Healthtech takes off with $2.2B in nearly 70 deals

The sector has seen huge gains in the last few years, growing 189% since 2011

It's a good time to be in healthtech.

The sector is absolutely booming right now, with deals and funding going through the roof! A CB Insights report from September found that health IT companies had already raised $2.2 billion in funding through the first half of this year. Those are some pretty impressive numbers.

Now the venture capital database has released a new report taking a deeper dive into how deals are shaping up, breaking them down by both stage and by state.

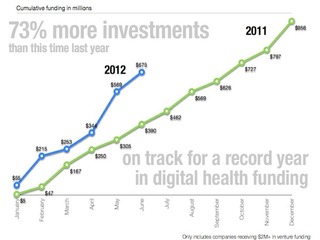

As you probably suspected, with the increase in funding there has also been a significant increase in deals. The number has reached nearly 70 already, with another two months left of 2014 to go, and already more than all of 2013 combined. Deal activity is up 89% from 2012, and 189% from 2011.

Since 2010, there have been around 210 deals, totaling $2.34 billion, in this sector. More than half of those occurred in the last two years.

Some of the big deals that have taken place this year include:

- Flatiron Health, a company that organizes real-time oncology data to help cancer patients and doctors, which raised $130 million in Series B funding from Google Ventures, First Round Capital, Laboratory Corporation of America, and angel investors

- Healthcare data warehousing and analytics company Health Catalyst, which raised $41 million in funding from Sequoia Capital, Norwest Venture Partners, Kaiser Permanente Ventures, Sorenson Capital, CHV Capital and Partners HealthCare

- Telcare, a connected devices platform for diabetes management, which raised $32.5 million in a Series C round of funding led by Norwest Venture Partners with participation from Mosaic Health Solutions, Sequoia and Qualcomm.

When broken down by stage, its not surprising, given the relative age of this sector, that the vast majority of deals have been in the early to mid stages.

More than three quarters, 76%, of all healthtech deals this year were Series C or below. Only 16% were Series D, including raises by Practice Fusion, Voluntis and HealthSense.

The report also broke deals down by state. Do I have to tell you that California led the way with 36% of the deals? No? Ok.

Next, way down the list were Massachusetts and New York with 9%, followed by Ohio with 6%, and Minnesota and Virginia with 4%.

And, finally, the top five firms currently investing in the healthtech sector are Qualcomm Ventures, Merck Global Health Innovation Fund, BlueCross BlueShield Venture Partners, Google Ventures and Intel Capital.

(Image source: futurama.wikia.com)

Related Companies, Investors, and Entrepreneurs

Practice Fusion

Startup/Business

Joined Vator on

Practice Fusion provides a free, web-based EMR system to physicians. With medical charting, scheduling, e-prescribing (eRx), lab integrations, referral letters, Meaningful Use certification, unlimited support and a Personal Health Record for patients, Practice Fusion's EMR the complex needs of today's healthcare providers and disrupts the health IT status quo. Practice Fusion is the fastest growing Electronic Medical Record community in the country with more than 150,000 users serving 40 million patients. The company closed a $23 million Series B round of financing led by Founders Fund in 2011. For more information about Practice Fusion, please visit www.practicefusion.com

Health Catalyst

Startup/Business

Joined Vator on

Leading Healthcare Data Warehouse Platform in the US

Related News