CYT003) and technologies related to oligonucleotide synthesis and VLP delivery.

- VATBox, a cloud-based provider of automated VAT recovery and governance solutions, announced the closing of $24 million in a new financing round led by Viola Private Equity with participation of existing private investors. The funding will further fuel VATBox's aggressive growth plans, accelerating its expansion in the massive, growing market of VAT recovery and governance.

- DoubleDutch , a San Francisco, CA-based mobile event technology and event performance company, raised $45 million in growth financing. The round was led by KKR, with participation from existing investors Bessemer Venture Partners, Index Ventures, and others. The company intends to use the funds for global expansion, sales and marketing, and targeted acquisitions.

- Infogain, a global business and IT consulting leader, announced that ChrysCapital has invested US $63M into the company. This infusion of capital will enable Infogain to broaden its solution offerings, pursue strategic acquisitions, explore new geographies and accelerate the expansion of its employee base.

- Flexpoint Ford, LLC a private equity investment firm specializing in the financial services and healthcare industries, announced the first and final closing of its third private equity fund, Flexpoint Fund III, L.P. (“Fund III”) at $950 million, along with a new investment vehicle, Flexpoint Special Assets Fund, L.P. (“Special Assets Fund”) at $317 million. The initial targets for the funds were $750 million and $250 million, respectively.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: bbj.hu

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

DoubleDutch

Startup/Business

Joined Vator on

DoubleDutch is an award-winning provider of mobile event applications, with a unique focus on capturing and surfacing data from live events. The first to bring a data-driven technology approach to the event industry, DoubleDutch customers include SAP, Proctor & Gamble, Audi, Verizon, UBM, Estee Lauder, and more. Founded in January 2011, DoubleDutch has raised $37.5M total in financing from top investors including Mithril Capital Management, Bessemer Venture Partners, Floodgate Fund, and more.

Bessemer Venture Partners

Angel group/VC

Joined Vator on

In 1911, Henry Phipps founded Bessemer Securities to reinvest the proceeds of his sale of Carnegie Steel for the benefit of his descendents. The start-up investment operations were spun out into Bessemer Venture Partners, which now operates out of seven offices around the globe.

Index Ventures

Angel group/VC

Joined Vator on

Many venture firms would be best described as a collection of free agents who pursue their own deals and share offices and overhead with their partners. They are more mercenary than missionary and will tell you to focus more on the individual partners and less on the partnership. We hope to have the opportunity to show you how we are different.

We are true partners who have built our own firm together, brick by brick; the same way you are building your company. When we commit to supporting your company, each and every partner in our firm commits to contributing his or her network, creativity and resources towards achieving your success. We are big believers in the power of teams.

We believe you will want an investor with whom you can build a close, supportive relationship over a number of years, yet who will be bold enough to challenge your thinking and your expectations. If Index looks like a good fit, we encourage you to learn about us through the stories and news articles on this website. We invite you to read about the companies we have invested in, and to speak to the entrepreneurs we have partnered with. Their experience is our best reference.

PokitDok

Startup/Business

Joined Vator on

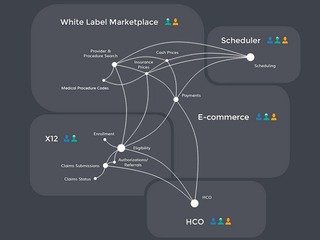

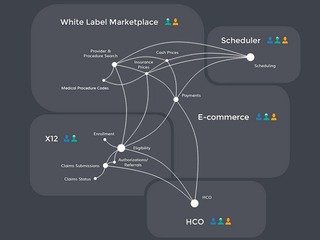

Provider of a cloud-based application programming interface (API) platform designed to make healthcare transactions more efficient and streamline the business of health. The company's platform enables third-party developers such as payers, health systems and digital health companies to process eligibility checks, claims, scheduling, payments, and other business transactions, enabling hospitals and health systems to build new patient-centered experiences. With DokChain, an evolution of PokitDok’s platform utilizing blockchain and other distributed technologies, PokitDok seeks to remove even more waste from healthcare administration while enabling new value creation by healthcare and other industry stakeholders for the consumers they serve.

Related News