Top 10 lessons learned articles in 2012

Why Facebook is killing the Valley; How Instagram hooked users; The Darwinian evolution of a startup

While 2010 and 2011 were the most recent years in which entrepreneurs had the upper hand over venture capitalists as more money came into the startup system, thanks to new funds and angels, 2012 was the year in which the money started drying up. As Steve Loeb wrote earlier, there could be about 1000 seed-funded deals orphaned in the next year, due to the explosion of seed-funded deals. Yet optimism prevailed for many. As such, entrepreneurs continued to seek lessons and advice about how to start businesses, how to raise funds and how to add game dynamics into their business practices or websites. They were intrigued with how Facebook was changing the Silicon Valley landscape and how Instagram hooked Facebook, and how to replicate Silicon Valley across cities across the country and in the world.

Here are the top 10 lessons learned articles on VatorNews this year.

Why Facebook is killing the Valley

Facebook has adroitly capitalized on market forces on a scale never seen in the history of commerce. For the first time, startups can today think about a Total Available Market in the billions of users (smart phones, tablets, PC’s, etc.) and aim for hundreds of millions of customers. Second, social needs previously done face-to-face, (friends, entertainment, communication, dating, gambling, etc.) are now moving to a computing device. And those customers may be using their devices/apps continuously. This intersection of a customer base of billions of people with applications that are used/needed 24/7 never existed before.The potential revenue and profits from these users (or advertisers who want to reach them) and the speed of scale of the winning companies can be breathtaking. The Facebook IPO has reinforced the new calculus for investors. In the past, if you were a great VC, you could make $100 million on an investment in 5-7 years. Today, social media startups can return 100’s of millions or even billions in less than 3 years.Software is truly eating the world.

Facebook has adroitly capitalized on market forces on a scale never seen in the history of commerce. For the first time, startups can today think about a Total Available Market in the billions of users (smart phones, tablets, PC’s, etc.) and aim for hundreds of millions of customers. Second, social needs previously done face-to-face, (friends, entertainment, communication, dating, gambling, etc.) are now moving to a computing device. And those customers may be using their devices/apps continuously. This intersection of a customer base of billions of people with applications that are used/needed 24/7 never existed before.The potential revenue and profits from these users (or advertisers who want to reach them) and the speed of scale of the winning companies can be breathtaking. The Facebook IPO has reinforced the new calculus for investors. In the past, if you were a great VC, you could make $100 million on an investment in 5-7 years. Today, social media startups can return 100’s of millions or even billions in less than 3 years.Software is truly eating the world.

Gamification is the exact opposite of what you think

Fast forward to today, and gamification is now being applied in the enterprise: not so that employees can goof off, but to help them be more productive. Here’s an example. Imagine opening up Salesforce.com and seeing a mission titled “President’s Club.” The employee would not only have a clear problem to solve, but, in real time, can track the progress he or she is making, right in Salesforce.com, without the need for any manual tracking - its all automatically being tracked as work is being done. That progress is completely transparent to others in the company, bestowing a degree of status compared to those who will also be competing for the President’s Club reward. Most business leaders would love to have their employees focused on and completing those missions in the enterprise software tools that the company has invested time and money in deploying. They clearly map to business results and smack of productivity. Which is the exact opposite of what many people think of when they hear the word gamification.

Fast forward to today, and gamification is now being applied in the enterprise: not so that employees can goof off, but to help them be more productive. Here’s an example. Imagine opening up Salesforce.com and seeing a mission titled “President’s Club.” The employee would not only have a clear problem to solve, but, in real time, can track the progress he or she is making, right in Salesforce.com, without the need for any manual tracking - its all automatically being tracked as work is being done. That progress is completely transparent to others in the company, bestowing a degree of status compared to those who will also be competing for the President’s Club reward. Most business leaders would love to have their employees focused on and completing those missions in the enterprise software tools that the company has invested time and money in deploying. They clearly map to business results and smack of productivity. Which is the exact opposite of what many people think of when they hear the word gamification.

Effective March 30, all Facebook Brand Pages will switch to the new Facebook Timeline layout. This change will have a huge impact on the way brands and companies market to their Facebook audience. In particular, the new focus on engagement creates opportunities for brands to interact with and reach their audience in a more personal way. However, to get the most out of this change (and avoid the threat of a time bomb!), companies need to make some short term updates to their page to “fit” the new layout and they need to put some thought—and effort—into their long term Facebook strategy to ensure their page is engaging Facebook users. Below is a quick overview of some of the things Facebook page administrators should do today to prepare for and manage their Facebook Page with Timeline, but first, start with a quick “Are you ready for Timeline?” quiz to test how much you know about Timeline and what it means for your page.

Effective March 30, all Facebook Brand Pages will switch to the new Facebook Timeline layout. This change will have a huge impact on the way brands and companies market to their Facebook audience. In particular, the new focus on engagement creates opportunities for brands to interact with and reach their audience in a more personal way. However, to get the most out of this change (and avoid the threat of a time bomb!), companies need to make some short term updates to their page to “fit” the new layout and they need to put some thought—and effort—into their long term Facebook strategy to ensure their page is engaging Facebook users. Below is a quick overview of some of the things Facebook page administrators should do today to prepare for and manage their Facebook Page with Timeline, but first, start with a quick “Are you ready for Timeline?” quiz to test how much you know about Timeline and what it means for your page.

Billion-dollar mind trick; How Instagram hooked users

Yin is an Instagram addict. The photo sharing-social network, recently purchased by Facebook for $1 billion, captured the minds of Yin and 40 million others like her. The acquisition demonstrates the increasing importance--and immense value created by--habit-forming technologies. Of course, the Instagram purchase price was driven by a host of factors including a rumored bidding war for the company. But at its core, Instagram is the latest example of an enterprising team, conversant in psychology as much as technology, that unleashed an addictive product on users who made it part of their daily routines. Like all addicts, Yin doesn’t realize she’s hooked. “It’s just fun,” she says as she captures her latest in a collection of moody snapshots reminiscent of the late 1970s. “I don’t have a problem or anything. I just use it whenever I see something cool. I feel I need to grab it before it’s gone.”

Yin is an Instagram addict. The photo sharing-social network, recently purchased by Facebook for $1 billion, captured the minds of Yin and 40 million others like her. The acquisition demonstrates the increasing importance--and immense value created by--habit-forming technologies. Of course, the Instagram purchase price was driven by a host of factors including a rumored bidding war for the company. But at its core, Instagram is the latest example of an enterprising team, conversant in psychology as much as technology, that unleashed an addictive product on users who made it part of their daily routines. Like all addicts, Yin doesn’t realize she’s hooked. “It’s just fun,” she says as she captures her latest in a collection of moody snapshots reminiscent of the late 1970s. “I don’t have a problem or anything. I just use it whenever I see something cool. I feel I need to grab it before it’s gone.”

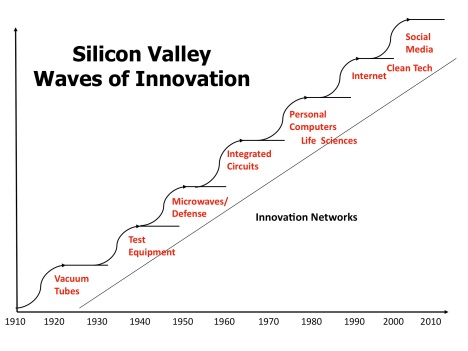

The Darwinian evolution of a startup

The development of NYC as a startup hub is very much on my mind. And so I thought I'd post about the development of startup hubs. This theory, which I like the call The Darwinian Evolution of Start-up Hubs, is not new and I certainly didn't come up with it. But I think it is important for everyone to understand and so I'm going to blog about it. If you study Silicon Valley, what you see is something that looks like a forest where trees grow tall, produce seeds that drop and start new trees, and eventually the older trees mature and stop growing or worse, die of disease and rot, but the new trees grow up even taller and stronger. In my mental model of Silicon Valley, the first "tree" was Fairchild Semiconductor (founded in 1957) which begat Intel (founded 1968) which begat Apple (1976) and Oracle (1977), which begat Sun (1982), Silicon Graphics (1981), and Cisco (1984) which begat Siebel (1993) and Netscape (1994), which begat Yahoo! (1995) and eBay (1995), which begat Google (1998) and PayPal (1998), which begat YouTube (2005), Facebook (2004), and LinkedIn (2003) which begat Twitter (2006) and Zynga (2007), which begat Square (2010), Dropbox (2008), and many more.

The development of NYC as a startup hub is very much on my mind. And so I thought I'd post about the development of startup hubs. This theory, which I like the call The Darwinian Evolution of Start-up Hubs, is not new and I certainly didn't come up with it. But I think it is important for everyone to understand and so I'm going to blog about it. If you study Silicon Valley, what you see is something that looks like a forest where trees grow tall, produce seeds that drop and start new trees, and eventually the older trees mature and stop growing or worse, die of disease and rot, but the new trees grow up even taller and stronger. In my mental model of Silicon Valley, the first "tree" was Fairchild Semiconductor (founded in 1957) which begat Intel (founded 1968) which begat Apple (1976) and Oracle (1977), which begat Sun (1982), Silicon Graphics (1981), and Cisco (1984) which begat Siebel (1993) and Netscape (1994), which begat Yahoo! (1995) and eBay (1995), which begat Google (1998) and PayPal (1998), which begat YouTube (2005), Facebook (2004), and LinkedIn (2003) which begat Twitter (2006) and Zynga (2007), which begat Square (2010), Dropbox (2008), and many more.

Fundraising rule of thumb: $19M, $9M and $4M

Getting hung up on a high valuation can quickly take the wind out of your entrepreneurial sails. For most first-time entrepreneurs, deciding on the right valuation can often seem arbitrary and confusing. Consider the experience of my friend Larry (name changed to protect the guilty), who was raising his first round for a coupon/loyalty company. The space was apparently red hot and his investment banker strategized that he should raise a $20M post valuation despite the fact that he only needed $1M to prove the business model milestone. Seems great, right? Raise $1M at a $19M pre-money valuation. However, after almost five months of getting “great” first meetings with VCs, he and his investment banker were unable to get a single term sheet. Surprised? What went wrong here? Larry was very certain that everything would close quickly so that he could build and create value. Unfortunately, he spent five months pounding the pavement with his investment banker with no funding to show for it leading to stalled progress on the product. His main competitor in the meantime raised $1M with a $4M pre-money valuation and were well on their way in building the product.

Getting hung up on a high valuation can quickly take the wind out of your entrepreneurial sails. For most first-time entrepreneurs, deciding on the right valuation can often seem arbitrary and confusing. Consider the experience of my friend Larry (name changed to protect the guilty), who was raising his first round for a coupon/loyalty company. The space was apparently red hot and his investment banker strategized that he should raise a $20M post valuation despite the fact that he only needed $1M to prove the business model milestone. Seems great, right? Raise $1M at a $19M pre-money valuation. However, after almost five months of getting “great” first meetings with VCs, he and his investment banker were unable to get a single term sheet. Surprised? What went wrong here? Larry was very certain that everything would close quickly so that he could build and create value. Unfortunately, he spent five months pounding the pavement with his investment banker with no funding to show for it leading to stalled progress on the product. His main competitor in the meantime raised $1M with a $4M pre-money valuation and were well on their way in building the product.

Authentic happiness, the maker movement, and the future

A few years ago (back when I used an AOL email account over a dial-up connection) I stumbled across a mailing list called "Authentic Happiness Coaching". I don't remember exactly how I got involved, but it turns out that it was the early emergence of Dr. Martin Seligman of the University of Pennsylvania. His work, which has provided a foundation for a new branch of psychology called Positive Psychology, is a look at the optimization of human performance. Different from the predominant approach of psychology (and medicine, for that matter), Positive Psychology doesn't aim to fix problems by applying solutions. It instead provides a scientific insight into the ways that people achieve lasting happiness. While still young, this research already provides a useful framework: move beyond transient Pleasantness, and focus on achieving a Good and Meaningful life.

A few years ago (back when I used an AOL email account over a dial-up connection) I stumbled across a mailing list called "Authentic Happiness Coaching". I don't remember exactly how I got involved, but it turns out that it was the early emergence of Dr. Martin Seligman of the University of Pennsylvania. His work, which has provided a foundation for a new branch of psychology called Positive Psychology, is a look at the optimization of human performance. Different from the predominant approach of psychology (and medicine, for that matter), Positive Psychology doesn't aim to fix problems by applying solutions. It instead provides a scientific insight into the ways that people achieve lasting happiness. While still young, this research already provides a useful framework: move beyond transient Pleasantness, and focus on achieving a Good and Meaningful life.

Box CEO: Tackling unsexy problems is good business

At this year's Vator Splash in San Francisco, Box's Aaron Levie shared his experience improving the enterprise software world. Levie originally created Box as a college business project with the goal of helping people easily access their information from anywhere in the world at anytime. Launched in a dorm room in 2005 with the help of CFO Dylan Smith, Box has grown to become a major player in the cloud sharing space both with individuals and enterprises. And Box continues to grow, now with the addition of a recent Series-D investment from Bessemer Venture Partners, NEA, SAP Ventures and Salesforce.com, Box has raised $162 million. As of the end of 2011, Box had seven million individual users and 100,000 businesses, with 250,000 new people joining each month. Levie shared with the crowd that building a software company that doesn't suck.

At this year's Vator Splash in San Francisco, Box's Aaron Levie shared his experience improving the enterprise software world. Levie originally created Box as a college business project with the goal of helping people easily access their information from anywhere in the world at anytime. Launched in a dorm room in 2005 with the help of CFO Dylan Smith, Box has grown to become a major player in the cloud sharing space both with individuals and enterprises. And Box continues to grow, now with the addition of a recent Series-D investment from Bessemer Venture Partners, NEA, SAP Ventures and Salesforce.com, Box has raised $162 million. As of the end of 2011, Box had seven million individual users and 100,000 businesses, with 250,000 new people joining each month. Levie shared with the crowd that building a software company that doesn't suck.

So you think you have what it takes to start a business

The truth is, your “good idea” is worthless. If you think I’m wrong, imagine walking into the Honda corporate office and pitching this: “Listen. I’ve got an AWESOME idea. Let’s create a Honda Civic that can fly and runs on flex fuel! We’ll go 50/50 on it. We’ll be disruptors!” Lots of people say they will handle the “business side” of things, but do they even know what that entails? They obviously asked me to be their partner because they know I am capable of building the product. But what have they proved? Nine times out of 10, they have no start-up experience and no track record. Even if they have an MBA, it doesn’t impress me. To rashly claim they’ll “handle the business side of things” is an insult to the engineer and to the true businessmen/women out there that DO know what they are doing AND have a proven track record. To top it off, can you afford to pay your engineer? If not, ALL the risk is on the engineer’s side. If the product sells, great. If not, you’ve lost nothing. Programmer time is NOT cheap my friends. With Google and Facebook competing to swoop up all the engineering talent, salaries have been rising fast. Even the mid-level engineers at Google are earning salaries of $250,000 and up. If you’re pitching to an engineer to join you, you better have a REALLY compelling reason.

The truth is, your “good idea” is worthless. If you think I’m wrong, imagine walking into the Honda corporate office and pitching this: “Listen. I’ve got an AWESOME idea. Let’s create a Honda Civic that can fly and runs on flex fuel! We’ll go 50/50 on it. We’ll be disruptors!” Lots of people say they will handle the “business side” of things, but do they even know what that entails? They obviously asked me to be their partner because they know I am capable of building the product. But what have they proved? Nine times out of 10, they have no start-up experience and no track record. Even if they have an MBA, it doesn’t impress me. To rashly claim they’ll “handle the business side of things” is an insult to the engineer and to the true businessmen/women out there that DO know what they are doing AND have a proven track record. To top it off, can you afford to pay your engineer? If not, ALL the risk is on the engineer’s side. If the product sells, great. If not, you’ve lost nothing. Programmer time is NOT cheap my friends. With Google and Facebook competing to swoop up all the engineering talent, salaries have been rising fast. Even the mid-level engineers at Google are earning salaries of $250,000 and up. If you’re pitching to an engineer to join you, you better have a REALLY compelling reason.

Six myths about tech entrepreneurship

My good friend Drew Curtis, founder of Fark, invited me to speak at the Haas Business School the other day. Since I've been covering entrepeneurship for years, and have become one in the last several years, he thought I should talk about entrepreneur myths. In other words, what I've learned from entrepreneurs and from being one that aren't so obvious at first. Some of these will seem apparent, but when you're an entrepreneur in the process of building a startup, you often find yourself going down a different path. When I first started out, Mark Cuban (owner of the Dallas Mavericks and Internet pioneer) said to me, "Don’t look at VC funding as an end goal. Most first-time entrepreneurs and those intrigued by raising millions of dollars see this feat as a big crowning achievement in and of itself." I thought, "Well, of course I don't see it as that. What kind of advice is that?" Well, turns out it was and is good advice. While many people may think that venture financing enables them to build their dream, more often than not, they make decisions based on those funding milestones. Sure, it's a milestone and it's material. But it serves a purpose. That purpose is to pursue and build a product that’s game changing.

My good friend Drew Curtis, founder of Fark, invited me to speak at the Haas Business School the other day. Since I've been covering entrepeneurship for years, and have become one in the last several years, he thought I should talk about entrepreneur myths. In other words, what I've learned from entrepreneurs and from being one that aren't so obvious at first. Some of these will seem apparent, but when you're an entrepreneur in the process of building a startup, you often find yourself going down a different path. When I first started out, Mark Cuban (owner of the Dallas Mavericks and Internet pioneer) said to me, "Don’t look at VC funding as an end goal. Most first-time entrepreneurs and those intrigued by raising millions of dollars see this feat as a big crowning achievement in and of itself." I thought, "Well, of course I don't see it as that. What kind of advice is that?" Well, turns out it was and is good advice. While many people may think that venture financing enables them to build their dream, more often than not, they make decisions based on those funding milestones. Sure, it's a milestone and it's material. But it serves a purpose. That purpose is to pursue and build a product that’s game changing.

Bambi Francisco Roizen

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.

All author postsRelated Companies, Investors, and Entrepreneurs

Nir Eyal

Joined Vator on

Nir Eyal founded and sold two tech companies and today is a consultant to several companies and incubators. Nir blogs about the intersection of psychology, technology, and business at NirAndFar.com

Steve Patrizi

Joined Vator on

Steve Patrizi leads sales for Bunchball, the leader in providing gamification solutions for businesses.

Steve Blank

Joined Vator on

Manu Rekhi

Joined Vator on

Partner at Inventus Capital. Seek to support entrepreneurs, particularly those building disruptive digital services businesses.

Eddie Kim

Joined Vator on

Nick Such

Joined Vator on

CEO at BuildingLayer. Past at GE/Toyota/KSTC. Used to race solar-powered cars. Got into Stanford MBA, but chose startup path. I love assembling teams of smart people to solve hard problems.Related News

Authentic happiness, the maker movement, and the future

The Darwinian evolution of start-up hubs

Avoid Facebook Timeline being a time bomb

Why Facebook is killing Silicon Valley

Fundraising rule of thumb: $19M, $9M and $4M

So you think you have what it takes to start a business

Box CEO: Tackling unsexy problems is good business