Social media predictions for 2013

Will Google+ finally rise? Will Twitter go public? What will the next big thing be?

Some of the biggest social media stories that took place in 2012 included the rise of Pinterest and the Facebook IPO, but what should we expect to happen over the next 12 months? Here are some predictions:

1. Google+ will use authorship to become a top tier social network

Google+ will be the social network everyone will be talking about next year, but only if it can "wrap everything together" by using authorship, or the ability for users to link their Google+ profile to the content they create, predicts Chris Winfield, Chief Marketing Officer at BlueGlass Interactive.

Authorship gives usera a byline that will then attach to the name on their Google) profile. It is the key to Google+ growing into a social network on par with Facebook and Twitter, Winfield says.

This function, Winfield said, is the advantage Google+ has over its competitors. It allow users to have greater control over their own content and gives people are real reason to use Google+ by making their profiles more powerful, he said.

Since their name is attached to what they have created, the authors can see how much adoption their content has seen. This can be especially useful in the enterprise space he said, as companies can see how they rank based on social search.

BlueGlass offer online marketing services, including paid and organic search, social and content marketing. The company’s main focus is on search marketing campaigns.

2. Pay attention to the smaller properties

2012 was the year of Pinterest and Instagram, two companies that were basically unknown at the beginning of the year but were able to rise and become competitors to the largest social networks, including Facebook and Twitter. No one can know if those two companies will continue to grow, and there are some indications that Instagram may already be stumbling, but there were will surely be other small social networks that will rise in 2013.

As Deven Parekh of Insight Partners Path said, Facebook is so big that it will no longer be able to grow at the same rate it has in the past, since it has pentetrated most of the big markets around the world.

While it is "not a trivial thing for people to move their social graph," he said, other, smaller networks will see big growth, including Path.

Path is a social network built around exclusivity, meaning that it only allows users to have a maximum of 50 friends. The limitation is meant to foster greater connections between people, and to encourage the sharing of more personal information. The idea is that you will only choose the people you are closest to, and will feel more comfortable telling those people more personal things about yourself. It is a more personal kind of social network.

The reason that a service like Path will become popular, Parekh said, is because people start being sensitive to privacy on bigger networks like Facebook. They simply do not want to tell intimate things to a lot of people at once.

In an interview, Sergio Monsalve, partner at Norwest Venture Partners said something similar. Pay attention to the smaller properties, he told me, since they are growing fast in terms of users and revenue.

Two companies in the Norwest Venture Partners portfolio that Monsalve sees as the potential next big things are MeetMe and BranchOut.

MeetMe, formerly known as MyYearbook, is a social networking service founded in 2005 that provides the opportunity to interact and meet new people. The company has been on the public market since December 2004 and is currently trading at $3.33 a share.

BranchOut is the largest professional network on Facebook with over 30 million active users and over 500 million professional connections. Users leverage their existing friend network to identify all of their inside connections for jobs, recruiting, sales leads and career networking. BranchOut has raised $49 million in funding from Accel Partners, Redpoint Ventures, Mayfield Fund, Norwest Venture Partners and a dozen of the best angel investors in Silicon Valley.

3. Myspace will try to make a comeback, but it will fail

Some leaked documents in November showed how MySpace, once the biggest social media network, will try to make a comeback by competing in the music space.

The service expects to eventually become profitable again by launching a subscription model in the second quarter of 2013, and by launching an e-commerce wing in the second half of next year, where it will sell merchandise and tickets.

Myspace is also going to have to depend on outside funding to get back on its feet, namely $50 million. $10 million of that will go toward marketing for the website's relaunch, $15 to $25 will go toward renewing music rights with the labels and $15 to $25 will be used for "general working capital purposes."

Whhile website has also seen traffic go up by 36% since December of last year, and, because of its renewed focus on music, it is now the 44th largest website, and is also the fastest growing top 50 website in the United States, there are serious hinderances to MySpace actually being able to compete again.

The online music scene is a crowded, and ultra competative space right now, so you have to wonder if it is really the right move for MySpace right now. Companies like Microsoft, Nokia and Apple, and Spotify already have a headstart, and MySpace will have a hard time trying to keep up.

4. Pinterest will try to branch out by appealing to men

As I mentioned earlier, Pinterest had a meteoric rise in 2012, and that was due in no small part to women.

According to a report released in September by the Pew Internet & American Life Project, one in five online women are now on Pinterest.

The survey found that Pinterest is most popular among women between the ages of 18 and 29, those with some college education, and those with an annual household income of $50,000—$75,000. While 19% of women are using the site, just 5% of online men are on Pinterest.

The survey also found that women are more likely than men to post images that they’ve created themselves or found online. Some 47% of women and 43% of men said they’ve shared photos they’ve created themselves online, while 40% of women and 31% of men said they’ve shared images they’ve found online.

While this certainly has helped the network rise, a recent Nielsen report revealed that Pinterest has seen the most growth out of any other social network, it also might eventually become a problem is Pinterest wants to conitinue to grow.

That is why Ben Pickering, CEO of Strutta, is predicting that Pinterest will attempt to woo men. He is also predicting that the move will ultimately fail.

"Likely it will partner with a brand that targets male consumers (e.g., sports, beer) and make a push to get men pinning. Sadly I don't think the response will be strong and I've already got my #fail board ready to pin the results of this experiment. Whether the company can succeed by catering to its current demographic alone and whether it can find a revenue model to support it will be questions that are hopefully answered in 2013 as well," Pickering wrote.

5. More control to own sites

One trend that began in 2012, and will continue in 2013, Winfield said, is social networks will " try to move away from specific campaigns and platforms they do not control," and toward "building on the land they own." This means that there will be a move toward networks controlling their own content, through their own in order to bring people back to their own sites.

We have seen this happen twice this year: first, in June, when Twitter announced that it would no longer allow Twitter posts to appear on LinkedIn profiles because it did not want other parties, such as LinkedIn copying their content. Then, in December Instagram did the same thing to Twitter when it took its photos off of the social network.

This trend will begin to spread to other websites, which will begin to attempt to create their own social networks. For example Airbnb, which recently bought Localmind, a startup that is designed to allow users to post questions about specific locations, which will then answered in real time by local experts. Websites will lean toward leveraging their audiences, and gaining more control over content.

6. Social gaming will learn lessons from Zynga

2012 was the year that Zynga, which was once the biggest social gaming compay due to its relationship with Facebook, fell hard. After a lackluster IPO in December 2011, the company saw its stock fall all throughout 2012, causing its executives leave in droves.

In 2013, Parekh says, other social gaming companies will learn the lessons from Zynga, specifically not to develop on only one platform.

"Zynga made a bet to only develop on Facebook," Parekh told me. "It was a risky strategy." And one that ultimately cost the company big time, once the relationship between the two fell apart.

In addition, he said, Zynga did not create games with long lifecycles. "They did not hold interest, they weren't deep," he said, and so casual gamers eventually fled.

In the coming year, companies such as Kixeye will be able to grow better by doing the opposite of what Zynga did.

7. Curation and consumption will lead to growth

Twitter and Tumblr will see strong growth and engagement in 2013, Parekh said, because they have both gone from networks that were about producing content to networks that are more about consuming content, even for users who do not create any themselves.

Parekh calls his a "psychological change," and one that will help these networks separate themselves from Facebook. While Facebook is a user's social graph, with all of the people they know, Twitter and Tumblr are more about connecting with "people you respect" and those that have common interests.

Three years ago, Tumblr was a known as a publishing tool. Now it is investing in mobile, releasing an iPad app which allows users to consume content on the go.

8. The next big thing will probably be mobile only

2012 was the year that social networks went mobile. In Septemper, Mark Zuckerberg said, "We’ve transitioned, and we are a mobile company. All the code that is being written is mobile.”

In the conference call following the company's third quarter results, he said that there are three reasons mobile he gave for why mobile is so good for Facebook: it can reach more people on mobile than desktop, people on mobile use Facebook more often, and in the long-term Facebook will be able to monetize better for the amount spent on mobile than on desktop.

With mobile becoming all the more important to social networks, and desktop starting to fade, "it would not surprise me if the next big thing was mobile only, or at least majority mobile," Parekh told me.

It would be fitting aince of the biggest success stories of 2012 wa Instagram, a mobile first company bought by Facebook for $1 billion, that decided to create a desktop version secondary to its mobile app.

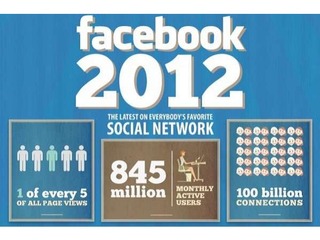

9. Twitter goes public

One of the biggest social media stories in 2012 was the Facebook IPO, which turned into a huge disaster. At first, the disaster began scaring off other potential IPOs, but the market eventually began to rebound. SaaS IT management company Servicenow raised over $209 million in June, debuting, 37% above its IPO price of $18, two other high profile companies debuted in July: travel search engine Kayak and enterprise firewall and security firm Palo Alto Networks.

Kayak shares closed at $33.18, while Palo Alto Networks closed at $53.13. Both companies were up 27% in their debuts.

There was even some who said that the Facebook IPO, in the long run, will be a good thing

In July, Valerie Foo, senior research manager at Dow Jones VentureSource, told VatorNews that she thinks that the Facebook IPO might have been a good thing, as it may have set expectations back to the normal.

“Entrepreneurs and corporate buyers were not seeing eye-to-eye on price but Facebook’s IPO delivered a dose of reality. The uptick in M&A may be a result of entrepreneurs resetting their valuations so that they’re now in line with what acquirers are willing to pay,” Foo said.

So will Facebook's IPO hurt Twitter's chances of going public in 2013? Pickering seems to think that it will not have an effect, and that 2013 will be the year that Twitter finally decides to file.

"Twitter has become an essential communications platform for many individuals, companies and organizations. More importantly, after years of questions about its business model the company has begun to deliver real revenue. The company has rolled out a number of ad products in the past year, positioning Twitter to become an integral part of media plans for major brands as well as a very accessible channel for small business. On the heels of major revenue growth and international expansion, 2013 is likely to see the long anticipated S-1 filing for Twitter as well," he says.

10. Facebook search

If you will allow me, I have my own prediction to make for what will happen in 2013: after years of talk Facebook will finally get into search.

In September, Mark Zuckergberg, during his first interview since Facebook’s IPO, was asked if Facebook ever thinks about search. This is the reply he gave:

"You know, search is interesting. We do on the order of a billion queries a day already and we’re basically not even trying. So today, search is, the vast majority of it, is people trying to find people but there are also a meaningful portion of queries of people trying to find pages, brand pages, businesses pages and apps. So there’s a bunch of it actually does link to commercial behavior, and I think that there’s a big opportunity there, at some point, and we just need to go do that.”

He also said that there was a team working on search and called it, “One kind of obvious thing for us to do in the future if we got to state where we were excited about it.”

If Facebook does get into search, there are arguments to be made on both sides as to whether or not it is a good idea for it to try to infringe on Google's turf. But, as Parekh said to me, Google has a social network, so the two companies already see each other as competitors anyway.

(Image source: https://www.forbes.com)

Related Companies, Investors, and Entrepreneurs

BlueGlass Interactive, Inc.

Startup/Business

Joined Vator on

BlueGlass is a strategy-driven digital marketing company. Beyond that, we are a fundamentally different kind of digital marketing agency, created to fill a void in a crowded marketplace.

Larger agencies are often slow moving and lack the ability toquickly shift gears. Small agencies may have trouble properly servicing large accounts or maintaining consistency and reliability.

We combine the best of both types of agencies: we’re nimble andinnovative, while offering the scalability and reliability necessary to take take on even the most challenging projects.

Zynga

Startup/Business

Joined Vator on

Zynga is the largest social gaming company with 8.5 million daily users and 45 million monthly users. Zynga’s games are available on Facebook, MySpace, Bebo, Hi5, Friendster, Yahoo! and the iPhone, and include Texas Hold’Em Poker, Mafia Wars, YoVille, Vampires, Street Racing, Scramble and Word Twist. The company is funded by Kleiner Perkins Caufield & Byers, IVP, Union Square Ventures, Foundry Group, Avalon Ventures, Pilot Group, Reid Hoffman and Peter Thiel. Zynga is headquartered at the Chip Factory in San Francisco. For more information, please visit www.zynga.com.

BranchOut

Startup/Business

Joined Vator on

BranchOut is the largest professional network on Facebook with over 30 million active users and over 500 million professional connections. Users leverage their existing friend network to identify all of their inside connections for jobs, recruiting, sales leads and career networking. BranchOut has raised $49 million in funding from Accel Partners, Redpoint Ventures, Mayfield Fund, Norwest Venture Partners and a dozen of the best angel investors in Silicon Valley.

Airbnb

Startup/Business

Joined Vator on

Airbnb.com is the “Ebay of space.” The online marketplace allows anyone from private residents to commercial properties to rent out their extra space. The reputation-based site allows for user reviews, verification, and online transactions, for which Airbnb takes a commission. As of June, 2009, the San Francisco-based company has listings in over 1062 cities in 76 countries.

Chris Winfield

Joined Vator on

Related News

The top 10 Facebook events of 2012

Social media trends to look out for in 2012

Tweets no longer allowed to be posted on LinkedIn

Here's how Myspace will compete in the music space

Facebook search engine: good or bad idea?

The top 10 social media events of 2012